Top Crypto News This Week: Solana ETF Deadline, FOMC Minutes, Aster Airdrop Checker, and More

This week, multiple crypto news items are in the pipeline, positioning the market for volatility. These events span various ecosystems, from Solana to Aster DEX, with US macro events also on the calendar.

Traders can position their portfolios strategically by frontrunning the following events this week.

Final Deadline for Spot Solana ETFsOctober is ETF (exchange-traded fund) month, with 16 funds awaiting final decision from the US SEC (Securities and Exchange Commission). However, none of the funds with the October deadline were issued by Fidelity or BlackRock, the two major players in the Crypto ETF space.

NEW: Here is a list of all the filings and/or applications I'm tracking for Crypto ETPs here in the US. There are 92 line items in this spreadsheet. You will almost certainly have to squint and zoom to see but best I can do on here pic.twitter.com/lDhRGEQBoW

— James Seyffart (@JSeyff) August 28, 2025Among them, asset manager Grayscale’s Solana trust, with Nate Geraci, president of the ETF Store, indicating that the next few weeks could be enormous for crypto ETFs.

“Enormous next few weeks for spot crypto ETFs… SEC’s final deadlines for numerous filings are approaching. Starts this week with/ deadline on the Canary spot LTC ETF. Will be followed by decisions on SOL, DOGE, XRP, ADA, & HBAR ETFs (though SEC can approve any or all of these whenever),” wrote Geraci.

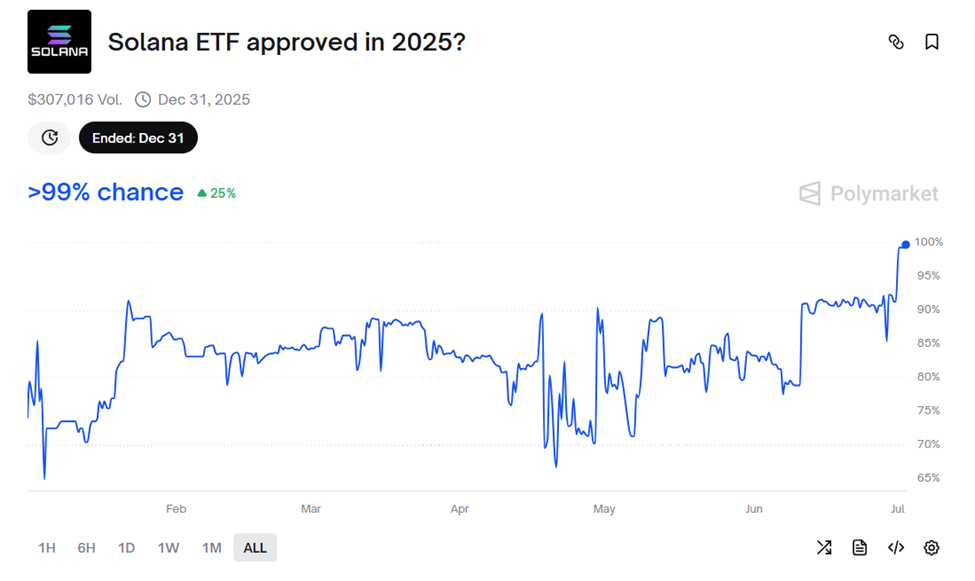

VanEck, 21Shares, and Grayscale have already filed for a spot Solana ETF, with the SEC’s final decision due by October 16. Analysts put approval odds near 90% in 2025.

Solana ETF Approval Odds in 2025. Source: Polymarket

Solana ETF Approval Odds in 2025. Source: Polymarket

Bitfinex research suggests approvals could spark a new altcoin cycle, as institutions gain safer exposure.

Pendle Incentive CampaignAnother crypto headline this week is the Pendle incentive campaign, which is expected to be announced in partnership with Plasma (XPL).

“XPL rewards are live for Plasma markets on Pendle! In addition to all of their existing yield + points, Pendle pools will be receiving another layer of XPL rewards on top,” wrote Pendle.

Meanwhile, Pendle’s market data currently suggests that sUSDe yields are priced around 4–5% APY, yet Ethena’s projections point to a much higher 10% APY.

According to Pendle community members, this discrepancy opens an interesting window for yield speculators. If you’re bullish on market momentum and funding rates, this could mark an attractive entry for long-yield exposure.

For instance, Plasma’s sUSDe is trading at roughly a 9.1% implied APY, barely a 1% premium over the underlying APY of 8.15%, even before factoring in possible yield increases.

Some yield tokens (YTs) appear undervalued relative to projected rates, offering asymmetric upside for those betting on higher yields or funding improvements ahead.

Of course, none of this constitutes financial advice, and investors should conduct their own research.

FOMC Minutes for September MeetingAnother crypto news to watch this week is the FOMC minutes from the September meeting, which is one of the US economic events with crypto implications this week.

Early signs of another move up?

Trade balance (Tue), FOMC minutes (Wed), jobless claims (Thu) all on deck.

If data softens and Fed tone lightens, risk-on assets could run again. pic.twitter.com/pmqbOJoPx7

After this event, Federal Reserve chair Jerome Powell will also give his opening remarks, with both data points expected to influence Bitcoin sentiment this week.

Aster Airdrop CheckerThe release of the Aster airdrop checker on October 10 will add to the list. The project recently confirmed that rewards for Genesis Stage 2, opening for claims on October 14, will come with no locking period. This would allow recipients to sell their tokens instantly.

However, with 4% of the total supply unlocked at once, analysts and traders like Duo Nine indicated the possibility of selling pressure.

Aster crashed 15% today once it was announced the airdrop will have no lock period.

Essentially, people can dump 4% of the supply on October 14.

I'm a buyer around $1. They will probably list Aster on Binance after. Buy the coming discounts. pic.twitter.com/QywLiALBkZ

Aster’s announcement framed the update as a push for fairness and flexibility, emphasizing “no pause” between stages and promising smarter reward mechanics in Stage 3. This includes new scoring formulas, team boosts, and spot trading incentives.

The post Top Crypto News This Week: Solana ETF Deadline, FOMC Minutes, Aster Airdrop Checker, and More appeared first on BeInCrypto.