10 Cryptos That Could Make You 1000x Returns in 2024

Navigating the global regulatory landscape of asset tokenization is a complex challenge, requiring a deep understanding of diverse legal frameworks across regions. As traditional assets are increasingly tokenized on blockchain platforms, the regulatory environment around these digital assets continues to evolve, with each country adopting its stance on compliance, security, and investor protections. This diversity creates both opportunities and hurdles for companies aiming to innovate within the boundaries of the law. Compliance entails not only adhering to anti-money laundering (AML) and know-your-customer (KYC) protocols but also understanding tax implications, data privacy laws, and securities regulations specific to each jurisdiction.

For firms operating internationally, maintaining flexibility and developing tailored compliance strategies are essential to effectively navigate these ever-shifting regulations. By staying informed of global developments, partnering with experienced legal advisors, and leveraging robust technology solutions, companies can turn regulatory complexity into a competitive advantage, building trust and ensuring sustainable growth in the expanding world of asset tokenization.

Table of ContentWhat is Asset Tokenization?Major Regulatory Hurdles for Asset Tokenization

Strategies for Navigating Global Regulations

Key Regional Considerations in Asset Tokenization

Leveraging Technology for Compliance

The Future of Asset Tokenization Regulation

ConclusionWhat is Asset Tokenization?

Asset tokenization is the process of converting real-world assets, like real estate, stocks, or commodities, into digital tokens on a blockchain. Each token represents a fraction of the asset, allowing for easier ownership, transfer, and trading, often on a decentralized platform. This process makes high-value assets more accessible by enabling fractional ownership, allowing investors to buy and sell portions of assets that may otherwise be out of reach. Tokenization brings increased transparency, security, and liquidity to asset markets, as blockchain’s immutable ledger allows for transparent tracking of ownership and transaction history.

Additionally, the automation of processes through smart contracts can reduce the need for intermediaries, lowering transaction costs and speeding up settlement times. By digitizing assets, tokenization opens up new investment opportunities for a broader audience, democratizing access to markets and enhancing capital efficiency. However, tokenization must comply with varying regulatory standards globally, making understanding legal requirements essential for secure and compliant asset tokenization practices.

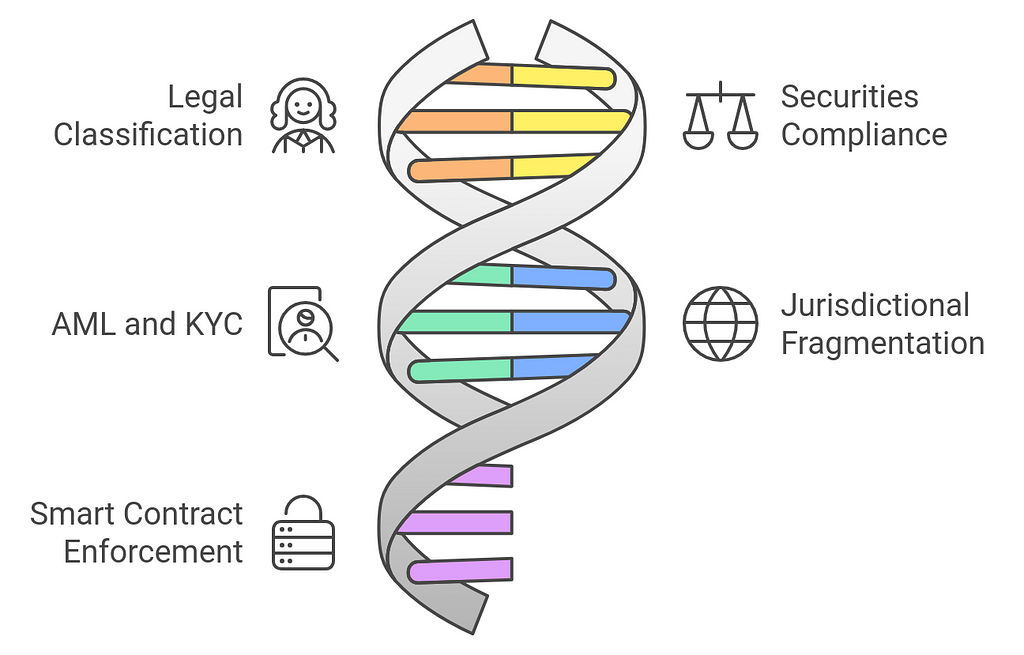

Major Regulatory Hurdles for Asset TokenizationAsset tokenization, or the process of converting real-world assets like real estate, art, or commodities into digital tokens on a blockchain, has immense potential for improving liquidity, accessibility, and transparency in various markets. However, regulatory hurdles present significant challenges. Here are some of the major regulatory hurdles:

1. Legal Classification and Definition of Tokens

1. Legal Classification and Definition of Tokens- Challenge: Regulatory bodies globally differ in how they classify tokens. Some see them as securities, while others may consider them commodities, utility tokens, or digital assets.

- Impact: This lack of uniformity leads to uncertainty, as businesses must comply with the strictest interpretations across jurisdictions to avoid penalties.

- Challenge: Many jurisdictions require tokenized assets to comply with existing securities laws, especially if they represent equity or debt. This can involve extensive disclosure requirements, investor protections, and registration processes.

- Impact: Compliance can be costly and time-consuming, particularly for smaller players looking to tokenize assets at scale.

- Challenge: Tokenization platforms must comply with AML and KYC regulations to prevent fraud and ensure that token buyers are properly vetted.

- Impact: This adds complexity, as blockchain-based transactions can be pseudonymous, making it difficult to monitor and enforce identity requirements without disrupting the user experience.

- Challenge: Different countries have varying regulatory frameworks, creating a fragmented landscape where compliance in one jurisdiction does not guarantee compliance in another.

- Impact: This limits cross-border tokenization and makes it difficult for companies to operate internationally without significant legal resources.

- Challenge: Many legal systems lack clarity on how to handle digital asset custody, especially if a custodian is holding the private keys on behalf of investors.

- Impact: This can create uncertainty around who truly owns an asset and raise concerns about investor protection in the case of fraud or bankruptcy.

- Challenge: Tax treatment for tokenized assets varies widely, and the rapid transferability of tokens makes accurate tax reporting complex.

- Impact: High compliance costs and tax uncertainty can dissuade institutional investors from engaging with tokenized assets.

- Challenge: Smart contracts execute transactions without human intervention, but legal frameworks often require certain intermediaries and human oversight.

- Impact: In many jurisdictions, enforcement mechanisms are not yet in place to ensure smart contracts’ compliance with local laws.

- Challenge: Regulators are concerned about protecting retail investors from market manipulation, scams, and the volatility associated with tokenized assets.

- Impact: Regulatory bodies may impose restrictions or require additional disclosures, which could deter participation and stifle innovation in asset tokenization.

Addressing these regulatory hurdles will be essential for the widespread adoption of asset tokenization. Clear guidelines, international cooperation, and technological advancements may help mitigate these challenges over time.

Strategies for Navigating Global RegulationsNavigating global regulations, especially in emerging fields like asset tokenization or digital assets, requires a proactive and adaptive approach. Here are some strategies that organizations can use to manage compliance across diverse regulatory landscapes:

1. Establish a Dedicated Compliance Team

1. Establish a Dedicated Compliance Team- Strategy: Form a team focused on compliance to monitor regulatory changes, interpret laws across jurisdictions, and guide business decisions.

- Benefit: A specialized team ensures you stay updated on regulatory shifts and can respond quickly, reducing the risk of fines or operational disruptions.

- Strategy: Prioritize regions with clear regulatory frameworks to establish a compliant and secure foundation. Focus initially on jurisdictions that offer sandboxes or blockchain-friendly policies.

- Benefit: This helps in gaining regulatory credibility and builds an operational model that can be replicated or adapted for stricter markets as regulations mature.

- Strategy: Use special purpose vehicles (SPVs) or other legal structures to streamline compliance across various jurisdictions. Partnering with local entities can also reduce regulatory friction.

- Benefit: These structures allow businesses to separate and isolate regulatory risks, making it easier to comply with local laws and avoid cross-jurisdictional issues.

- Strategy: Implement robust AML (Anti-Money Laundering) and KYC (Know Your Customer) processes that can meet the highest standards of regulatory scrutiny.

- Benefit: A strong AML/KYC setup not only enhances customer trust but also prepares the business to expand into jurisdictions with stringent identity verification requirements.

- Strategy: Adopt regulatory technology (RegTech) solutions that automate compliance reporting, track regulatory changes, and perform real-time transaction monitoring.

- Benefit: RegTech can streamline compliance processes and minimize human error, enabling scalability and allowing compliance teams to focus on strategic issues.

- Strategy: Proactively engage with regulators through consultations, attending industry conferences, or participating in regulatory sandboxes.

- Benefit: Early involvement in regulatory discussions fosters goodwill, helps the company anticipate future changes, and can sometimes even influence regulatory outcomes.

- Strategy: Design products, processes, and compliance frameworks based on internationally recognized standards (e.g., FATF recommendations for AML, GDPR for data privacy).

- Benefit: This allows for easier adjustments as jurisdictions adopt similar standards, reducing rework and ensuring that your solution remains compliant across regions.

- Strategy: Offer transparent, standardized disclosures on the company’s approach to compliance, risks, and how regulations are addressed.

- Benefit: Clear, upfront communication improves credibility with regulators and users alike, which can lead to fewer regulatory challenges and increased trust.

- Strategy: Partner with established, compliant financial institutions or legal advisors in each jurisdiction to benefit from their regulatory knowledge and existing licenses.

- Benefit: Strategic partnerships can reduce regulatory hurdles and provide access to localized expertise, mitigating risks and fostering smoother operations in complex markets.

- Strategy: Invest in continuous learning and training for employees to keep up with regulatory changes, and have contingency plans in place for quick adaptation.

- Benefit: Staying informed minimizes risks and enables swift adjustments, which can be a competitive advantage in fast-evolving industries.

- Strategy: When implementing blockchain and smart contracts, ensure they are designed to be compliant with key jurisdictions or have adaptability features that can meet future regulatory requirements.

- Benefit: Well-structured smart contracts reduce the risk of regulatory breaches and enable scalable solutions that comply with legal obligations.

By combining these strategies, organizations can build a resilient compliance framework that not only supports current operations but also enables agile responses to regulatory developments globally.

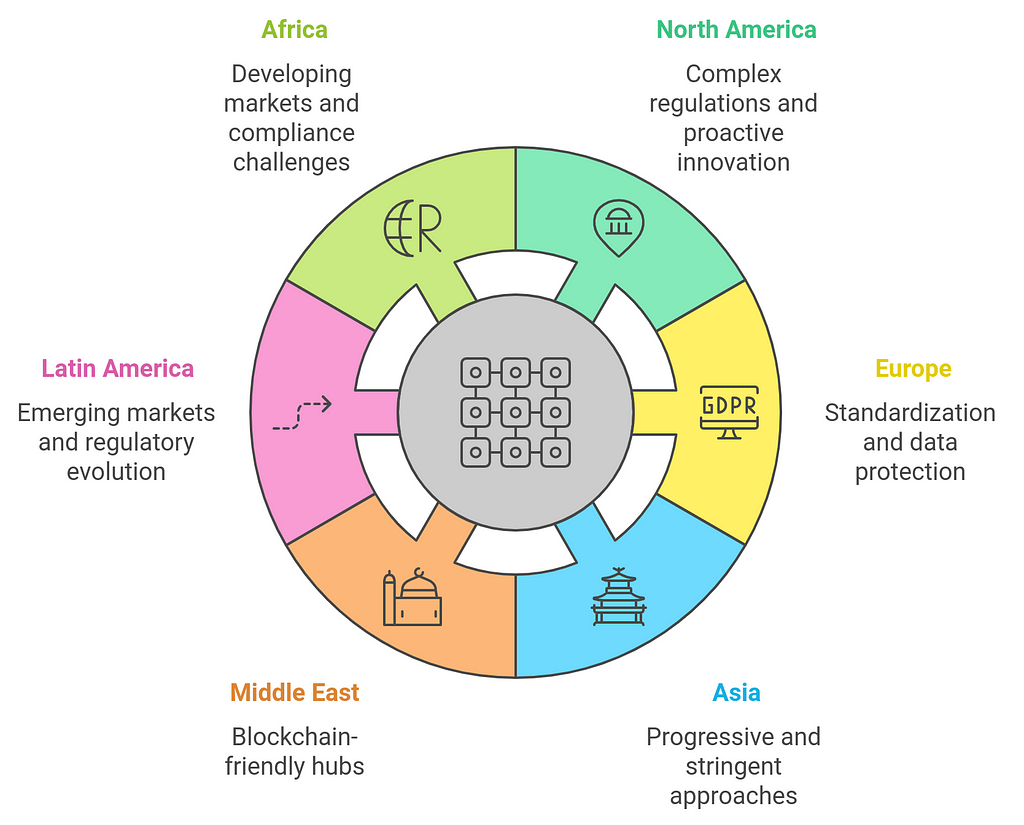

Key Regional Considerations in Asset TokenizationWhen considering asset tokenization across different regions, it’s essential to take into account the unique regulatory, market, and technological environments in each area. Here are some key regional considerations that organizations should be aware of:

1. North America (USA & Canada)USA:

1. North America (USA & Canada)USA:- Regulation: The U.S. has a complex regulatory landscape, with both state and federal laws impacting tokenization. The Securities and Exchange Commission (SEC) often classifies tokenized assets as securities, subjecting them to strict regulations (e.g., registration, reporting, and disclosure requirements).

- AML/KYC: Strong enforcement of Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, especially for crypto-related activities, mandates rigorous identity verification processes.

- Taxation: The IRS treats tokens as property for tax purposes, which means tokenized assets are subject to capital gains tax upon transfer or sale.

- Regulation: Canada has generally adopted a more favorable approach to blockchain and cryptocurrency regulations. Tokenized securities are subject to similar rules as traditional securities, governed by the Canadian Securities Administrators (CSA).

- AML/KYC: Similar to the U.S., Canada enforces strong AML/KYC regulations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

- Market: The Canadian government has been proactive in implementing regulatory sandboxes to test blockchain-based innovations.

- MiCA (Markets in Crypto-Assets Regulation): The EU is moving toward clearer regulations for crypto-assets, which will likely apply to tokenized assets. MiCA will help standardize the rules for digital assets across member states.

- GDPR: Tokenization efforts must comply with the EU’s General Data Protection Regulation (GDPR), particularly when handling personal data in blockchain systems.

- AML/KYC: The EU enforces strong AML/KYC measures, requiring platforms to ensure that they follow proper customer verification procedures.

- Market: Some European countries, such as Switzerland (with its Crypto Valley in Zug), Liechtenstein, and Germany, have favorable environments for digital assets and blockchain technology.

- Regulation: Singapore is one of the most progressive regions for tokenization, with clear regulatory guidelines under the Monetary Authority of Singapore (MAS). Tokenized assets, particularly securities, must adhere to securities laws.

- AML/KYC: Strong AML/KYC regulations are enforced by the MAS, and the country has established guidelines for the treatment of digital assets.

- Market: Singapore’s pro-business stance and clear regulatory environment make it a hub for blockchain innovation.

- Regulation: Hong Kong has recently moved towards more stringent regulation, with tokenized securities being considered as financial products regulated by the Securities and Futures Commission (SFC).

- AML/KYC: Similar to Singapore, Hong Kong enforces strict AML/KYC rules for digital asset platforms and services.

- Market: Hong Kong remains a key financial hub in Asia, although recent changes in regulatory stance have raised questions about the region’s future role in blockchain.

- Regulation: China has a strict stance against cryptocurrency trading, and many aspects of asset tokenization are subject to prohibitions. However, the government has expressed interest in blockchain technology for other use cases, such as supply chain and government data management.

- Market: While China’s blockchain adoption remains significant, its regulatory environment creates challenges for the tokenization of assets.

- Regulation: Japan is one of the most progressive countries for blockchain regulation, with clear laws governing the treatment of tokenized assets. The Financial Services Agency (FSA) regulates crypto and tokenized securities.

- AML/KYC: Japan has robust AML/KYC regulations in place, ensuring compliance with international standards.

- Market: Japan has a large, active market for cryptocurrency trading, and the government is encouraging blockchain innovation.

- Regulation: The UAE, particularly Dubai, is one of the most blockchain-friendly regions in the Middle East. The Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM) have established regulatory frameworks for tokenized assets and blockchain projects.

- AML/KYC: The UAE enforces rigorous AML/KYC regulations, ensuring that tokenized platforms comply with global standards.

- Market: The UAE is positioning itself as a global blockchain hub, with numerous initiatives supporting the growth of tokenization in real estate, commodities, and financial products.

- Regulation: Saudi Arabia has expressed interest in blockchain but has been cautious with tokenization. The Saudi Arabian Monetary Authority (SAMA) regulates digital assets but has strict rules for token offerings.

- Market: Saudi Arabia’s focus is primarily on blockchain infrastructure and fintech development, with tokenization efforts in the early stages.

- Regulation: Brazil is taking steps towards regulating digital assets and tokenized securities. The Brazilian Securities and Exchange Commission (CVM) has provided some guidelines on token offerings, but clarity around tokenized assets is still developing.

- AML/KYC: Brazil enforces AML regulations under the Brazilian Central Bank and CVM, but their application to tokenized assets is still evolving.

- Market: Brazil has an emerging fintech ecosystem, and blockchain technology is gaining traction, particularly in the financial sector.

- Regulation: Argentina has had a more flexible approach to blockchain and cryptocurrencies but with increasing calls for regulation in the asset tokenization space due to concerns over inflation and currency stability.

- Market: Asset tokenization could provide a means to hedge against local economic instability, making it an appealing area for growth.

- South Africa:

- Regulation: South Africa is working towards clearer regulations for blockchain and digital assets. The South African Reserve Bank (SARB) has issued guidelines for cryptocurrencies but has yet to fully regulate tokenized securities.

- AML/KYC: The country follows international standards for AML/KYC compliance, which are becoming more relevant for digital asset exchanges.

- Market: South Africa has an emerging blockchain market, and tokenization has the potential to address challenges in sectors like real estate and commodities.

Successfully navigating these regional differences requires a well-planned strategy, flexible legal frameworks, and an understanding of local compliance requirements to ensure global scalability.

Leveraging Technology for ComplianceLeveraging technology for compliance is essential in today’s complex regulatory landscape, especially for industries like finance, healthcare, and asset management, where regulatory requirements are stringent and constantly evolving. Advanced technologies such as artificial intelligence (AI), blockchain, and machine learning are transforming compliance by automating processes, enhancing accuracy, and reducing operational costs. AI-powered algorithms can quickly analyze vast datasets to detect anomalies, predict risks, and flag suspicious transactions, while blockchain provides a transparent, immutable ledger that enhances accountability and trust.

Machine learning tools help organizations adapt to regulatory changes by identifying patterns and suggesting timely updates to compliance protocols. Additionally, regulatory technology (RegTech) solutions streamline reporting, auditing, and risk management, ensuring organizations can meet compliance standards efficiently. By embracing these technologies, companies not only mitigate compliance risks but also gain a competitive advantage, fostering trust with clients and regulators alike. As regulations grow more intricate, leveraging technology becomes indispensable for maintaining compliance and operational resilience.

The Future of Asset Tokenization RegulationThe future of asset tokenization regulation is poised to evolve significantly as the technology matures, markets expand, and governments continue to address the challenges associated with digital assets. Several key trends and potential regulatory developments will shape the landscape of asset tokenization in the coming years.

1. Global Regulatory Harmonization

1. Global Regulatory Harmonization- Trend: A key challenge today is the fragmented regulatory environment, where different countries have varying rules and interpretations of asset tokenization. As digital asset markets grow, there will be increased pressure for harmonized regulations that allow for cross-border transactions and uniform legal frameworks.

- Potential Outcome: We are likely to see international regulatory bodies, such as the Financial Action Task Force (FATF) and IOSCO, collaborate to create global standards for tokenized assets. This could lead to a more cohesive approach to how tokenized assets are classified, traded, and taxed.

- Trend: The legal classification of tokens is still evolving, with some jurisdictions treating them as securities, others as commodities, or even creating new asset classes for tokenized properties. This uncertainty poses a barrier to widespread adoption.

- Potential Outcome: In the future, we can expect more jurisdictions to create clear legal definitions for digital tokens. Regulatory authorities will likely develop a standard framework that distinguishes between utility tokens, security tokens, and other types of digital assets. This clarity will reduce legal ambiguity and provide greater confidence to investors and businesses.

- Trend: Security token offerings (STOs) represent a major opportunity for asset tokenization, allowing traditional assets (like equity, real estate, or debt) to be digitized and traded. However, STOs currently face regulatory hurdles, particularly in countries like the U.S. where they are treated as securities.

- Potential Outcome: The future will likely see more comprehensive frameworks for STOs, particularly for tokenized real estate and equity markets. These frameworks could standardize disclosure requirements, investor protections, and trading mechanisms. As regulatory clarity increases, STOs could become a mainstream method for capital raising, enabling greater access to financial markets.

- Trend: As asset tokenization expands, regulators will increasingly focus on safeguarding investors and ensuring market integrity. This includes enforcing transparency, managing volatility, and preventing fraud and market manipulation.

- Potential Outcome: Enhanced investor protections will likely involve stricter rules for token offerings, requiring companies to provide more detailed disclosures, risk warnings, and mechanisms for dispute resolution. Regulators may also enforce rules around market conduct, limiting manipulation or abuse of tokenized assets, much like traditional securities markets.

- Trend: Asset tokenization has the potential to transform traditional financial markets by increasing liquidity and broadening access to investments. However, current regulatory frameworks often struggle to integrate tokenized assets with established financial systems.

- Potential Outcome: In the future, there will likely be greater alignment between tokenized assets and traditional finance. This may include the development of regulated exchanges for tokenized assets, integration with banking systems, and the development of hybrid models that bridge the gap between the two ecosystems. Central bank digital currencies (CBDCs) may also play a role in making tokenized assets more compatible with fiat currencies.

- Trend: DeFi platforms, which allow for the trading and lending of tokenized assets without intermediaries, are growing rapidly. However, they operate in a largely unregulated environment, posing risks related to fraud, hacking, and systemic instability.

- Potential Outcome: Regulators are likely to introduce frameworks to address the risks associated with DeFi, potentially requiring DeFi platforms to adhere to certain compliance standards (e.g., KYC/AML) and operate with transparency. This will create a more secure and regulated space for decentralized tokenized assets while preserving the innovation and efficiency benefits of DeFi.

- Trend: The taxation of tokenized assets remains a gray area in many jurisdictions. With the increased volume of digital asset transactions, regulators are under pressure to develop clear tax guidelines.

- Potential Outcome: Over time, we will likely see more standardized and transparent tax frameworks for tokenized assets. This may include clear rules on capital gains taxes, transaction reporting, and cross-border tax treatment. Many jurisdictions will probably move towards real-time reporting for tokenized transactions, helping to ensure that taxes are paid on profits derived from asset tokenization.

- Trend: AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations are critical aspects of digital asset regulation. The ability of tokenized assets to enable anonymous transactions presents challenges in preventing illegal activities such as money laundering and terrorism financing.

- Potential Outcome: Expect stricter enforcement and expansion of AML/KYC regulations in asset tokenization. Future regulation may require all tokenized asset platforms to implement advanced monitoring tools, verify the identity of participants, and report suspicious activity. Governments could also collaborate on cross-border tracking of transactions to enhance global AML/KYC compliance.

- Trend: One of the most significant opportunities for asset tokenization lies in traditional assets, particularly real estate, which is often illiquid and difficult to trade. Tokenization allows real estate to be divided into smaller, tradable units, opening it up to a wider pool of investors.

- Potential Outcome: As regulators become more familiar with tokenized real estate, clearer legal structures and frameworks will emerge, enabling the global expansion of tokenized property markets. Governments may also work with the private sector to ensure that the tokenization of tangible assets aligns with existing property laws, land registries, and taxation systems.

- Trend: The adoption of blockchain technology for asset tokenization depends heavily on the interoperability of different blockchain networks. Without common standards, different tokenized assets may become siloed, creating inefficiencies and limiting liquidity.

- Potential Outcome: The future of asset tokenization will likely involve the development of cross-chain standards and interoperability protocols that allow different blockchains to communicate and share tokenized assets seamlessly. This could significantly boost liquidity and open up new opportunities for tokenized assets in global markets.

The future of asset tokenization regulation will likely be shaped by evolving legal frameworks that balance innovation with investor protection. As regulatory bodies around the world address the unique challenges of digital assets, we can expect clearer classifications, improved market integrity, and enhanced integration with traditional finance. Collaboration between regulators, blockchain developers, and financial institutions will be key to ensuring that tokenization can unlock its full potential while maintaining a secure and transparent environment for all participants.

ConclusionIn the evolving world of asset tokenization, understanding and adapting to the global regulatory landscape is key to long-term success. As regulations continue to emerge and change across jurisdictions, companies must stay agile and proactive, integrating regulatory compliance into their business models.

This requires a multi-faceted approach: building strong legal partnerships, investing in compliance technology, and staying attuned to policy shifts in key markets. By developing comprehensive strategies that address anti-money laundering (AML) requirements, know-your-customer (KYC) protocols, tax laws, and securities regulations, companies can mitigate risks and build a foundation of trust with investors and regulators alike.

Embracing transparency and demonstrating commitment to compliance not only enhances credibility but also opens doors to broader market opportunities. In this rapidly growing field, organizations that can adapt to regulatory changes and foster trust are best positioned to lead and innovate in asset tokenization, turning regulatory complexity into a pathway for sustainable growth and industry leadership.

How Do You Navigate the Complex Global Regulatory Landscape of Asset Tokenization? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.