Bitcoin mining difficulty reach all-time high on US election day

Bitcoin mining difficulty has reached a historic peak, surpassing 100 trillion on the same day as the US elections, signaling an intense landscape for miners.

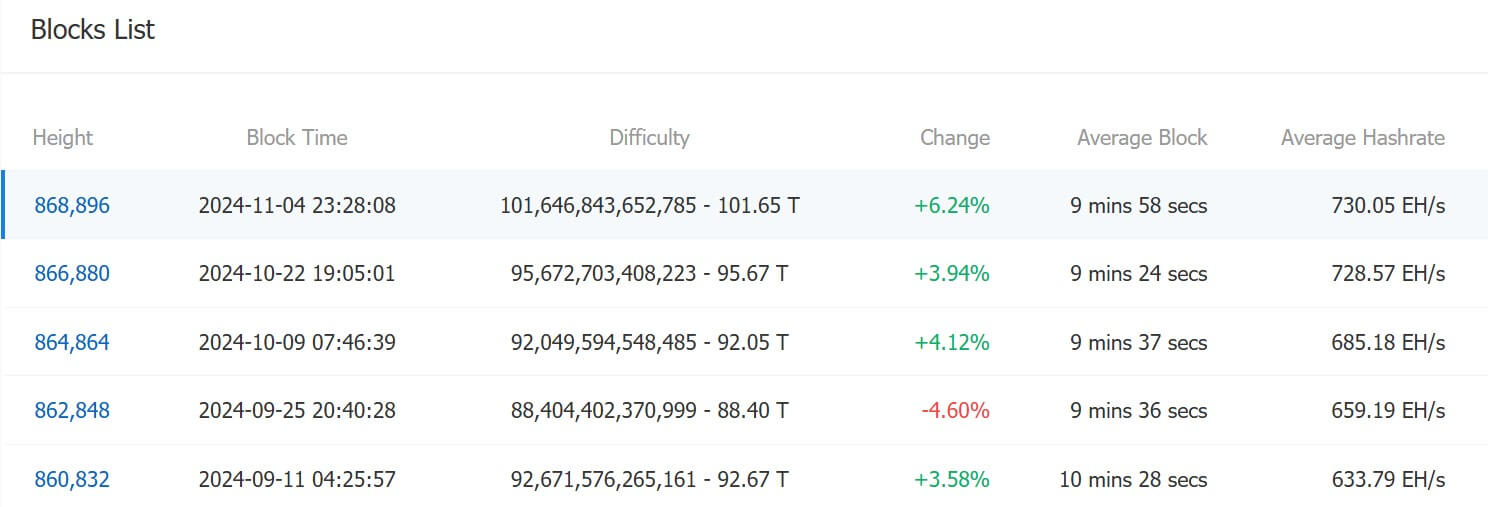

On Nov. 5, Bitcoin’s mining difficulty jumped 6.24%, reaching 101.65 trillion at block height 868,896, setting a new all-time record. This marks the 23rd difficulty adjustment of 2024, with 14 of these increases pushing the total difficulty by 40% this year.

Bitcoin Mining Difficulty Adjustments (Source: Cloverpool)

Bitcoin Mining Difficulty Adjustments (Source: Cloverpool)

Alongside this rise, Bitcoin’s hashrate, the network’s combined computational power, has also hit unprecedented levels. The seven-day moving average is around 730 exahashes per second (EH/s).

Typically, a higher hashrate strengthens the network but makes mining significantly more challenging, which inadvertently increases the operational demands on mining companies. So, BTC miners must invest in more advanced, energy-efficient equipment to stay competitive.

According to CoinShares’ Q3 report, the average cost of producing one Bitcoin across public mining firms reached about $49,500 in Q2, up from $47,200 in Q1. However, with Bitcoin’s market price around $69,000, many miners still find keeping their operations running at current levels profitable.

The post Bitcoin mining difficulty reach all-time high on US election day appeared first on CryptoSlate.