Celestia’s (TIA) 176 Million Token Unlock Stirs Market Unrest

TIA’s price has slumped over the past 24 hours, following Celestia’s 176 million token unlock on Wednesday.

This substantial influx of tokens has intensified downward pressure, leading to a nearly 10% drop in TIA’s value. With bearish sentiment growing, the altcoin appears likely to face further declines. This analysis examines the factors behind this trend.

Celestia’s Token Unlock Leads to Spike in Selling PressureOn Wednesday, Celestia unlocked 176 million TIA tokens, valued at $890 million at current market prices. This influx of new tokens has increased TIA’s circulating supply and put significant pressure on its price. TIA currently trades at $4.68, shedding 9% of its value over the past 24 hours.

Token unlocks often create uncertainty and fear among investors, especially if they perceive a high risk of selling pressure from token holders. This has been the case for TIA, despite clarifications that not all of the unlocked tokens would be immediately available for sale.

In a post on X, Taran Sabharwal, CEO of Stix trading platform, explained that Celestia’s 21-day unstaking period means that anyone planning to sell their unlocked TIA tokens has likely already unstaked. As a result, the expected total selling pressure from the token unlock stands at 92.3 million TIA, or roughly $460 million.

“This equates to a max selling pressure of ~$460M. What is also interesting here is that this accounts for <50% of the total cliff unlocks, which means that the sell pressure is half of what people have been expecting,” Sabharwal posted.

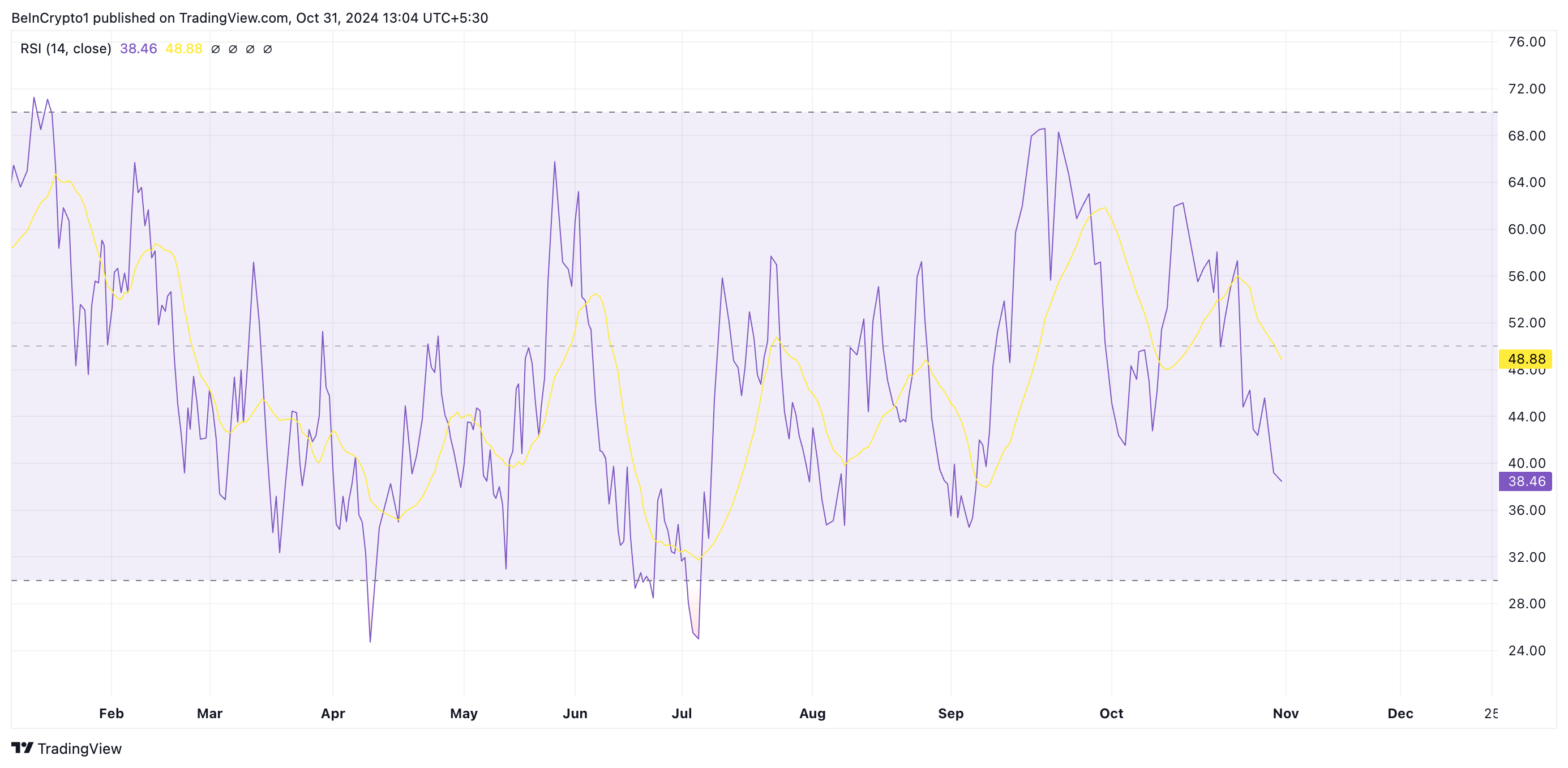

Selling Activity Underway, But There Is a CatchBeInCrypto’s assessment of the TIA/USD one-day chart confirms the uptick in selling pressure following the Celestia 176 million token unlock. As of this writing, the coin’s Relative Strength Index (RSI), which measures oversold and overbought market conditions, is in a downward trend at 38.46. This RSI reading signals that selling pressure outweighs buying activity among market participants.

Read more: Top 9 Safest Crypto Exchanges in 2024

Celestia RSI. Source: TradingView

Celestia RSI. Source: TradingView

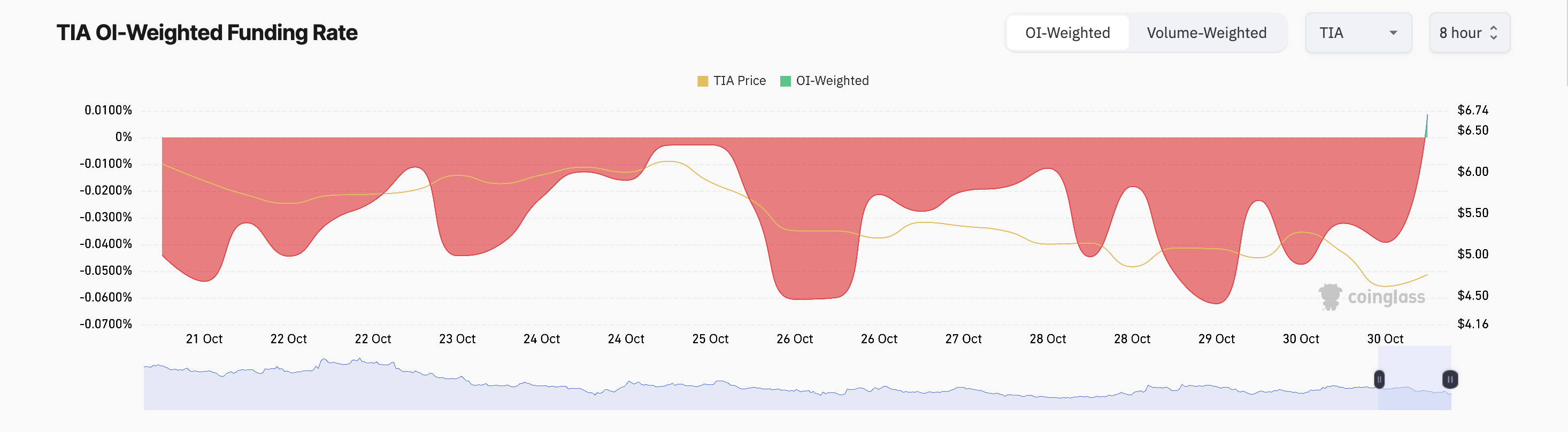

Interestingly, TIA’s futures traders have adopted a more bullish outlook, as reflected by its funding rate. Coinglass data shows that the coin’s funding rate has turned positive for the first time since September 10.

The funding rate is a periodic fee paid between traders in a perpetual futures market to balance the price of the futures contract with the underlying spot price. When the funding rate turns positive after being negative for a prolonged period, it indicates a potential shift from bearish to bullish sentiment. It suggests that traders now take long positions, expecting prices to rise.

Celestia Funding Rate. Source: Coinglass

TIA Price Prediction: Coin Struggles With Support

Celestia Funding Rate. Source: Coinglass

TIA Price Prediction: Coin Struggles With Support

TIA is currently trading at $4.68, down 9% over the past 24 hours. This decline has pushed it below the support level of a horizontal channel established since July. In this range, the upper boundary at $6.83 serves as resistance, while $4.71 marks the support level.

Read more: 9 Best Blockchain Protocols To Know in 2024

Celestia Price Analysis. Source: TradingView

Celestia Price Analysis. Source: TradingView

Should selling pressure continue, TIA’s value may slide further, potentially reaching its multi-month low of $3.72. Conversely, a bullish reversal at the $4.71 support could prompt a recovery, with TIA aiming for a breakout above the $6.83 resistance. Clearing this threshold could drive TIA’s price past $7, a level it hasn’t surpassed since June.

The post Celestia’s (TIA) 176 Million Token Unlock Stirs Market Unrest appeared first on BeInCrypto.