Bitcoin Miners Face Revenue Slump as BTC Stumbles Away from $100,000 Mark

Bitcoin’s price has dropped nearly 10% since hitting an intraday high of $102,735 on Tuesday. This decline has significantly affected miners, with daily revenue on the Bitcoin network sinking to a 30-day low.

As buying pressure weakens, BTC risks slipping below $90,000, potentially amplifying losses for miners already facing financial strain.

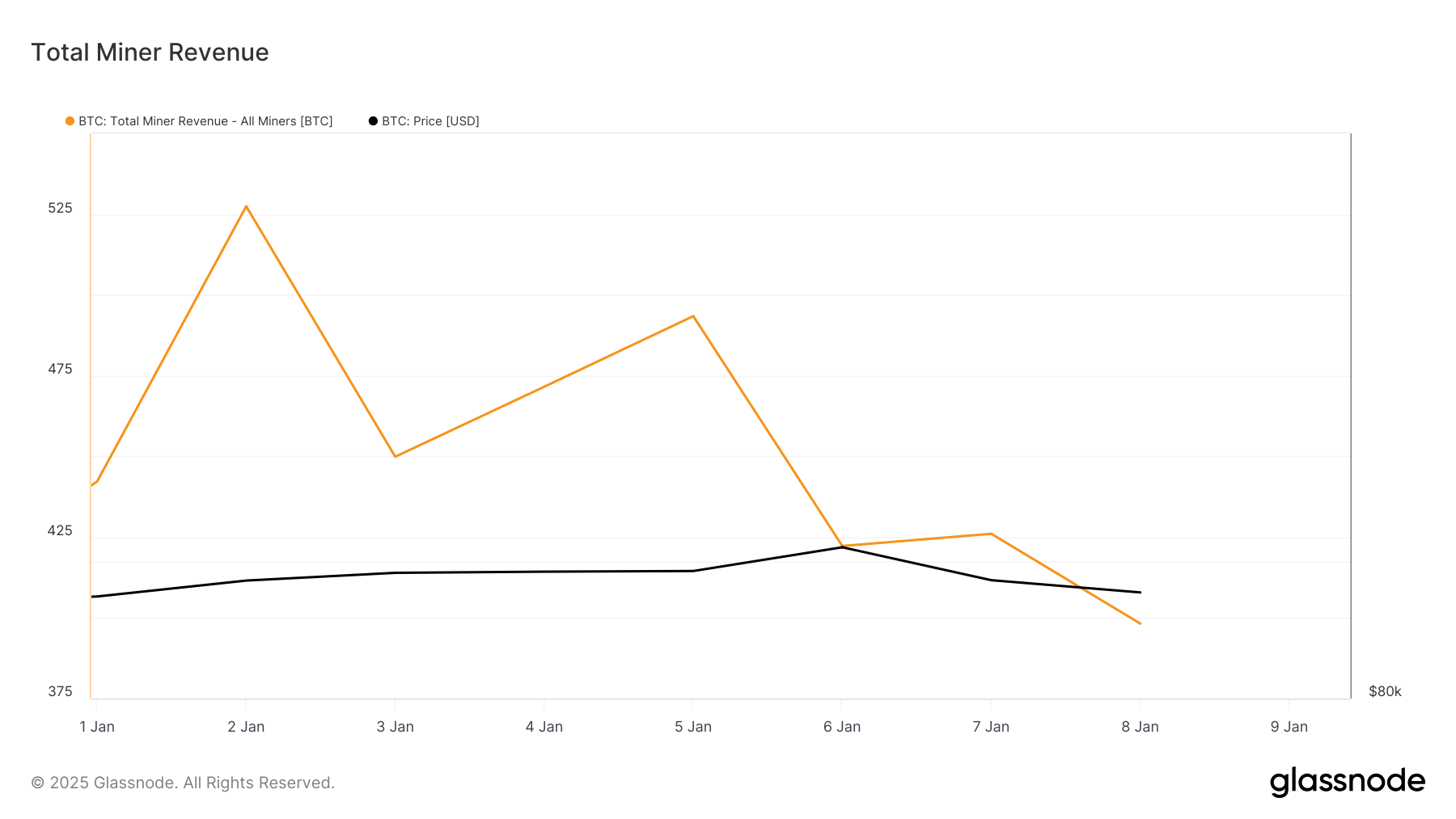

Bitcoin Miner Revenue Declines Amid Price DropBTC miner revenue derived from transaction fees and block rewards has fallen steadily since January 2. According to Glassnode, it is currently at 398.20 BTC, down 24% over the past week.

When Bitcoin miner revenue falls, it means that miners are earning less from validating transactions and securing the network. This decline typically occurs when Bitcoin’s price drops, reducing the value of rewards paid to miners.

Bitcoin Total Miner Revenue. Source: Glassnode

Bitcoin Total Miner Revenue. Source: Glassnode

Over the past two days, Bitcoin has noted a significant fall. For context, during Tuesday’s intraday trading session, the leading cryptocurrency traded briefly at a high of $102,735. However, selling activity soon gained momentum, causing the coin’s price to trend downward. At press time, BTC trades at $93,419.

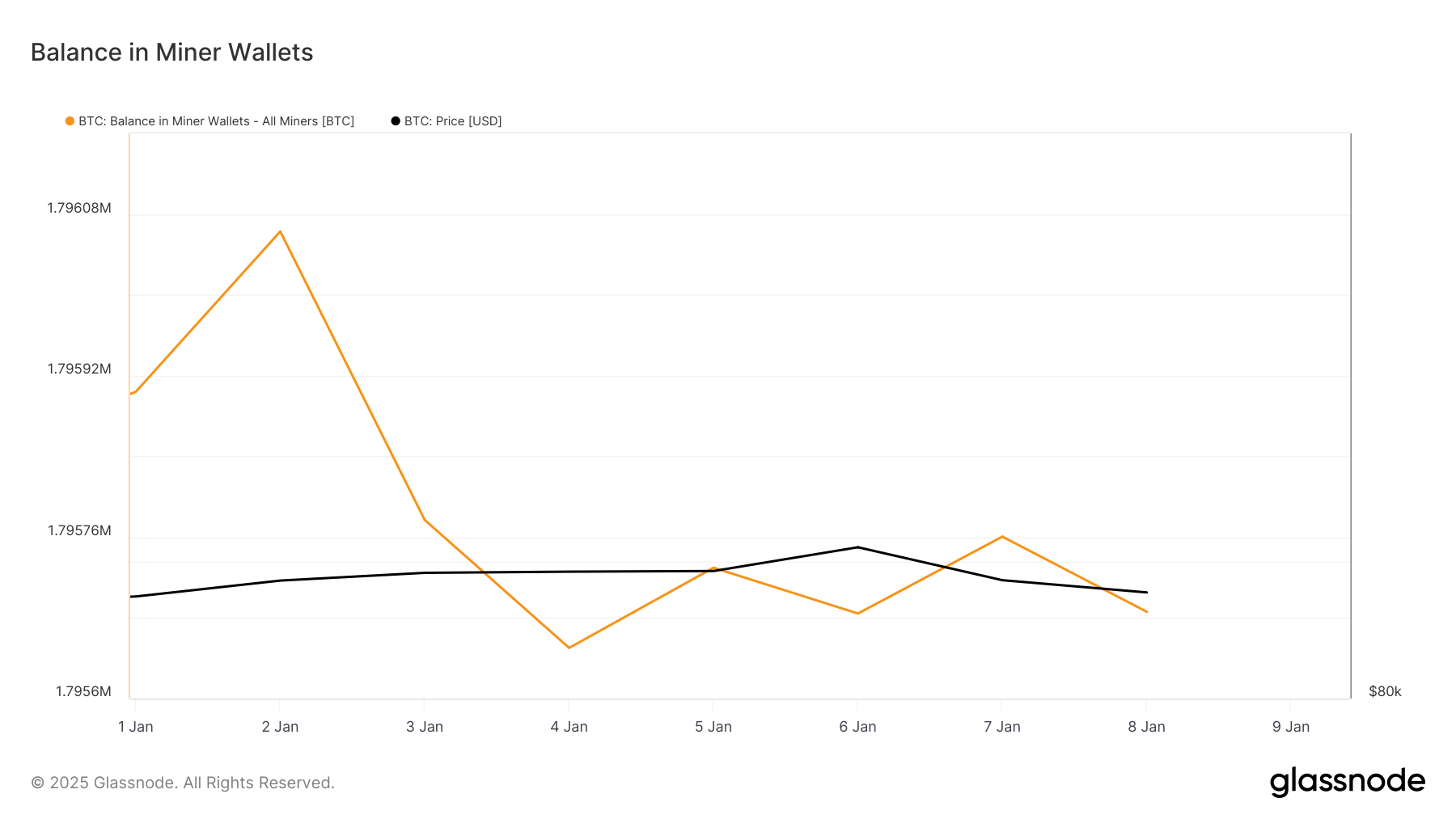

As more Bitcoin miners rush to offload their coins to prevent further losses to their BTC holdings, the amount of BTC held in miner wallets has steadily declined. As of this writing, this stands at 1.79 million BTC, a drop of 0.005% since January 2.

Bitcoin Balance in Miner Wallets. Source: Glassnode

BTC Price Prediction: Will it Hold or Break Below $90K?

Bitcoin Balance in Miner Wallets. Source: Glassnode

BTC Price Prediction: Will it Hold or Break Below $90K?

On the BTC/USD daily chart, BTC trades slightly above the support formed at $91,437. If selloffs persist, the coin’s price could break below this level and the $90,000 range to trade at $85,224. In this scenario, Bitcoin miner revenue would plunge further, causing more miners to sell their coins to cover operational costs.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if market sentiment improves and the demand surges, this may drive the coin’s price toward $102,538, increasing BTC miner revenue.

The post Bitcoin Miners Face Revenue Slump as BTC Stumbles Away from $100,000 Mark appeared first on BeInCrypto.