Bitcoin’s Supply Trends Mirror 2021: What It Means for Price

Bitcoin’s price action has been volatile in recent days, with the leading cryptocurrency struggling to secure the $100,000 mark as firm support. Despite multiple attempts, BTC has faced strong resistance, leading to increased selling pressure.

Recent market conditions suggest that Bitcoin’s inability to hold key price levels could further weaken its position, leaving it vulnerable to a potential correction.

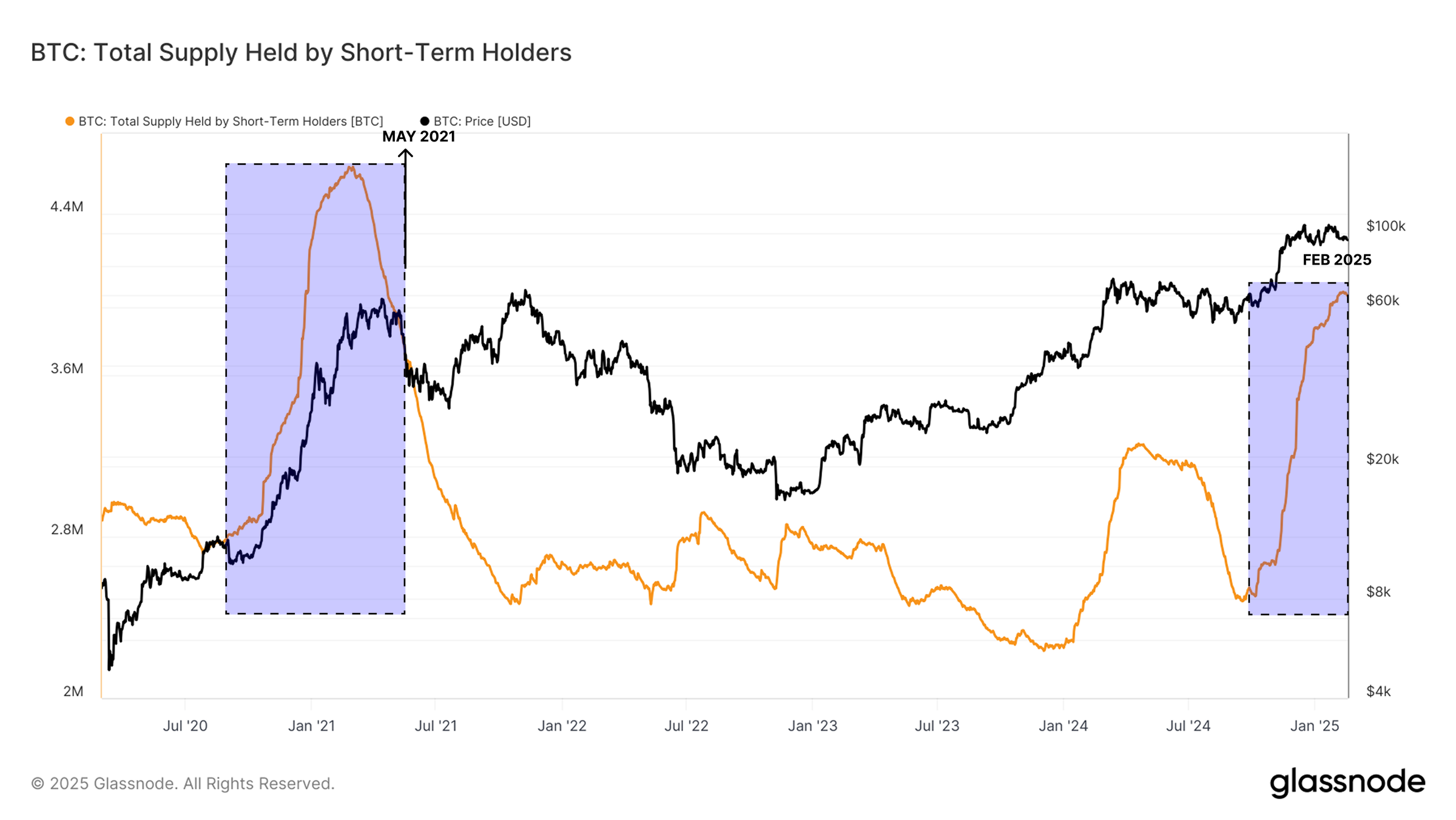

Bitcoin Investors Are Driving The PriceShort-term holders (STH) have played a crucial role in Bitcoin’s recent price action. The supply held by these investors indicates that the market is mirroring the accumulation phase seen in May 2021.

Back then, Bitcoin saw a significant influx of supply, leading to increased sensitivity among investors to any downward movement. If BTC fails to maintain support above $92,500, these holders may start offloading their assets, exacerbating the selling pressure.

Should demand remain steady, Bitcoin could establish a new range above its all-time highs. However, a lack of sustained buy pressure could trigger a deeper correction.

Historically, post-ATH phases have led to widespread panic among new entrants, particularly those who recently accumulated BTC at peak prices. If their holdings slip into unrealized losses, it may prompt a wave of distribution, increasing the chances of a sharp price decline.

Bitcoin Short-Term Holder Supply. Source: Glassnode

Bitcoin Short-Term Holder Supply. Source: Glassnode

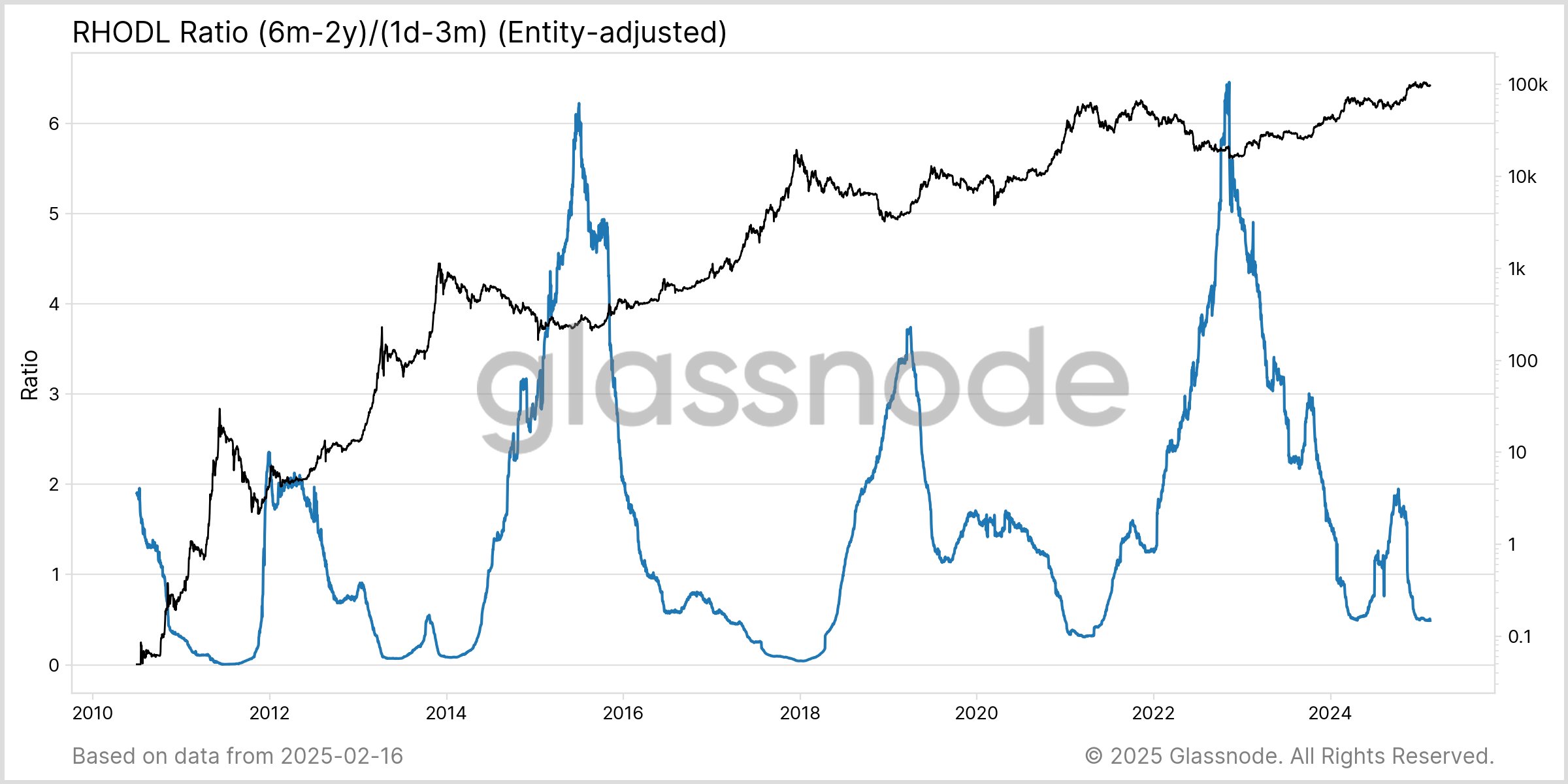

The RHODL Ratio, which measures the balance between mid-cycle holders (6 months to 2 years) and new entrants (1 day to 3 months), has been declining. This trend suggests that short-term speculation is rising, a common indicator observed before market tops. While the ratio is not yet at extreme lows, its current movement aligns with patterns seen in the latter stages of previous bull cycles.

A further drop in the RHODL Ratio could signal an impending correction. Historically, when the ratio rebounds after hitting a low, it has marked key turning points in Bitcoin’s price cycles. If this pattern repeats, Bitcoin may enter a distribution phase before stabilizing or initiating another upward movement.

Bitcoin RHODL Ratio. Source: Glassnode

BTC Price May Find It Difficult To Rally

Bitcoin RHODL Ratio. Source: Glassnode

BTC Price May Find It Difficult To Rally

Bitcoin price is currently consolidating between $98,212 and $95,761 and is at risk of a decline. Multiple tests of the lower support indicate that BTC remains susceptible to another retest. Should this level fail to hold, Bitcoin could face increased selling pressure, leading to a sharper decline.

Given the ongoing macro trends and STH supply distribution, Bitcoin’s price may see a correction in the short term. A drop to $93,625 is plausible, and if bearish momentum intensifies, BTC could decline further to $92,005. These levels could act as critical support zones, influencing the next market movement.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

On the other hand, continued accumulation by investors with a long-term outlook could provide Bitcoin with the necessary support to break through $98,212. If BTC successfully reclaims $100,000, bullish momentum could accelerate, propelling the cryptocurrency toward its all-time high of $105,000.

The post Bitcoin’s Supply Trends Mirror 2021: What It Means for Price appeared first on BeInCrypto.