4 Key US Economic Data to Shape Bitcoin Sentiment This Week

Bitcoin traders are preparing for a pivotal week, as four major US economic releases, including the Federal Reserve’s interest rate decision and essential labor market data, stand to influence market sentiment and determine the crypto’s next move.

This convergence of monetary policy updates and employment figures finds Bitcoin trading near technical levels that may result in notable volatility, upward or downward.

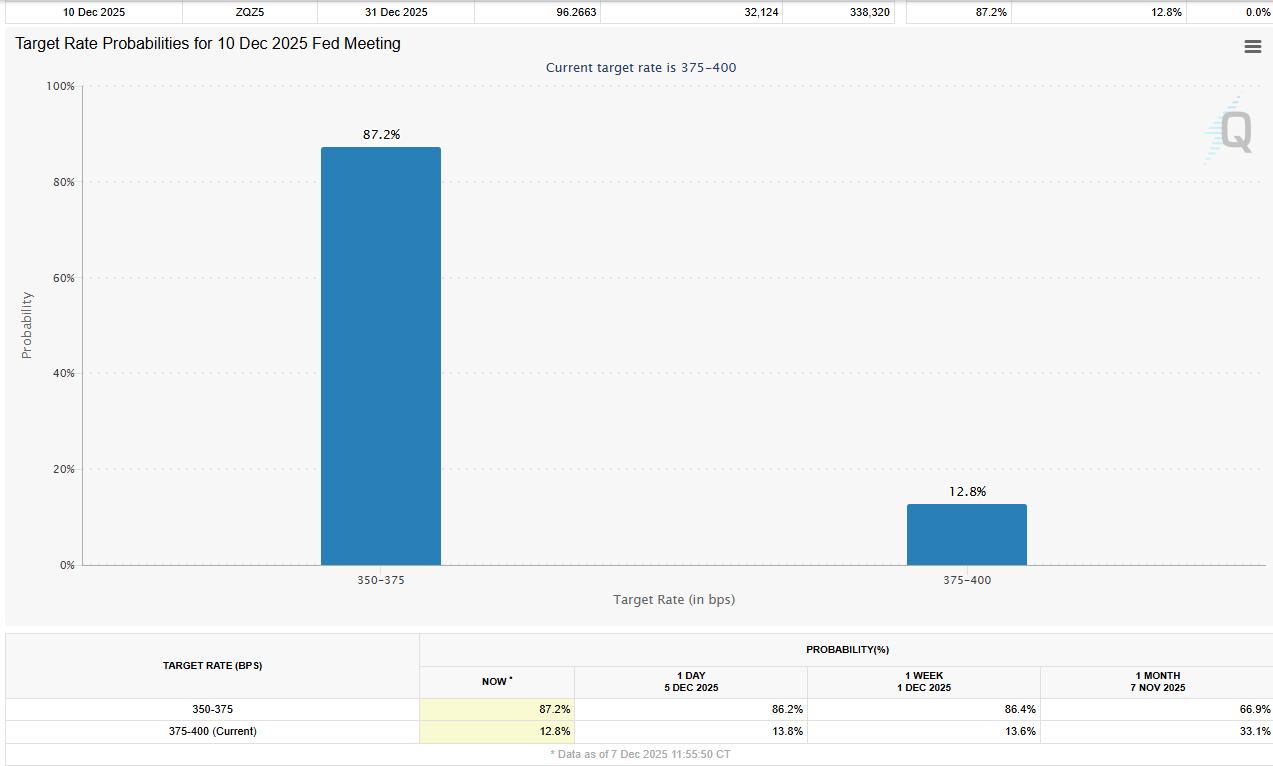

FOMC Interest Rate DecisionThe FOMC (Federal Open Market Committee’s) interest rate decision, scheduled for Wednesday at 2:00 p.m. ET, is widely viewed as the most significant event for Bitcoin and risk assets this week.

Market pricing implies an 87% probability of a rate cut, based on CME Group data, reflecting broad expectations for accommodative monetary policy that often benefits cryptocurrencies.

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Speculation is growing on social media about the scope of any rate change, with some saying that the market is already pricing a rate cut.

Market already pricing it in.

— Rodney (@cryptojourneyrs) December 8, 2025This assumption comes as the Bitcoin price is already showing strength, holding well above the $90,000 psychological level after the weekend’s whipsaw event.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Beyond the interest rate decision, the actual impact on Bitcoin may depend less on the decision and more on the Fed’s guidance for future policy.

Fed Chair Powell Press ConferenceAfter the announcement, Federal Reserve Chair Jerome Powell will hold a press conference at 2:30 p.m. ET. Powell’s commentary on future policy, inflation, and the economy is likely to provide important cues for crypto investors.

Historically, his statements have shaped positioning across markets, with Bitcoin being especially sensitive to changes in monetary policy direction.