Bitcoin Price Analysis: Key Support and Resistance Levels to Watch Now

The post Bitcoin Price Analysis: Key Support and Resistance Levels to Watch Now appeared first on Coinpedia Fintech News

At the beginning of April, Bitcoin was trading at $82,539. Since then, it has dropped by more than 3.27%. But now, the price is showing early signs of a recovery as it slowly climbs back toward the important $80,000 level. At the same time, on-chain data shows signs of panic selling from short-term holders, which some analysts believe could actually be a long-term buying opportunity.

With major support and resistance levels now in focus, the market could be gearing up for a big move. Here’s what you need to know.

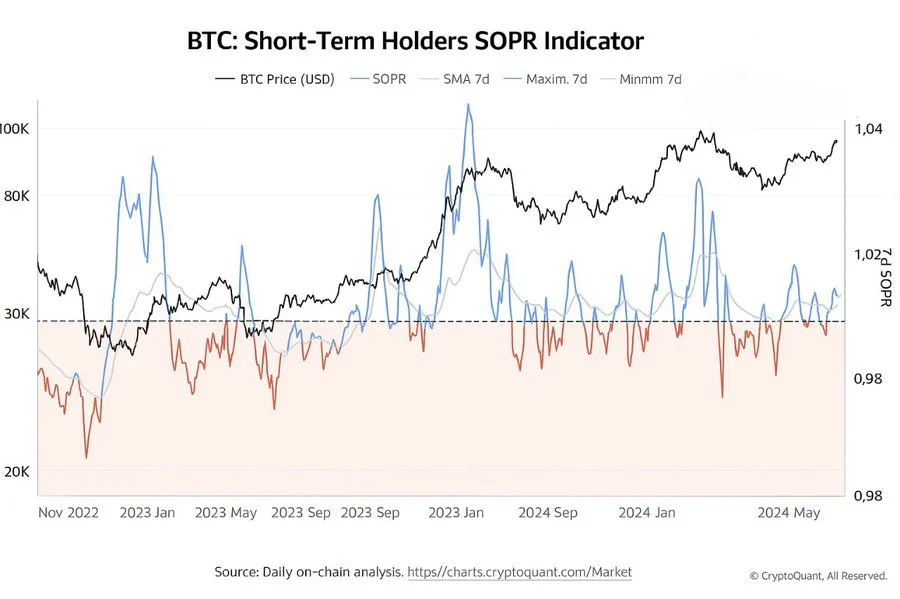

On-Chain Data Shows Panic SellingThe BTC Short-Term Holders SOPR (Spent Output Profit Ratio) indicator is currently moving downward. This means many short-term Bitcoin holders—those who have owned their coins for less than 155 days—are selling at a loss.

A SOPR value below 1 indicates that coins are being sold for less than what they were bought for. Right now, that’s exactly what’s happening. This trend is often a sign of fear or panic in the market.

Analysts See a Pattern: Past Dips Led to HighsA crypto analyst who goes by FOUR Crypto Spaces on X compares the current drop in Bitcoin’s price to earlier dips—specifically the fall to $60K in 2024 and the dip to $26K in 2023. He believes these patterns show that market pullbacks are often followed by strong recoveries and new highs.

Diamond Hands Forming?

Short-term #Bitcoin SOPR flashing "panic sell" = long-term "buy signal". $80K dips?

Time-warp to $60K '24, $26K '23.

Macro data: weak hands gift strong wallets.

Zone in, not pinpoint#BTC #Crypto pic.twitter.com/szcaX3wfIQ

Since yesterday, Bitcoin has gained nearly 1.82%. Its current price is $79,839—just 0.17% below the important $80,000 level.

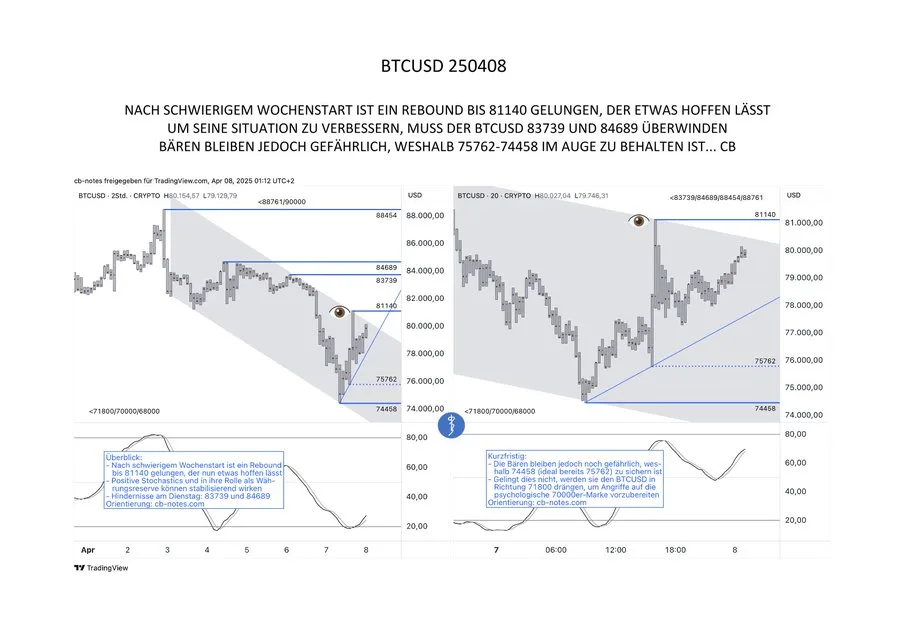

#BTCUSD 250408 #CRYPTO

NACH SCHWIERIGEM WOCHENSTART IST EIN REBOUND BIS 81140 GELUNGEN, DER ETWAS HOFFEN LÄSST / UM SEINE SITUATION ZU VERBESSERN, MUSS DER BTCUSD 83739 UND 84689 ÜBERWINDEN / BÄREN BLEIBEN JEDOCH GEFÄHRLICH, WESHALB 75762-74458 IM AUGE ZU BEHALTEN IST… CB pic.twitter.com/aBkV24aocp

A German analyst known as cb on X says that Bitcoin needs to break above $83,739 and $84,689 to continue moving higher. These are now seen as the next key resistance levels.

On April 6, Bitcoin dropped sharply to a low of $77,212, driven by heavy market volatility. According to cb, if BTC falls below the $75,762 to $74,458 range, it could lead to further losses.

Still Bearish? Maybe Not for Long

Although there’s still some downward pressure in the market, the recent bounce has given traders a reason to be optimistic. Some see this dip as a healthy correction and a possible setup for Bitcoin’s next upward run.

.article_register_shortcode { padding: 18px 24px; border-radius: 8px; display: flex; align-items: center; margin: 6px 0 22px; border: 1px solid #0052CC4D; background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%); } .article_register_shortcode .media-body h5 { color: #000000; font-weight: 600; font-size: 20px; line-height: 22px; text-align:left; } .article_register_shortcode .media-body h5 span { color: #0052CC; } .article_register_shortcode .media-body p { font-weight: 400; font-size: 14px; line-height: 22px; color: #171717B2; margin-top: 4px; text-align:left; } .article_register_shortcode .media-body{ padding-right: 14px; } .article_register_shortcode .media-button a { float: right; } .article_register_shortcode .primary-button img{ vertical-align: middle; width: 20px; margin: 0; display: inline-block; } @media (min-width: 581px) and (max-width: 991px) { .article_register_shortcode .media-body p { margin-bottom: 0; } } @media (max-width: 580px) { .article_register_shortcode { display: block; padding: 20px; } .article_register_shortcode img { max-width: 50px; } .article_register_shortcode .media-body h5 { font-size: 16px; } .article_register_shortcode .media-body { margin-left: 0px; } .article_register_shortcode .media-body p { font-size: 13px; line-height: 20px; margin-top: 6px; margin-bottom: 14px; } .article_register_shortcode .media-button a { float: unset; } .article_register_shortcode .secondary-button { margin-bottom: 0; } } Never Miss a Beat in the Crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.subscription-options li { display: none; } .research-report-subscribe{ background-color: #0052CC; padding: 12px 20px; border-radius: 8px; color: #fff; font-weight: 500; font-size: 14px; width: 96%; } .research-report-subscribe img{ vertical-align: sub; margin-right: 2px; }As per Coinpedia’s BTC price prediction, 1 BTC could peak at $169,046 this year if the bullish sentiment sustains.

How much will 1 Bitcoin be worth in 2030?With increased adoption, the price of 1 Bitcoin could reach a height of $610,646 in 2030.

How much will the price of Bitcoin be in 2040?As per our latest BTC price analysis, Bitcoin could reach a maximum price of $5,148,828.

How much will the Bitcoin price be in 2050?By 2050, a single BTC price could go as high as $12,436,545.