Bitcoin Whales Unstoppable, $283M Fresh BTC Purchase Amid ATH

The post Bitcoin Whales Unstoppable, $283M Fresh BTC Purchase Amid ATH appeared first on Coinpedia Fintech News

On November 22, 2024, all eyes are on Bitcoin (BTC), the world’s largest cryptocurrency by market cap, as it approaches the long-anticipated $100,000 mark. With a significant price surge of over 5% in the past 24 hours, the asset has reached a new all-time high of $98,988, shifting the overall market sentiment to bullish.

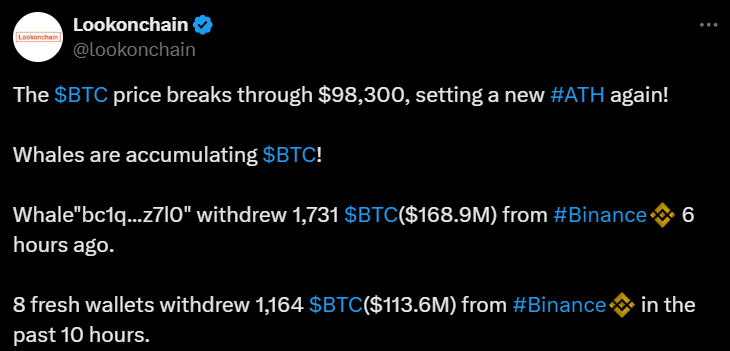

Bitcoin Whales Bags $283 Million of BTCAmid this bull run, Bitcoin whales appear unstoppable as they have made continuous and significant BTC purchases in the past 12 hours. Recently, a whale transaction tracker Lookonchain made a post on X (previously Twitter) that crypto whales have purchased a significant 2,895 BTC worth $283 million from Binance, the world’s largest cryptocurrency exchange.

Source: X (Previously Twitter)

Source: X (Previously Twitter)

In a post on X, Lookonchain noted that the whales are currently accumulating the asset as it price continue to soar.

The potential reasons for BTC’s bullish outlook include the current market sentiment, notable adoption by whales and institutions in recent days, the resignation of SEC Chairman Gary Gensler, and other factors.

With this bullish outlook, Bitcoin is currently trading near $98,600 and has experienced an impressive price surge of over 5.2% in the past 24 hours. During the same period, its trading volume jumped by nearly 50%, indicating heightened participation from traders and investors as market sentiment has shifted.

Will BTC Hit $100,000? Key Levels to WatchAccording to expert technical analysis, Bitcoin appears bullish and has been consolidating in a tight range between the $96,320 and $98,100 levels over the past few hours. Based on recent price action, if BTC breaks out of this consolidation and closes a four-hour candle above the $98,100 level, there is a strong possibility that it could reach $100,000 in the coming hours.

Source: Trading View

Source: Trading View

Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend. Meanwhile, its Relative Strength Index (RSI) suggests a potential upside rally may be imminent.