Bitcoin Drop Wipes $1B Off Strategy’s Holdings – Time to Pivot?

The post Bitcoin Drop Wipes $1B Off Strategy’s Holdings – Time to Pivot? appeared first on Coinpedia Fintech News

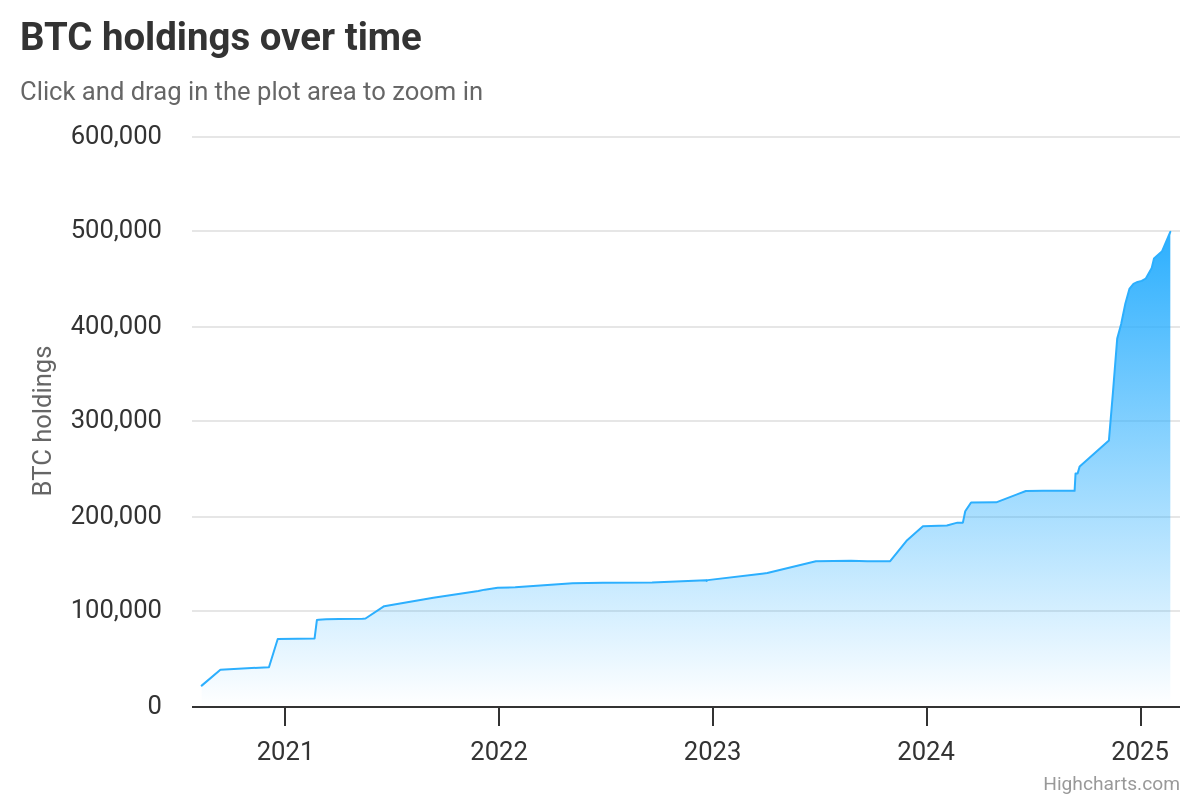

Strategy has a special place in the crypto community. When the company first entered the Bitcoin market, few public firms were willing to take the risk. But under Michael Saylor’s leadership, Strategy adopted an aggressive Bitcoin investment strategy. Today, it holds 499,096 BTC.

The company made headlines when Bitcoin briefly crossed the $100K milestone. However, since February 4, BTC has not closed above this level. The price now stands at $88,724.95, down 11.26% from its peak. This raises an important question – has Bitcoin’s decline affected Strategy’s stock? And has Saylor’s strategy hit a roadblock?

Strategy’s Dollar-Cost Averaging ApproachStrategy follows a Dollar-Cost Averaging (DCA) strategy, where it buys Bitcoin in regular intervals instead of making one large purchase. This explains why the company bought BTC even when prices were between $95K and $106K.

However, Bitcoin has dropped significantly since its peak of $106K—down 16.28% overall.

- In early February, BTC traded at $100,621.97.

- On February 2, it briefly closed above $101,305.27.

- February 3 saw a 3.49% drop.

- Between February 5 and 23, BTC stayed between $98,290.71 and $95,678.10.

- On February 24, it fell below this range, dropping 12.48% in three days.

- Although BTC rebounded 11.77% between March 1 and 2, it failed to recover completely.

- On March 3, BTC saw another 8.49% decline.

Now, Bitcoin is still struggling to get back above $100K.

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; } .entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; } .entry ul.article-inside-link li:last-child { display: none; } Strategy’s $1 Billion Unrealized LossBecause of its aggressive buying, Strategy is now facing $1 billion in unrealized losses. The biggest loss came from a $1.11 billion Bitcoin purchase at an average price of $105,596 per BTC.

The company’s most recent Bitcoin purchase was on February 24, when it bought 20,356 BTC for $1.99 billion. Currently, Strategy’s total Bitcoin holdings are worth $44.63 billion.

If Bitcoin doesn’t recover soon, Strategy might have to reassess its approach. Will Saylor continue to buy more, or will the company take a different route? For now, all eyes are on Bitcoin’s next move.

.article_register_shortcode { padding: 18px 24px; border-radius: 8px; display: flex; align-items: center; margin: 6px 0 22px; border: 1px solid #0052CC4D; background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%); } .article_register_shortcode .media-body h5 { color: #000000; font-weight: 600; font-size: 20px; line-height: 22px; text-align:left; } .article_register_shortcode .media-body h5 span { color: #0052CC; } .article_register_shortcode .media-body p { font-weight: 400; font-size: 14px; line-height: 22px; color: #171717B2; margin-top: 4px; text-align:left; } .article_register_shortcode .media-body{ padding-right: 14px; } .article_register_shortcode .media-button a { float: right; } .article_register_shortcode .primary-button img{ vertical-align: middle; width: 20px; margin: 0; display: inline-block; } @media (min-width: 581px) and (max-width: 991px) { .article_register_shortcode .media-body p { margin-bottom: 0; } } @media (max-width: 580px) { .article_register_shortcode { display: block; padding: 20px; } .article_register_shortcode img { max-width: 50px; } .article_register_shortcode .media-body h5 { font-size: 16px; } .article_register_shortcode .media-body { margin-left: 0px; } .article_register_shortcode .media-body p { font-size: 13px; line-height: 20px; margin-top: 6px; margin-bottom: 14px; } .article_register_shortcode .media-button a { float: unset; } .article_register_shortcode .secondary-button { margin-bottom: 0; } } Never Miss a Beat in the Crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.subscription-options li { display: none; } .research-report-subscribe{ background-color: #0052CC; padding: 12px 20px; border-radius: 8px; color: #fff; font-weight: 500; font-size: 14px; width: 96%; } .research-report-subscribe img{ vertical-align: sub; margin-right: 2px; }As of now, MicroStrategy holds 499,096 BTC, valued at approximately $44.6 billion, despite market fluctuations.

Has MicroStrategy lost money on Bitcoin?Yes, recent BTC price drops have led to over $1 billion in unrealized losses, with a significant loss from a $1.11B purchase at $105,596 per BTC.

How does Bitcoin’s price impact MSTR stock?MicroStrategy’s stock (MSTR) often moves with Bitcoin, rising during BTC rallies and facing sell-offs during major corrections.