The Invisible Tax on Merchants: Time Spent Managing Disputes

As the payments change, businesses are confronted with a need to refine their dispute resolution strategies to mitigate the impact of chargebacks.

With the costs and prevalence of chargebacks on the rise, a PYMNTS Intelligence report, “Recovering Revenue: A Merchant’s Guide to Automated Chargeback Management,” in collaboration with American Express, shows how merchants must adopt solutions that not only enhance their financial health, but also streamline operational processes.

Chargeback Challenge for Merchants

Chargebacks are becoming a challenge for merchants, affecting their financial stability and brand reputation. According to the report, chargebacks cost merchants about $54.5 billion annually, encompassing more than just lost sales revenue. The complexity surrounding chargebacks ranges from genuine consumer disputes to cases of friendly fraud, where customers initiate chargebacks for transactions they authorized.

The travel, retail and software sectors are particularly susceptible to chargeback disputes, incurring an average cost of $76 per dispute. Seventy-six percent of global eCommerce chargeback managers report year-over-year increases in chargeback rates, underscoring the inadequacies of existing transaction dispute processes. The burden of these disputes disproportionately affects small businesses, with nearly one-third of U.S. small businesses frequently facing chargebacks.

More than half these businesses recognize the negative impact of chargebacks on their operations. Traditional dispute management methods, reliant on communication and paperwork, further strain resources and distract from core functions.

Automation for Chargeback ResolutionTo combat the rising tide of chargebacks, many merchants are turning to automated dispute resolution tools. These technologies streamline processes, enhance efficiency, and deliver better outcomes for both businesses and their customers.

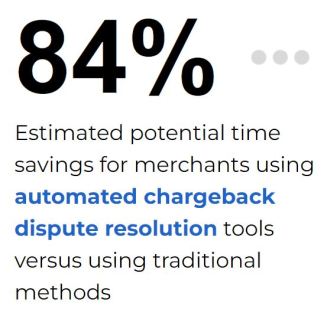

According the report, merchants using automated chargeback resolution tools could save up to 84% of the time traditionally spent on dispute management. The global market for chargeback management software is projected to grow at a 16% compound annual growth rate (CAGR), reflecting awareness among merchants regarding the benefits of automation.

Industries that have quickly embraced these technologies, such as gaming and clothing, report higher win rates in chargeback disputes, demonstrating the tangible results of automated solutions.

Automated tools not only accelerate the recovery of funds, but also reduce administrative burdens. Early adopters of these technologies are already experiencing improved financial recovery, showcasing the potential for data-driven dispute management to enhance overall outcomes.

Meeting Consumer ExpectationsIn today’s digital economy, consumers expect seamless experiences across all interactions, including dispute resolution. Merchants must implement strategies that leverage advanced automated tools to meet these expectations and cultivate customer loyalty.

Speed and convenience are paramount, as 41% of consumers prefer using banking apps to dispute transactions directly with their card issuers. About 36% of consumers place high value on the ability to review their dispute status in real time via an app. By adopting automated dispute resolution processes, merchants can address genuine disputes efficiently while discouraging misuse of the chargeback system.

With 75% of consumers seeing disputes as an alternative to refunds, a streamlined, user-friendly dispute process is essential. By ensuring high satisfaction with resolution methods, merchants can boost customer loyalty. Advanced automated systems help accurately distinguish between first-party and third-party fraud, preventing unnecessary chargebacks and creating consumer trust.

Effective chargeback management requires merchants to begin with an audit of current processes to identify inefficiencies. Collaborating with payment processors can enhance fraud detection, while investing in advanced tools improves outcomes through real-time detection and automated evidence collection.

Redesigning the customer dispute experience with a mobile-first approach increases satisfaction, establishing a feedback loop enables ongoing strategy refinement. These strategies support profitability and customer loyalty.

The post The Invisible Tax on Merchants: Time Spent Managing Disputes appeared first on PYMNTS.com.