Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

[Update Jan. 13, 11.15: Since publishing, Bitcoin has continued to fall below $92,000 increasing liquidations to $418 million with $349 million in long positions.]

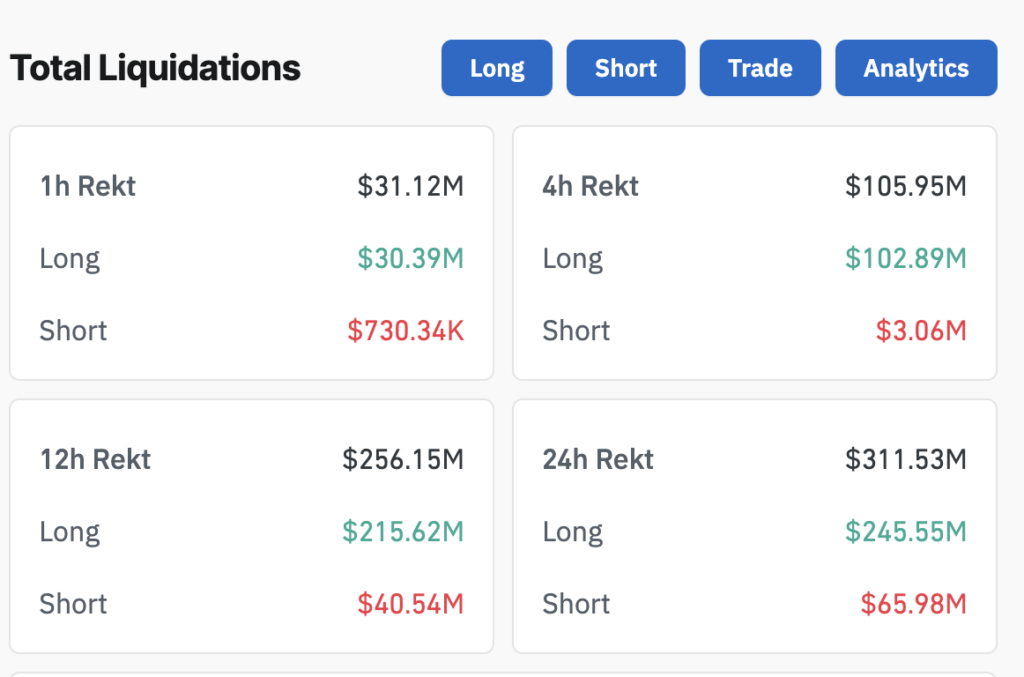

Bitcoin’s recent volatility triggered $311.53 million in total crypto liquidations over the past 24 hours, trading between $95,000 and $92,000. This movement followed an initial 2% rise offset by a 3% decline as the Asia markets opened.

Crypto liquidations (Source: Coinglass)

Crypto liquidations (Source: Coinglass)

Data from Coinglass shows that long positions accounted for 78.82% of liquidations, totaling $245.55 million. Short positions saw $65.99 million in liquidations. Binance led with $127.18 million liquidated, 81.21% from long positions. OKX and Bybit followed with $79.50 million and $52.87 million liquidated, respectively, similarly dominated by long liquidations.

Bitcoin remained the most liquidated asset, with $44.91 million from long positions and $20.43 million from shorts. Ethereum followed at $34.31 million liquidated from longs and $18.11 million from shorts. Other assets, including Solana, XRP, and Dogecoin, collectively contributed to the liquidations, reflecting broader market instability.

The largest single liquidation occurred on Binance’s BTCUSDT pair, valued at $8.21 million. Over 132,800 traders were affected, as crypto liquidations have remained elevated despite a slight decline in open interest. OI has fallen to $60 billion from a high of $71 billion on Dec. 18.

The post Bitcoin’s sharp rise and fall starts week with $418 million in liquidations appeared first on CryptoSlate.