More Than Half of Retailers Now Use AI to Catch Fraudsters

The holiday season is the most lucrative and perilous time of the year for retailers.

The PYMNTS Intelligence report “Securing the Season: Fighting Fraud Without Losing Customers,” a collaboration with Worldpay, suggests that the real story isn’t just about stopping fraudsters during the fourth-quarter rush. It’s about what happens next.

The post-holiday chargeback wave and the growing misuse of consumer protections are turning fraud prevention into a test of how well merchants can manage trust.

The study outlines the dual challenge for merchants of keeping up with a surge in artificial intelligence-driven scams while maintaining a frictionless shopping experience. Consumers spent nearly $1 trillion during the 2024 holiday season, but fraud losses rose to $12.5 billion, up 25% from the year before. While those headline numbers signal the scale of the problem, the more nuanced takeaway is that many of those losses occur after the holidays, when friendly fraud and chargeback abuse take hold.

Key findings include:

- Friendly fraud accounts for 75% of digital goods merchants’ fraud losses.

- Customers receive their purchases and later dispute them, often out of post-holiday remorse or budget pressure. Most skip the retailer entirely and go straight to the bank, triggering automatic chargebacks that could have been resolved directly.

- Consumers believe AI has made online scams more sophisticated, at 88%.

- Deepfake technology and cloned brand identities now fool even digital-savvy shoppers. One in three consumers aged 18 to 34 has fallen for a deepfake scam, compared with just 5% of those 55 and older, a generational gap that underscores how AI fraud tactics are evolving faster than consumer awareness.

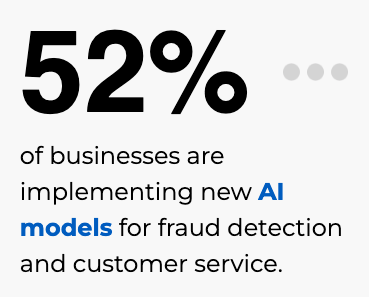

- Businesses are turning to tech, as 52% of them are rolling out new AI models for fraud detection.

- Retailers are using adaptive machine learning systems to spot anomalies in real time, cutting false positives by up to 85% while doubling compromised card detection. Yet only 37% use generative AI for fraud protection, even as 72% expect AI-driven fraud to be their top challenge by 2026.

What emerges from the data is a broader operational shift. Merchants no longer see fraud protection as a cost center or a seasonal emergency plan. It’s becoming a brand-defining capability that shapes reputation, customer loyalty and long-term profitability. According to the report, 93% of eCommerce businesses say anti-fraud tools improve the overall customer experience, provided those tools don’t slow checkout.

The convergence of AI-powered detection, two-factor authentication and responsive customer service is forming the foundation of “layered security,” which is a model that recognizes how technology and trust intersect, the report said. The research shows that if merchants fail to respond promptly to a customer complaint, 85% of consumers are likely to file a chargeback. That statistic reframes fraud prevention as much about communication as computation.

Worldpay’s own partnerships highlight the shift. Its acquisition of Ravelin brings merchants AI-native fraud prevention capabilities, while a collaboration with Trulioo adds a know your agent framework to verify AI-agent-led commerce, which is a recognition that the next wave of fraud won’t always involve humans.

In the end, the true cost of holiday fraud is not measured only in dollars lost but in confidence gained or eroded.

The post More Than Half of Retailers Now Use AI to Catch Fraudsters appeared first on PYMNTS.com.