Bitcoin’s Fourth of July Price Drop Explained | Weekly Whale Watch

Bitcoin saw a mild selloff on the Fourth of July as on-chain data revealed rare movements from long-dormant whale wallets and a notable shift in whale accumulation trends.

The flagship cryptocurrency briefly touched $110,000 before retreating to around $107,600 by midday. The intraday decline—around 2%—comes amid unusually high on-chain activity from early Bitcoin holders and weakening whale metrics.

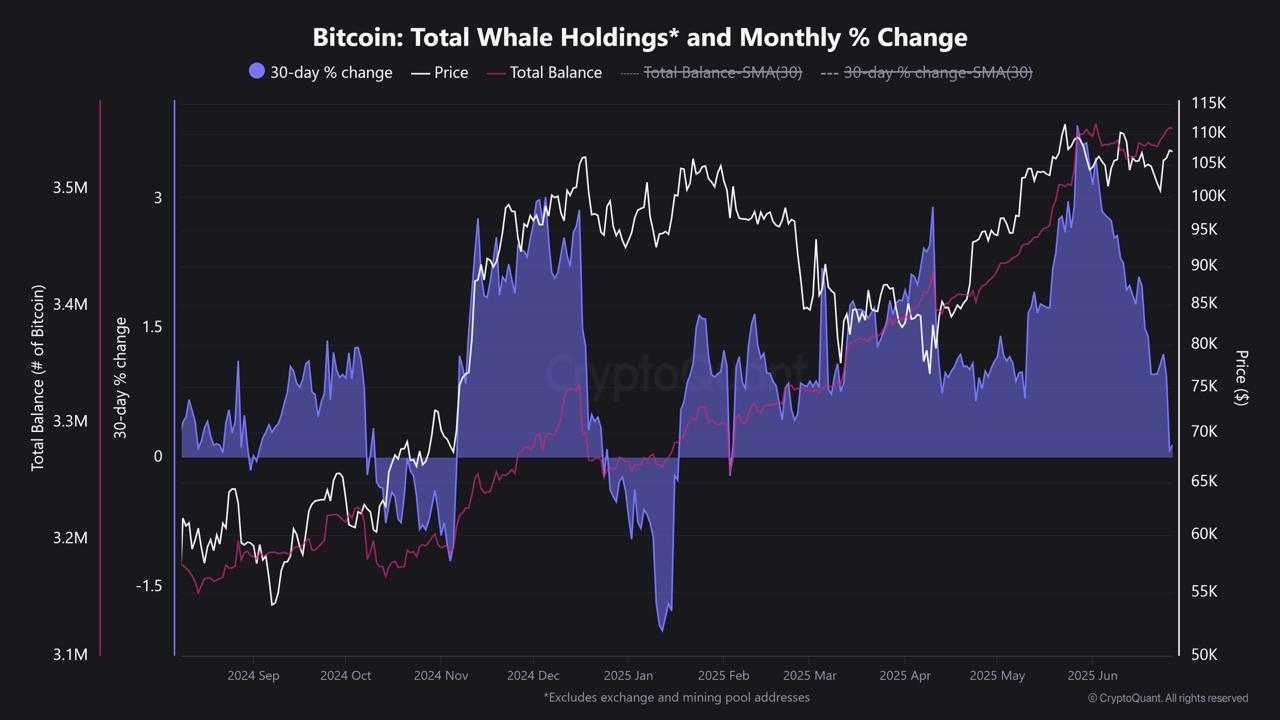

Whale Accumulation Trend Turns NegativeOn-chain metrics from CryptoQuant reveal a deeper structural shift. The 30-day percentage change in total whale holdings has now turned negative for the first time in six months.

Whale holdings steadily increased from 3.28 million BTC in January to a peak of 3.55 million BTC in June. This accumulation phase helped support Bitcoin’s price recovery through Q1 and Q2.

However, this upward trend has now reversed. The decline in net whale holdings signals the start of a distribution phase, when large holders begin offloading or reallocating capital.

Bitcoin Whale Holdings Chart. Source: CryptoQuant

Bitcoin Whale Holdings Chart. Source: CryptoQuant

Historically, negative shifts in this metric have coincided with short- to mid-term corrections. Institutional and long-term holders often reduce exposure or prepare for liquidity events.

If more of these dormant coins start moving—or selling pressure mounts—we may see a short-term retest of support zones near $105,000.