MOVE Token Price Crashes 20% After Coinbase Delisting Notice

Global crypto exchange Coinbase delisted the Ethereum Layer 2 project Movement (MOVE), following reports of crypto market manipulation and token governance issues. The exchange had already changed the L2 crypto to limit-only trading before the Coinbase MOVE token delisting, which suspended trading for the token on May 15, 2025.

For all its crypto asset listings, Coinbase evaluates the legal, technical, and business points of potentially new tokens it could accept. However, the concerning events surrounding the MOVE token could tighten new listing standards for Coinbase and other established cryptocurrency exchanges.

Flagged Trading Activity Prompts Market InvestigationLeaked reports showed abnormal trading activity on MOVE Token in late 2024. Shortly after MOVE was listed on various crypto exchanges, the market maker Web3Port reportedly liquidated $38 million worth of MOVE. The incident led to Binance freezing the market maker’s account, which involved the selloff of 66 million MOVE tokens.

Before the mass liquidation, the Movement Foundation, the company behind Movement, was completing a market maker deal with Rentech, which acted as a middleman between Movement Labs and Web3Port. Initially, the Movement Foundation’s general counsel rejected the market maker contract due to its outrageous proposals to a company with no previous market history.

However, Movement finally agreed to a revised edition of the market-making deal with Rentech, which contained a clause that enabled Web3Port to borrow 5% of the MOVE token supply and liquidate it for a profit.

Reported Internal Governance Conflicts at Movement LabsAnother leaked document revealed a pre-existing agreement between Web3Port and the Movement Foundation, but with Rentech acting as Movement’s representative. Following this, stakeholders and employees within Movement Labs began speculating and pointing fingers at possible insiders involved in the market maker deal and market manipulation scheme.

Additionally, Movement Labs, along with the Movement Foundation, commissioned a third-party review of the external market maker’s abnormal activities. On May 2, 2025, Movement suspended its co-founder, Rushi Manshe, and later terminated him due to the recent controversy.

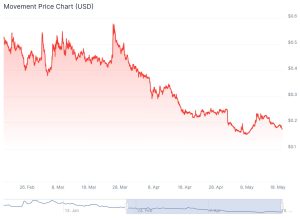

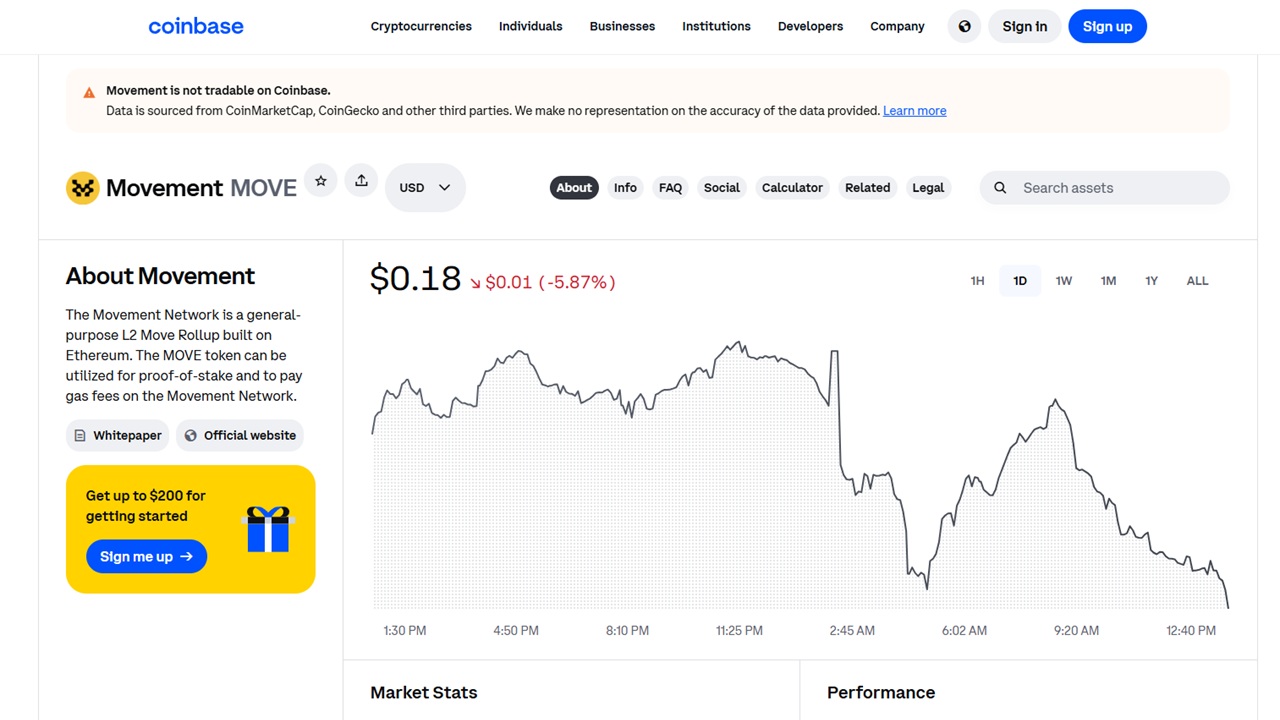

MOVE Token Price Slumps After Coinbase DelistingIn the aftermath of the Movement Labs scandal, Coinbase initiated a limit-only trading mode for the MOVE token and delisted the crypto asset entirely on May 15, 2025. The initial MOVE token delisting news in 2025 saw a 20% price drop in the L2 crypto.

Based on MOVE token Coingecko data, the cryptocurrency’s market cap collapsed below the $500 million mark. Despite Bitcoin’s surge to $97,000 at the time, investors observed a continued MOVE token price drop.

MOVE’s Collapse: From Rising Star to Lower LowsBacked by Donald Trump’s World Liberty Financial portfolio, Movement launched in mid-2024 and amassed significant market adoption. The Ethereum L2 project, built upon Meta’s Move programming language, saw an initial price increase to $0.70.

MOVE’s all-time high price of $1.45 in December 2024 gave it a $2.5 billion valuation, making it one of the best new cryptocurrencies to buy at the time. Since then, however, MOVE’s price has fallen by over 80%, with selloff after selloff each week.

How This Affects Future Crypto Exchange ListingsCoinbase follows a thorough asset listing process for vetting new tokens to buy for its platform. With the recent controversy surrounding the MOVE token, the exchange might tighten its review process and pin down internal governance issues before adding cryptocurrencies to live trading.

The MOVE token delisting has other implications, not only for upcoming Coinbase listings, but also for new tokens in all cryptocurrency exchanges. The issue is particularly pressing because of the L2 crypto’s huge market cap, a sign that many investors see as showcasing minimal risk and high trustworthiness.

International firms and regulatory agencies could start investigating more established crypto projects, issuing transparency checks and other requirements that exchanges might need to follow before listing new cryptocurrencies.

What Should MOVE Token Holders Do?While MOVE is no longer available on Coinbase, the cryptocurrency is still live on Binance, OKX, MEXC, and other centralized exchanges. Current MOVE holders should monitor Movement’s official social media channels for updates and announcements on third-party audits and project milestones.

Additionally, investors should look into the significant token governance changes that will be made to ensure more transparency regarding the crypto project. Based on the most recent updates on Movement’s X account and official blog page, no announcements have been posted regarding the market maker controversy.

Transparency and Clarity Above AllThe latest MOVE token debacle should alarm project developers and investors, as it demonstrates that clean and transparent governance is the key to long-term success. Any breaches or mismanagement can lead to disastrous consequences, with little to no possibility of recovery.

On Coinbase, the leading crypto exchange in the United States, you can get the proper tools for evaluating and investing in high-potential cryptocurrencies.

Visit Coinbase References:- Actions Taken on Market Maker Due to Market Irregularities (2024-03-25) | Binance Announcements (Binance News)

- MOVE Foundation Announces Third-Party Review Into External Market Maker Abnormalities (Movement Network)

- Movement Price: MOVE Live Price Chart, Market Cap & News Today (CoinGecko)

- Earn and Borrow Crypto | World Liberty Financial (World Liberty Financial)

The post MOVE Token Price Crashes 20% After Coinbase Delisting Notice appeared first on ReadWrite.