Fidelity Fuels Ethereum Buzz, But Bitcoin Sell Risk Stalls ETH Rally

Ethereum (ETH) has surged to the forefront of market attention after a rare flip in trading volume over Bitcoin (BTC).

However, analysts are concerned about the broader mismatch between euphoria and Ethereum price action.

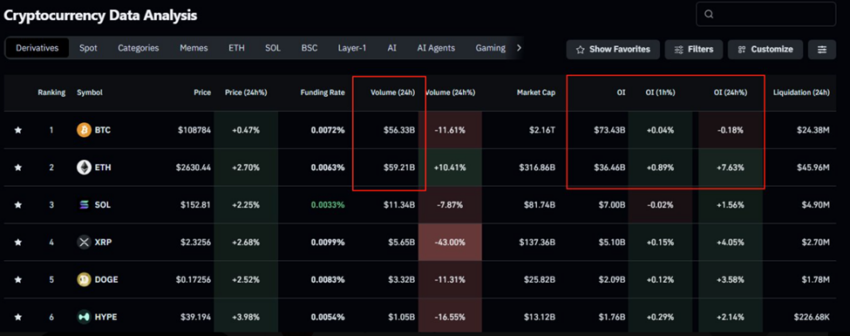

Ethereum Trading Volume Surpasses Bitcoin’s After Fidelity ReportAccording to data from Coinglass, Ethereum’s 24-hour trading volume recently surpassed Bitcoin’s for the first time in the current cycle.

Given both political and institutional interest around Bitcoin, this is not a mean feat for Ethereum. It marks a symbolic milestone for the largest altcoin on market cap metrics.

Ethereum’s 24-hour trading volume surpasses Bitcoin’s. Source: Coinglass

Ethereum’s 24-hour trading volume surpasses Bitcoin’s. Source: Coinglass

A surge in trading volume indicates traders are interacting with Ethereum more, an outlook likely stemming from Fidelity Investments, which manages $4.9 trillion. The firm stated that Ethereum’s operating structure is very similar to the GDP of a real economy.

Bankless co-founder Ryan Sean Adams shared his excitement over Fidelity’s recent Ethereum report, calling it a breakthrough.

It's finally happening.

TradFi analysts realizing the right way to value ETH is as the store of value asset of an emerging economy.

Brand new ETH report from @fidelity.

It's everything we've been saying for years.

I am euphoric in this moment.

ETH = world reserve asset pic.twitter.com/Pr6ROkLZTx