Iran’s Central Bank Bought $500 Million in USDT Stablecoin to Prop Up Rial

Iran’s Central Bank secretly purchased more than $500 million worth of Tether’s USDT stablecoin as the country’s currency crisis deepened, according to new findings from crypto security firm Elliptic.

The transactions point to a state-level effort to stabilize the collapsing rial and maintain trade flows while bypassing the global banking system.

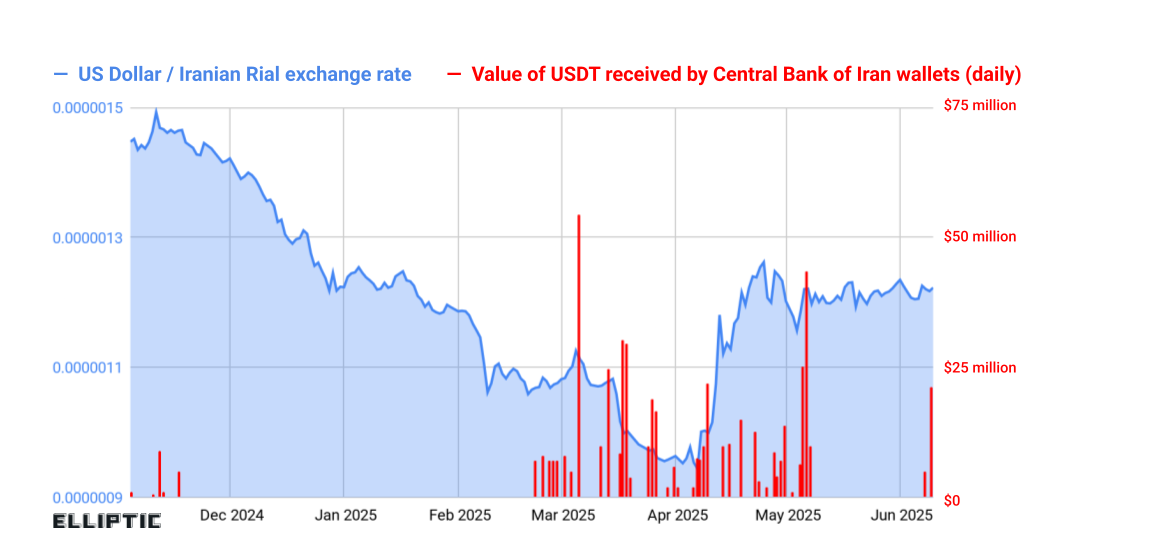

Iran’s Rial Crisis ExplainedElliptic said it identified a network of crypto wallets controlled by the Central Bank of Iran (CBI) that accumulated at least $507 million in USDT during 2025.

The figure represents a lower bound, as the analysis only includes wallets attributed with high confidence.

How Iran’s Central Bank Received USDT Periodically Througout 2025. Source: Elliptic

How Iran’s Central Bank Received USDT Periodically Througout 2025. Source: Elliptic

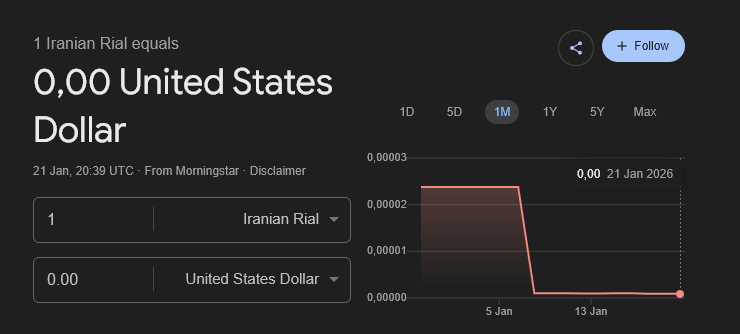

Iran’s currency crisis has intensified over the past year, with the rial plunging to historic lows on the open market.

By early 2026, the exchange rate had deteriorated to levels where the rial’s purchasing power was effectively wiped out, fueling public anger and market panic.

Although the rial did not technically fall to “zero,” its rapid depreciation rendered it nearly unusable for international trade and savings.

Iranian Rial Collapses Against the USD. Source: Google Finance

Iranian Rial Collapses Against the USD. Source: Google Finance

Multiple exchange rates, high inflation, and a loss of confidence pushed businesses and households toward dollars, gold, and crypto-linked alternatives.

Sanctions pressure compounded the crisis. Restricted access to dollar clearing and correspondent banking sharply limited Iran’s ability to deploy foreign currency reserves, even when oil revenues were available.

Elliptic Traces USDT Purchases to 2025Against this backdrop, Elliptic uncovered leaked documents showing two USDT purchases by the Central Bank in April and May 2025, paid for in UAE dirhams (AED). The timing coincided with rising pressure on the rial and renewed volatility in currency markets.

Using these documents as a starting point, Elliptic mapped the Central Bank’s broader wallet infrastructure. Its analysis revealed a systematic accumulation of stablecoins, rather than ad hoc crypto use.

Initial Reliance on Domestic ExchangesUntil mid-2025, most of the Central Bank’s USDT flowed into Nobitex, Iran’s largest cryptocurrency exchange. Nobitex allows users to hold USDT, exchange it for other cryptoassets, or sell it for rials.

This pattern suggests the Central Bank initially used the exchange as a domestic liquidity channel. USDT functioned as a parallel dollar reserve that could be converted into local currency when needed.

However, that approach carried significant exposure.

BREAKING