NFTs as Corporate Treasuries? GameSquare’s $5 Million CryptoPunk Bet Ignites Debate

GameSquare Holdings, Inc. has drawn attention by acquiring CryptoPunk #5577, a well-known NFT, for $5.15 million through preferred shares. Following the deal, CryptoPunk #5577 officially became a strategic treasury asset of GameSquare.

While NFTs have long been speculative digital collectibles, a new wave of companies treating them as treasury assets may redefine their role in corporate finance, if the market holds.

NFT Insiders Strongly Support the Idea of NFT Treasury CompaniesGameSquare’s decision is bold. It places NFTs on the same level as other recent reserve crypto assets like Bitcoin, Ethereum, and Solana.

Garga, CEO of Yuga Labs — the company behind the Bored Ape Yacht Club collection — predicted that NFT treasury companies will become a trend. He also expressed a desire to see an APE-focused treasury company.

“The world isn’t ready for NFT treasury companies, but they are coming anyway,” Garga said.

Matt Medved, a member of the Digital Art Council at Art Basel, echoed his expectations. Medved believes the NFT market cap is small but still has massive growth potential. Other NFT investors also argue that NFTs hold a unique advantage — their strong cultural and social elements.

“But I think there’s way more to it. This won’t be just a cold finance strategy like what Michael Saylor is doing. It will involve real social dynamics,” NFT investor Loki said.

Notably, the market is witnessing a sharp rise in NFT trading volume in July. A recent report from BeInCrypto noted that the floor prices of CryptoPunks and Moonbirds have surged, signaling a potential comeback of the NFT season.

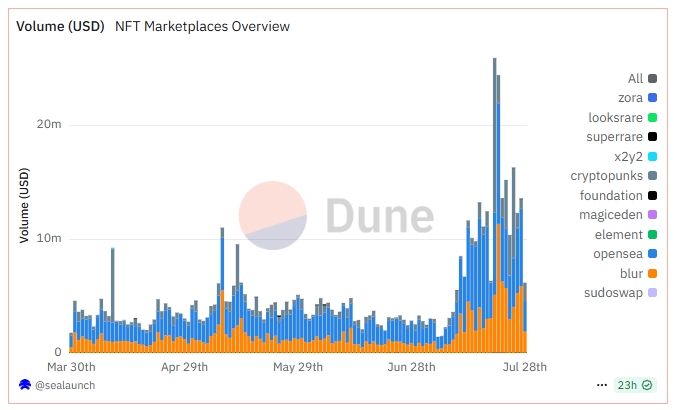

July NFT Market Sees Trading Volume SpikeAccording to data from Dune, NFT marketplace volumes exploded in July. On some days, trading volume reached $26 million, with the daily average above $10 million.

NFT Marketplaces Volume. Source: Dune.

NFT Marketplaces Volume. Source: Dune.

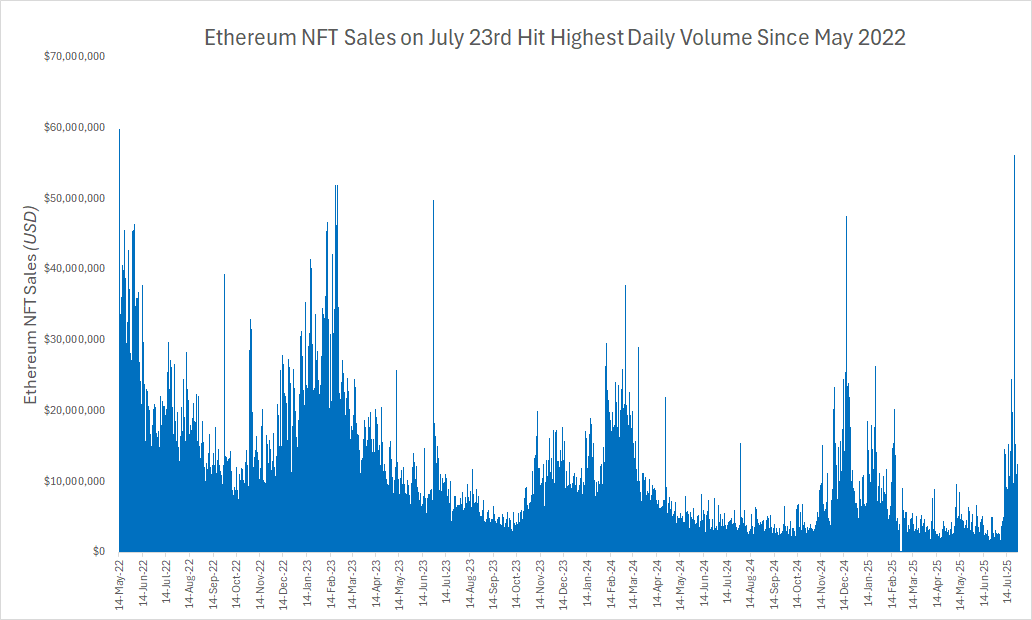

Additionally, Nathan Frankovitz — an analyst at VanEck — cited data from CryptoSlam, noting that Ethereum NFT trading volume on July 23 spiked to the highest level since May 2022.

Ethereum NFT Sales. Source: CryptoSlam

Ethereum NFT Sales. Source: CryptoSlam

This data shows renewed interest in NFTs, creating favorable conditions for businesses to consider these assets as part of their strategic reserves.

GameSquare may be the first signal, but it’s still too early to call it a full-blown trend.

If this movement gains momentum, the most promising NFT collections likely to benefit would include Pudgy Penguins, CryptoPunks, and Bored Ape Yacht Club. According to OpenSea, these collections account for most of the liquidity in the NFT market.

The Value of NFTs Remains ControversialEven though NFT industry leaders believe that NFT treasury companies could revolutionize corporate finance — similar to how MicroStrategy used Bitcoin — the intrinsic value of NFTs remains hotly debated, even within the crypto sector.

Anatoly Yakovenko, co-founder of Solana, bluntly criticized NFTs and memecoins in a recent discussion on X (formerly Twitter).

“I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value. Like a mobile game loot box. People spend $150B a year on mobile gaming,” Yakovenko said.

Skepticism goes beyond NFTs themselves. Using crypto as a strategic reserve has faced doubt since its early days.

Like Bitcoin-reserve companies, NFT treasury firms could issue bonds to purchase NFTs, inflating NFT and stock values. Then, retail investors would buy shares in companies holding high-value NFT portfolios. Those companies would recycle that capital. The cycle could break if capital inflows weaken and NFT prices crash.

Therefore, assets used for strategic reserves must demonstrate sustainable growth. Historically, this is where NFTs fundamentally differ from Bitcoin.

The post NFTs as Corporate Treasuries? GameSquare’s $5 Million CryptoPunk Bet Ignites Debate appeared first on BeInCrypto.