S&P 500 Remains Strong as Bitcoin Slides to a 1-Year Low

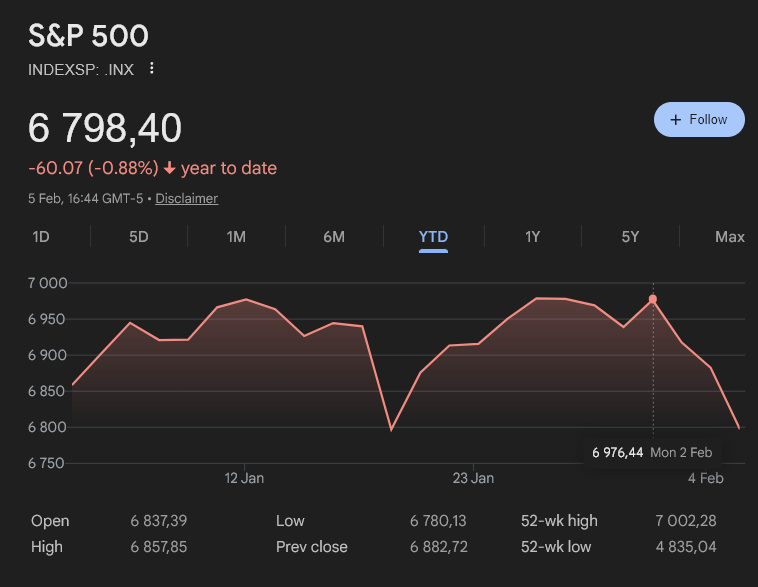

US equities rebounded as the S&P 500 climbed to $6,976, before correcting. Earlier in the week, the benchmark index closed just shy of its prior record before briefly moving higher in subsequent trading, while risk appetite in equities contrasted sharply with continued weakness across crypto markets.

At the same time, Bitcoin continued to underperform, with selling pressure accelerating as broader capital flows favored traditional risk assets. The divergence has become more pronounced in recent sessions, reinforcing the growing split between equity and crypto sentiment.

S&P 500 Year-to-Date Chart

AI Stocks and Small Caps Drive Equity Momentum

S&P 500 Year-to-Date Chart

AI Stocks and Small Caps Drive Equity Momentum

The latest leg higher in the S&P 500 was led by large-cap technology and semiconductor stocks, as investors rotated back into AI-linked names after a brief pause driven by valuation concerns.

Alphabet rose to a new record, Amazon advanced ahead of earnings, and chipmakers posted broad-based gains as demand expectations firmed.

We're definitely in an AI memory supercycle!$SNDK Sandisk +135.83%$STX Seagate +44.59%$WDC Western Digital +41.21%$MU Micron +40.58%$LRCX Lam Research +31.27%$SIMO Silicon Motion +25.79% https://t.co/29plHSR63k pic.twitter.com/djxvCgZ8SJ

— Lin (@Speculator_io) January 31, 2026Beneath the surface, market breadth also improved. Small-cap stocks outpaced megacaps, with the Russell 2000 gaining around 3% year-to-date.

That relative strength is often interpreted as a signal of confidence in domestic growth and has added support to broader stock market predictions that point to continued upside as long as earnings momentum holds.

Earnings, Not Valuations, Now Anchor the RallyCorporate results remain the central driver of the market’s advance. Analysts now expect S&P 500 companies to deliver close to 11% earnings growth for the December quarter, up sharply from estimates earlier in January.

More than 80% of reporting firms have exceeded expectations so far, according to FactSet data cited by market strategists.

Recent research suggests earnings growth has accounted for roughly 84% of total S&P 500 returns in the current cycle, marking a shift away from multiple expansion as the primary engine of gains. This transition has softened concerns around an AI-driven bubble, as profits and cash flow increasingly justify higher prices.

GS: S&P 500 year/year EPS growth is tracking at +11%, 4ppt above the +7% rate that consensus expected at the start of earnings season. pic.twitter.com/9DC2qkAbgJ

— Mike Zaccardi, CFA, CMT