Scroll (SCR) Drops 19% a Day After Market Debut

Ethereum layer-2 network Scroll launched its SCR token in a highly anticipated airdrop conducted on October 22. However, widespread dissatisfaction among recipients, who complained about the small amounts of SCR they received, has put significant selling pressure on the token.

Currently trading at $1.04, SCR has seen a 19% decline in the past 24 hours. As bearish sentiment continues to grow, the token’s price may face further losses. Here’s why.

Scroll’s Airdrop is the Cause Of Its ProblemsAccording to a blog post from the team, Scroll’s airdrop distributed 5.5% of the total SCR supply—55 million out of 1 billion tokens—to early contributors within the ecosystem.

Of this amount, 40 million SCR was allocated to on-chain participants who earned 200 or more Scroll Marks, the platform’s reward points for engaging with the layer-2 scaling network. An additional 1% of the supply was evenly distributed across eligible wallets, while 0.5% was reserved as a “bonus” for users who met specific criteria.

After the airdrop, some users of the L2 network, disappointed by the amount of coins they received, voiced their frustrations on X (formerly Twitter). One user, Joshyy, described it as the “worst airdrop so far,” sharing his disappointment after “farming Scroll with $60 only to receive 973 $SCR.”

Another user claimed to have dumped the tokens they received via the airdrop and bridged all their assets off the chain.

SCR Holders Sell Off HoldingsThis surge in SCR’s selling pressure since its launch has caused its value to plummet by double digits. BeInCrypto’s assessment of its technical setup on an hourly chart signals the possibility of an extended decline.

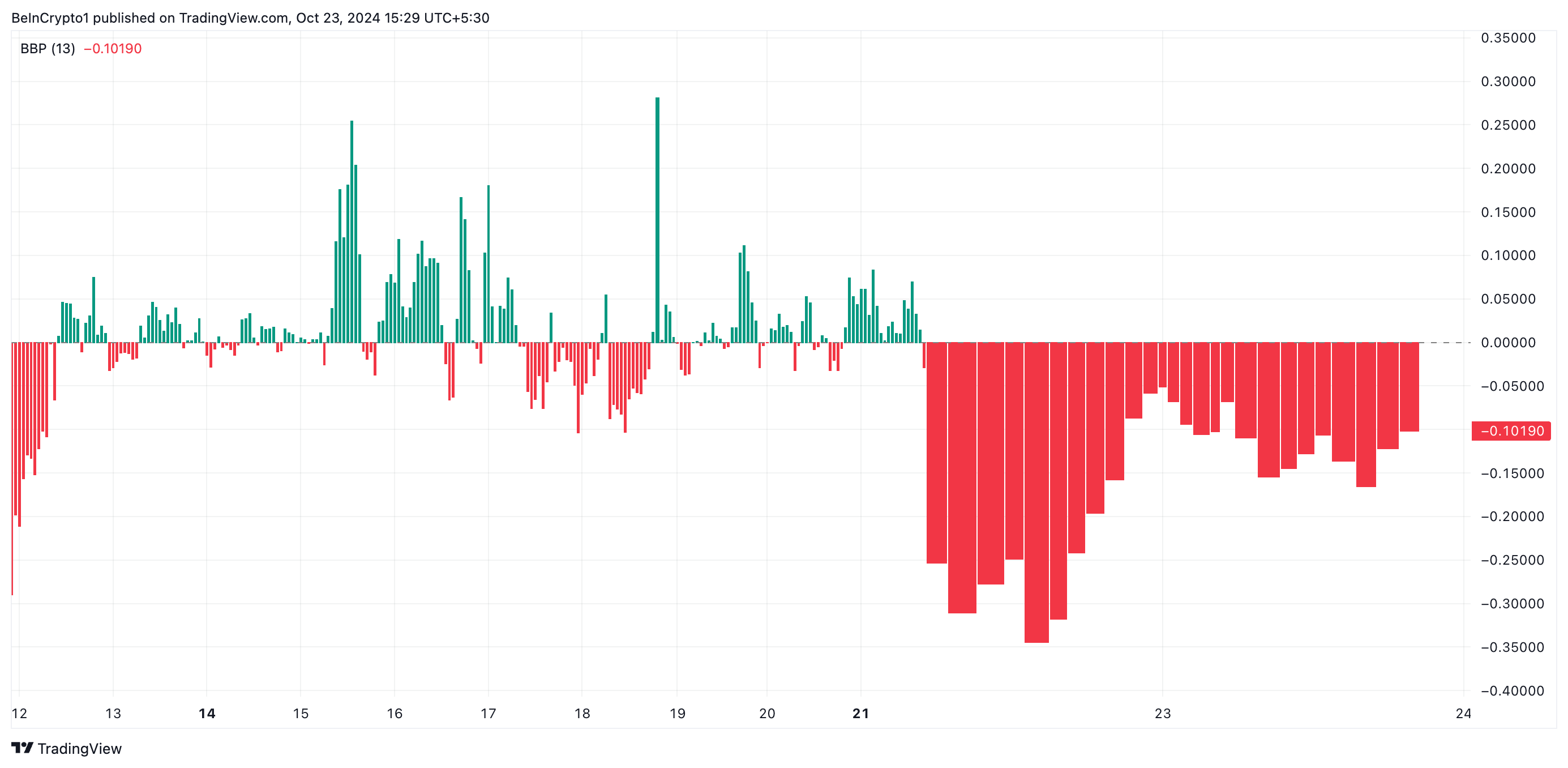

For one, the bearish sentiment trailing the altcoin continues to grow, as evidenced by the negative value of its Bull Bear Power (BBP), which stands at -0.10 as of this writing.

Read more: Best Upcoming Airdrops in 2024

SCR BBP. Source: TradingView

SCR BBP. Source: TradingView

This indicator measures the strength of buyers and sellers in the market. A negative BBP reading signals that sellers are in control and the market is experiencing downward pressure.

Furthermore, SCR’s price trades near the lower band of its Bollinger Band (BB) indicator which measures its market volatility. Trading near this level usually indicates that the market is in a downtrend or facing selling pressure. This lower band usually serves as a support level, but if the price continues hugging this band, it reflects sustained bearish momentum.

SCR Bollinger Bands. Source: TradingView

SCR Price Prediction: Coin Risks Dropping to New Lows

SCR Bollinger Bands. Source: TradingView

SCR Price Prediction: Coin Risks Dropping to New Lows

SCR currently trades at $1.04, just above support formed at $0.99, representing its all-time low since it launched. Sustained selloffs amongst market participants will push SCR’s price below this level in the near term.

Read more: What are Crypto Airdrops?

SCR Price Analysis. Source: TradingView

SCR Price Analysis. Source: TradingView

However, if market sentiment changes from bearish to bullish and SCR witnesses a resurgence in demand, its price will initiate an uptrend and climb toward resistance at $1.55. A successful break above this level will make it rally toward the next resistance level at $1.72.

The post Scroll (SCR) Drops 19% a Day After Market Debut appeared first on BeInCrypto.