Cortez Masto slams GOP for blocking FULL HOUSE Act gambling tax fix

US Senator Catherine Cortez Masto from Nevada is calling out Senate Republicans for blocking her bipartisan fix to a Republican budget provision that limits how much taxpayers can deduct for wagering losses.

On Thursday (July 10), Cortez Masto went to the Senate floor and asked for unanimous consent to pass her Facilitating Useful Loss Limitations to Help Our Unique Service Economy Act, or FULL HOUSE Act. But a Republican senator objected because he wanted to add an unrelated amendment.

“This is a Republican piece of legislation that is actually causing people to pay taxes on money they lost. It makes no sense. And that’s all this is, is to try to fix it…So I’m disappointed, but I am not done.” – Senator Catherine Cortez Masto, D-Nevada

Senate Bill 2230 had just been introduced the day before, on July 9, by Cortez Masto, Democratic Senator Jacky Rosen, and Republican Senator Ted Cruz.

The bill aimed “to amend the Internal Revenue Code of 1986 to reinstate the rules for wagering losses.”

After the objection, Cortez Masto said, “It is a shame that we cannot pass this commonsense S.2230 [FULL HOUSE Act] because Republicans want to weigh it down with unrelated measures that they voted to support.

“This is a Republican piece of legislation that is actually causing people to pay taxes on money they lost. It makes no sense. And that’s all this is, is to try to fix it…So I’m disappointed, but I am not done.”

Following the decision, Senator Rosen wrote on X: “I won’t stop fighting to reverse this harmful provision and protect Nevada’s gaming and tourism economy.”

Senate Republicans just blocked @SenCortezMasto and my attempt to pass our bipartisan bill to repeal their misguided provision to unfairly tax gambling losses.

I won’t stop fighting to reverse this harmful provision and protect Nevada’s gaming and tourism economy. pic.twitter.com/qyklvSXT19

— Senator Jacky Rosen (@SenJackyRosen) July 10, 2025

FAIR BET Act still on the table as FULL HOUSE Act falls flatA press release from her office explained that the 2017 Tax Cuts and Jobs Act reformed how wagering losses are taxed but still allowed taxpayers to deduct 100% of their gambling losses. However, last week President Donald Trump’s new “One Big Beautiful Bill Act” changed the tax code so that taxpayers can now only deduct 90% of their losses.

Moments ago, Republicans chose to block my bill that would have protected Nevada's economy by repealing the GOP tax hike on gambling losses.

I'm not done fighting for our businesses and workers. Their tax hike is a bad deal for Nevada, and I'll keep working to repeal it. pic.twitter.com/YdqSQMq2YF

— Senator Cortez Masto (@SenCortezMasto) July 10, 2025

Experts warn this could force people to pay taxes on money they never actually had, potentially harming Nevada’s gaming industry, tourism, and economy. Cortez Masto said her bill “would restore the 100% tax deduction on gambling losses.”

The push also lines up with Nevada Democratic Representative Dina Titus’s FAIR BET Act, which would repeal the recent change. The FAIR BET Act would amend the language in the One Big Beautiful Bill Act from “90 percent” back to “100 percent” to bring back the old law.

But Titus had sharp words for the Senate effort earlier this week, saying, “Any bill or unanimous consent action in the Senate would be just for show.”

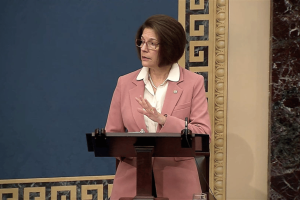

Featured image: Office of US Senator Catherine Cortez Masto

The post Cortez Masto slams GOP for blocking FULL HOUSE Act gambling tax fix appeared first on ReadWrite.