5 US Economic Indicators With Crypto Implications This Week

Several US economic indicators are in the pipeline this week, with potential implications for Bitcoin and crypto.

US macroeconomic data have broadly influenced sentiment in the cryptocurrency market over the past several months. Therefore, it is imperative that traders and investors adjust their portfolios and align their trading strategies to capitalize on key economic events.

US Economic Events This WeekSeveral factors, including macroeconomic sentiment, monetary policy expectations, and Bitcoin’s growing narrative as a hedge or risk asset, influence Bitcoin’s price dynamics. These make the following indicators particularly relevant this week.

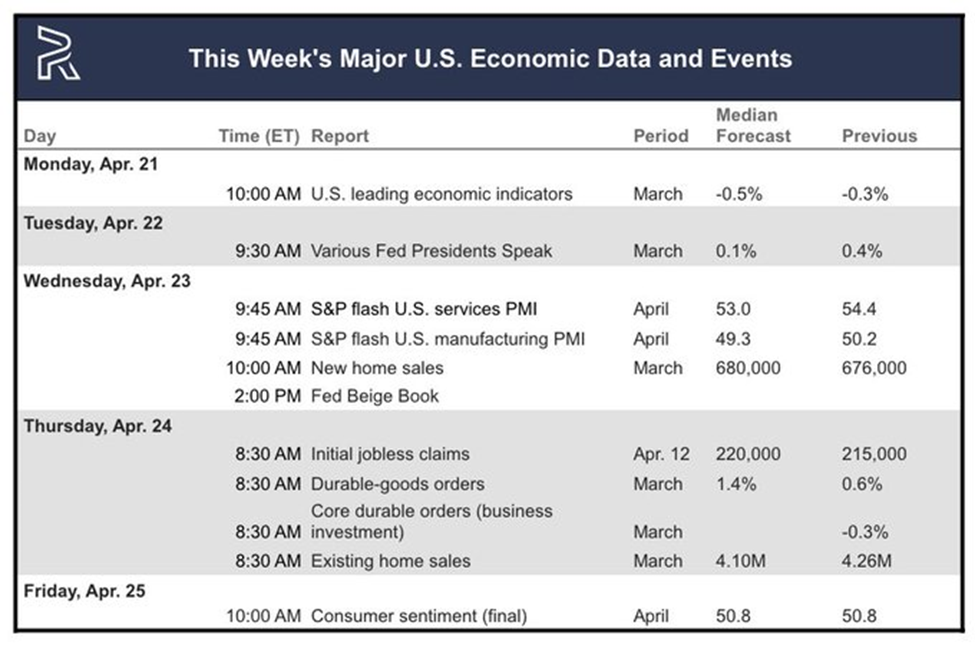

US economic indicators this week. Source: Rimac Capital on X

US Leading Economic Indicators

US economic indicators this week. Source: Rimac Capital on X

US Leading Economic Indicators

The first US economic indicator that could influence Bitcoin price is March’s leading economic indicator, due today, Monday, April 21.

The Conference Board Leading Economic Index (LEI), last reported for February 2025, declined by 0.3% month-over-month (MoM) after a revised 0.1% increase in December 2024.

This drop, driven by pessimistic consumer expectations and weaker manufacturing orders, continued a trend of negative signals. However, the six-month growth rate is improving, suggesting less severe headwinds than in 2024.

There is a median forecast of a 0.5% decline for the March report, versus a consensus of -0.6%. While these data points to economic slowdown, stabilizing trends and a projected 2.0% GDP growth for 2025 offer some optimism.

However, policy uncertainties, such as Trump’s tariffs, could exacerbate risks. For Bitcoin, declining LEI may dampen risk appetite, pushing investors toward safer assets like bonds and pressuring prices in the short term.

Conversely, Bitcoin’s “digital gold” narrative could gain traction if economic uncertainty fuels distrust in fiat systems. However, this is less likely unless broader trade tensions or policy shocks amplify the effect.

Services PMIThe S&P Global US Services PMI for March 2025 climbed to 54.4 from 51.0 in February, signaling strong expansion in the services sector. This rise, paired with a composite PMI 53.5, reflects resilient consumer demand.

This strength bolsters the US dollar, reducing expectations for Federal Reserve (Fed) rate cuts, which could challenge Bitcoin’s appeal. A stronger dollar and higher yields typically weigh on Bitcoin, as seen in past cycles when real yields rise.

However, rising input costs and tariff concerns temper business confidence. For the April Services PMI, the median forecast is 53.0.

Strong services activity may support broader risk-on sentiment, potentially lifting Bitcoin if equity markets rally, given its occasional correlation with indices like the Nasdaq.

Still, tariff uncertainties could cap any negative pressure, keeping the impact neutral to slightly bearish, as dollar strength overshadows marginal risk-on gains.

Manufacturing PMIIn contrast, the S&P Global US Manufacturing PMI for March 2025 fell to 50.2 from 52.7, hovering near stagnation. Meanwhile, the ISM Manufacturing PMI contracted to 49.0 from 50.3, with new orders, production, and employment declines.

This weakness, consistent with October 2024’s ISM reading 46.5, reflects high interest rates, weak global demand, and tariff-related uncertainty.

Moody’s Analytics and Statista highlight manufacturing’s struggles, warning of broader slowdown risks, especially with trade policy volatility under the Trump administration.

For Bitcoin, weak manufacturing data signals reduced risk appetite, likely exerting downward pressure, particularly given its equity market correlation.

While a sharp manufacturing decline could theoretically spur rate-cut expectations, persistent inflation and tariff-driven cost pressures make this unlikely. The outlook here is bearish, as fears of economic slowdown dominate.

“S&P Global Services/ManufacturingPMI (Wednesday): The pulse of the economy. Watch for a dip or rise in the numbers…it could hint at whether the recovery is running out of gas or shifting into overdrive,” one user remarked.

Initial Jobless ClaimsInitial Jobless Claims for the week ending April 19 recorded 215,000, down from 223,000 the week before.

It indicates a slight improvement but still reflects a labor market under pressure, suggesting ongoing challenges. High interest rates, cautious business investment, and uncertainties surrounding tariff policies likely drive this sentiment by eroding employer confidence.

“…66% of Americans expect higher unemployment in the next 12 months, the highest share since the Great Financial Crisis. Such sharp spikes have never occurred outside of recessions. The job market is set to get worse pretty quickly,” one analyst noted recently.

Nevertheless, despite reduced hiring and economic pressures, the decline suggests some layoff stabilization.

Analysts note that lower claims could ease concerns about rapid deterioration, persistent inflation, and policy uncertainties, which limit expectations for Fed rate cuts.

Meanwhile, jobless claims are a critical driver of Bitcoin sentiment. The modest drop in claims may temper economic weakness signals. If claims continue to decline significantly, sparking hopes of monetary easing, Bitcoin could benefit from increased liquidity and lower yields.

Consumer SentimentConsumer Sentiment, as measured by the University of Michigan’s index, was 50.8 in March 2025. This was a modest drop from February’s reading, reflecting tariff-related pessimism and inflation fears despite solid economic conditions.

Preliminary March data suggests a reading of 50.8, with sentiment still sour, per TradingEconomics estimates.

“US consumer sentiment is lower than in the great financial crisis. Consumer sentiment fell to 50.8, the 2nd-lowest level in history. The sentiment is lower than during every US recession over the last 50 years…This is a crisis,” a global markets investor noted.

Consumer sentiment is a gauge of retail investor confidence, critical for Bitcoin’s retail-driven market. Lower sentiment could sap enthusiasm for speculative assets, pushing Bitcoin lower, especially if risk-off sentiment dominates.

Conversely, if sentiment stabilizes or tariff fears ease, Bitcoin could ride a risk-on wave, though this seems unlikely given current trends.

The probable effect is bearish, as declining confidence aligns with broader economic caution.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCrypto

BeInCrypto data shows Bitcoin (BTC) was trading for $87,424 as of this writing. This represents a modest 2.66% gain in the last 24 hours.

The post 5 US Economic Indicators With Crypto Implications This Week appeared first on BeInCrypto.