Tether Expands Beyond Stablecoins as Profit Fuels 120+ Investments

Tether CEO Paolo Ardoino shared a glimpse into the stablecoin issuer’s investment bucket, revealing a diverse portfolio.

However, despite the crypto firm’s expansive venture, its foray into the European market remains impeded by MiCA’s stringent demands.

Tether Ventures Signals Strategic Shift Beyond StablecoinsArdoino shared part of Tether’s long-term vision, revealing a sprawling investment portfolio. Contrary to expectation, the company’s profits fuel the investment portfolio rather than stablecoin reserves.

Reportedly, Tether has invested in more than 120 companies, with an openness for this number to “grow significantly” in the months and years ahead.

The partial portfolio, published on Tether’s official site, includes names such as Bitdeer, Northern Data, Holepunch, Synonym, and Quantoz. These span industries from digital infrastructure to decentralized communications, education, and AI.

Others in the portfolio include Academy of Digital Industries, Adecoagro, Crystal Intelligence, Elemental Royalties, Neurotech, and Rumble.

“These investments have been made with Tether’s own profits ($13.7 billion in 2024) outside of USDt (and other stables) reserves and are part of Tether Investments arm,” Ardoino articulated in the post.

The capital came from the yield on the firm’s $130 billion in US Treasuries.

The growing reach of Tether Ventures highlights the company’s growth from a simple stablecoin issuer to a central player in the crypto ecosystem.

It points to Tether’s push to influence far more than just the stablecoin economy, with capital flowing into diverse areas such as Bitcoin infrastructure, energy, fintech, and emerging markets.

“Tether : A giant of the 21st century, building far beyond stablecoins. Congrats Paolo and your portfolio,” Tran Hung, CEO of Web3 shopping infrastructure UQUID, commented.

According to Ardoino, the investments are part of a broader strategy to strengthen USDT’s position amid tightening global regulations.

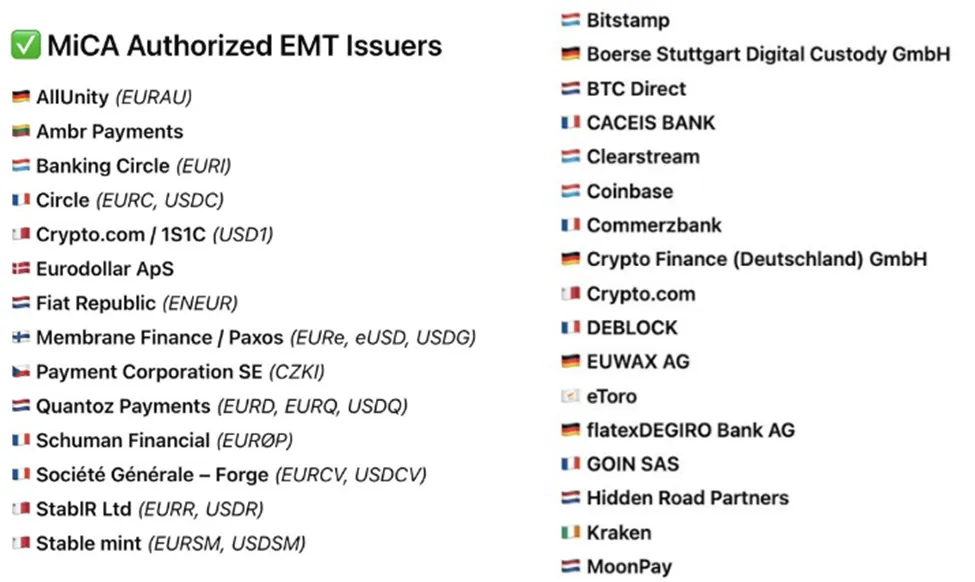

MiCA Friction Shows Tether’s Reluctance to Play by Europe’s New Stablecoin RulesIndeed, challenges remain, particularly in Europe, amid MiCA (Markets in Crypto Assets) regulations. BeInCrypto recently reported that the EU approved 53 crypto firms under MiCA, with Tether and Binance standing as clear outliers.

Key appearances in the list include Kraken exchange, Bybit exchange, and Coinbase exchange, among others.

ESMA’s MiCA interim register. Source: European Securities and Markets Authority

ESMA’s MiCA interim register. Source: European Securities and Markets Authority

The surge in approvals troubled EU regulators, worsened by the European Commission’s move to loosen MiCA rules.

Stringent rules under MiCA have even Trump’s USD1 stablecoin standing in uncertain waters, with the EU regulation requiring compliance with transparency, reserve backing, and conflict of interest rules.

“MiCA’s main requirements for stablecoins are: full reserve backing with liquid assets, strict reporting and transparency rules, a cap of 1 million daily transactions for non-EU currency stablecoins, a significant part of reserves (30% to 60%) must be held in EU-regulated banks,” Dessislava Ianeva-Aubert, Senior Research Analyst at Kaiko, told BeInCrypto.

Notwithstanding, Tether will not relent, appearing unwilling to engage under these terms. According to the firm’s CEO, Tether will not join Europe until MiCA becomes safer for consumers and stablecoin coin issuers.

When MiCA becomes safer for consumers and stablecoin issuers, then we might reconsider.

— Paolo Ardoino