Is artificial intelligence actually killing all the entry-level tech jobs?

The question of whether and when AI will begin to replace human labor has long been a subject of intense debate. Researchers at SignalFire, a data-driven venture capital firm that tracks workforce trends across more than 600 million professionals and 80 million companies on LinkedIn, believe they may be witnessing the initial signs of AI’s impact on employment dynamics.

Drawing on data from its Beacon AI platform, which tracks over 650 million professionals and 80 million organizations, the report highlights a dramatic downturn in new graduate hiring, the strategic dominance of elite AI labs like Anthropic in talent retention, and a significant reshuffling of geographic tech power centers.

Over the last few years, the competition for tech and AI talent has been nothing short of fierce. SignalFire’s latest analysis is about deep, structural changes. While headlines often focus on layoffs or the remote work debate, the data points to a more nuanced story of how, where, and who companies are hiring to build the next generation of technology.

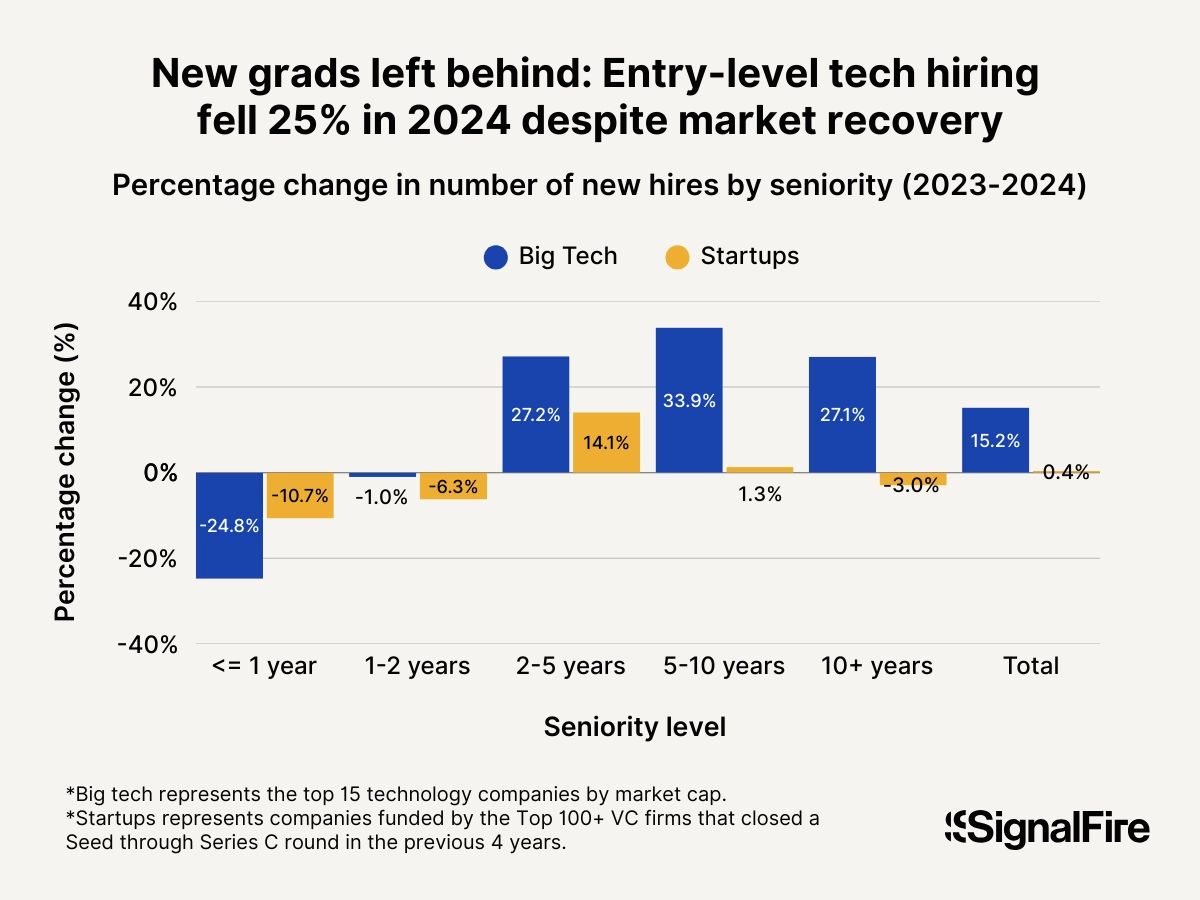

Tech’s “lost generation”Perhaps one of the most alarming trends identified in the report is the collapse of entry-level hiring. The door to the tech industry, once wide open for new graduates, is now “barely cracked.” This shift is attributed to a confluence of factors: smaller funding rounds for startups, shrinking team sizes, a reduction in new grad programs, and the increasing capabilities of AI automating routine tasks.

The numbers are sobering:

- Overall new grad hiring: has dropped a staggering 50% compared to pre-pandemic levels (2019).

- Big tech’s impact: new graduates now constitute just 7% of hires at these giants, a figure down 25% from 2023 and over 50% from 2019.

- Startup struggles: new grads make up under 6% of startup hires, with this segment seeing an 11% drop from 2023 and over 30% from pre-pandemic figures.

The report notes that while hiring bounced back in 2024 for mid- and senior-level roles after a general dip in 2023, the cuts for new graduates have only deepened. Data from the Federal Reserve Bank of New York corroborates this, showing a 30% rise in the unemployment rate for new college grads since September 2022, compared to an 18% rise for all workers. Perceptions aren’t helping either: 55% of employers state that Gen Z struggles with teamwork, and a striking 37% of managers admit they would rather use AI than hire a Gen Z employee.

This “experience paradox” means that even top computer science graduates are finding it difficult to break into the industry, especially at the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla), where the share of new graduates landing roles has more than halved since 2022. Companies are now prioritizing proven experience over potential, posting junior roles but often filling them with more senior individuals.

While AI often takes the blame for eliminating junior positions, SignalFire suggests the reality is more complex. The end of the low-interest “free money madness” of 2020-2022, leading to overhiring and subsequent corrections, is a major driver. With tighter budgets, companies are hiring leaner. Carta data shows Series A tech startups are, on average, 20% smaller than in 2020. This isn’t just about hiring less; it’s a “hiring reset,” with a focus on roles delivering high-leverage technical output, particularly in machine learning and data engineering, while non-technical roles in recruiting, product, and sales continue to shrink.

Anthropic sets a blistering pace in retentionThe launch of ChatGPT in November 2022 didn’t just usher in a new era of AI; it ignited an intense AI talent race. SignalFire’s analysis of retention across top AI labs reveals a clear leader: Anthropic. An impressive 80% of employees hired at Anthropic at least two years prior were still with the company at the end of their second year. This stands in stark contrast to an industry known for high turnover. DeepMind follows closely with a 78% retention rate, while OpenAI’s retention is lower at 67%, though still on par with large FAANG companies like Meta (64%).

Anthropic’s success isn’t just about keeping talent; it’s about strategically acquiring it. The report highlights:

- Precision talent poaching: engineers are reportedly 8 times more likely to leave OpenAI for Anthropic than the reverse. From DeepMind, the flow towards Anthropic is even more pronounced, at a nearly 11:1 ratio.

- Culture as an edge: beyond competitive salaries, Anthropic’s unique culture, which embraces unconventional thinkers and offers employees significant autonomy, flexible work options, and clear career growth paths without “title politics,” is a major draw. Employees reportedly value the intellectual discourse and researcher autonomy, attracting talent stifled by bureaucracy elsewhere.

- Product affinity: the growing popularity of Anthropic’s AI model, Claude, among developers may also be influencing career decisions, as engineers often gravitate towards companies whose products they admire and use.

Big Tech companies like Google, Meta, Microsoft, Amazon, and Stripe have also become prime hunting grounds for AI labs, with Anthropic being particularly successful in attracting senior researchers and engineers from these established players.

The geographic distribution of tech talent is also in flux. While San Francisco and New York City remain dominant (hosting over 65% of AI engineers), other hubs are making significant gains. The report notes key trends from 2024:

- Silicon Valley and New York City’s resilience: Despite high costs, these traditional hubs continue to attract tech talent and anchor the AI ecosystem.

- The “sunshine surge”: Miami and San Diego are emerging as attractive alternatives, drawing talent with lifestyle benefits and lower living costs. Miami saw a 12% jump in AI roles, buoyed by tax perks and quality of life. San Diego experienced a 7% rise in Big Tech roles, and its startups raised $5.7 billion in venture capital in 2024.

- Texas cooling off: Once boomtowns for tech growth, Austin and Houston are now losing startup talent. Austin saw a 6% drop in headcount at VC-backed startups, while Houston’s decline was steeper at 10.9%. Factors include lagging infrastructure, cultural mismatches, fluctuating housing costs, and a renewed emphasis on hybrid return-to-office (RTO) policies that favor proximity to traditional hubs.

This isn’t merely regional reshuffling. Companies are adopting a “proximity over presence” model, valuing closeness for hybrid schedules and anchor days over strict five-days-a-week office mandates, leading to a surge in in-state hiring.

41% of Gen Z workers are sabotaging their employer’s AI plans

SignalFire revisited its predictions from the previous year, noting successes like the persistence of fractional work, continued growth in cybersecurity talent demand, and the evolution of remote work into hybrid models. For 2025, the report forecasts several key developments:

- The rise of the generalist engineer: As AI tools like Copilot mature, companies may prioritize flexible, collaborative generalist engineers who can leverage these tools effectively, reducing the need for deep ML expertise for many roles.

- The year of the equity advisor: Lean startups, hesitant to hire for both junior and C-suite roles, will increasingly tap seasoned experts as equity advisors, a cost-effective way to gain experience.

- New ai-centric jobs emerge: Alongside concerns about job displacement, new roles are appearing. Titles like “AI governance lead,” “AI ethics and privacy specialist,” “agentic AI engineer,” and “non-human security ops specialist” are expected to become more common.

The overarching message of the SignalFire report is that “technology alone doesn’t build the future, people do.”