Here Are Four Potential Bullish Catalysts for Ethereum This Year, According to CryptoQuant CEO Ki Young Ju

Ethereum (ETH) has a flurry of potentially bullish catalysts this year, according to Ki Young Ju, the chief executive of the digital asset analytics platform CryptoQuant.

Young Ju notes on the social media platform X that there is no significant sell pressure following last week’s record-shattering Bybit hack.

“On-chain and market data remain neutral. Exchange selling takes time, and OTC (over-the-counter) offloads barely affect the price.”

The CryptoQuant CEO points out that Ethereum currently holds 56% of the stablecoin market cap.

“With Trump easing crypto regs, more firms may use ETH-based stablecoins and smart contracts in 2025.”

He also says it’s bullish that ETH already has approved and active spot exchange-traded funds (ETFs) in the US.

“Regulatory tailwinds could trigger a ‘Large Cap ETF altseason,’ boosting ETH this year.”

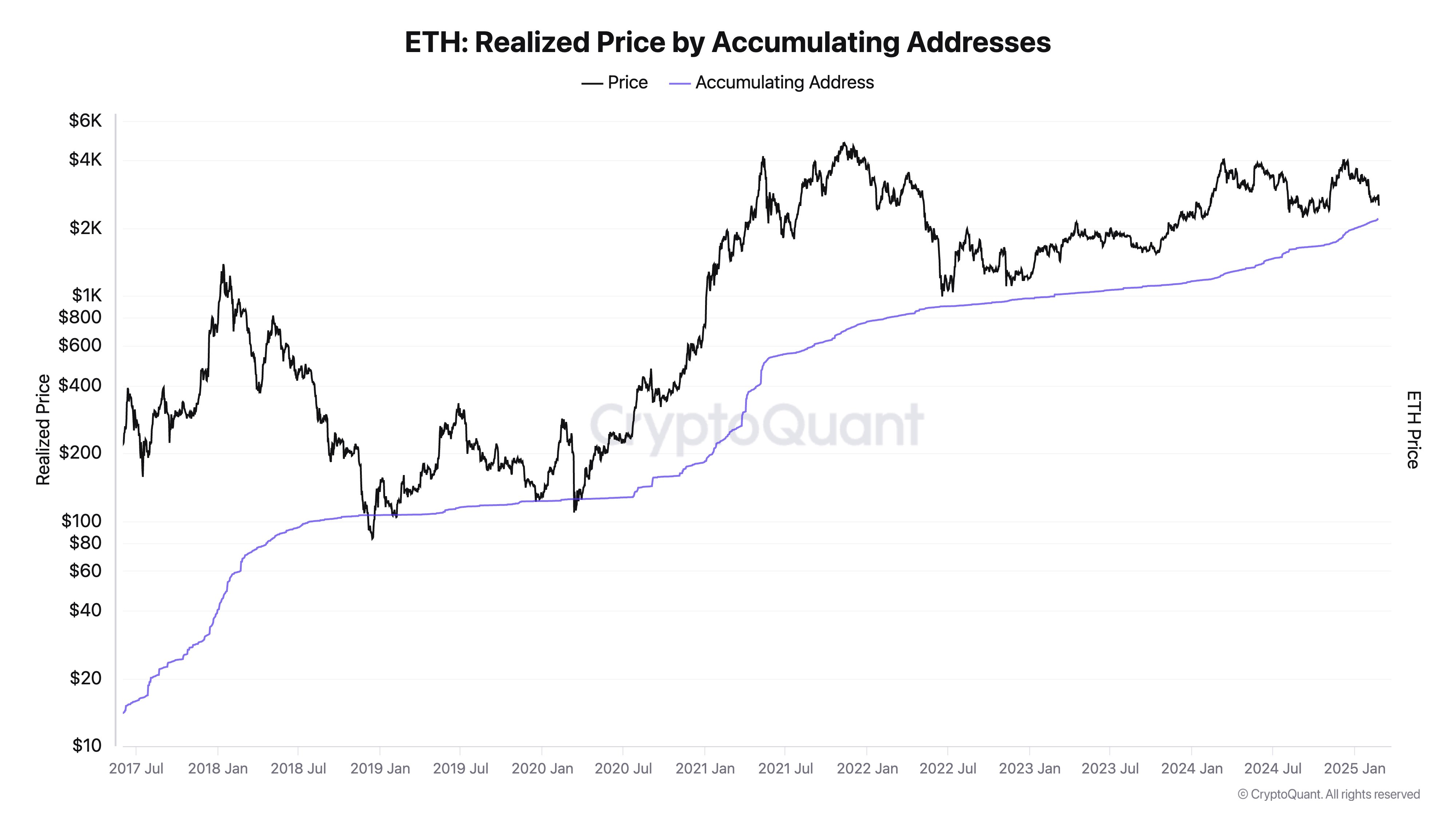

Lastly, Young Ju notes that whales have been accumulating Ethereum, another potentially bullish sign.

“10,000–100,000 ETH wallet balances are up 24% over the past year, mainly from wallets under 1,000 ETH. The current price is nearing the cost basis of accumulating addresses.”

Source: Ki Young Ju/X

Source: Ki Young Ju/X

Ethereum is trading at $2,424 at time of writing. The second-largest crypto asset by market cap is down nearly 9% in the past 24 hours and nearly 8% in the past seven days.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Here Are Four Potential Bullish Catalysts for Ethereum This Year, According to CryptoQuant CEO Ki Young Ju appeared first on The Daily Hodl.