US Fed News: Why Altcoins Are Suffering and Bitcoin Is Gaining Strength

The post US Fed News: Why Altcoins Are Suffering and Bitcoin Is Gaining Strength appeared first on Coinpedia Fintech News

Since January 18, the altcoin market has slipped by at least 7.49%. In the last 24 hours, almost all the top ten altcoins have shown bearish performances. Ethereum has slipped by around 1.4%, Solana by 1.6%, BNB by 0.5%, Dogecoin by 0.7%, and Cardano by 1.3%.

However, the Bitcoin market has showcased a bullish performance during the same period. Importantly, the US Federal Reserve is expected to announce its new interest rate decision within the next 24 hours. According to crypto market expert Michael van de Poppe, the reason for the latest altcoin market crash is the likelihood of no interest rate cuts. Curious to know more? Read on!

Altcoins Remain WeakAt the start of January 1, the total market cap of the altcoin market stood at $1.33T. On January 6, the market reached a peak of $1.49T. Though, between January 7 and 9, the market experienced a sharp correction of 10.73%, with a powerful single-day growth of 4.13%, it broke above the closing price of January 6. However, since January 18, the market has declined almost consistently. Between January 20 and 26, the market remained inside the range of $1.38T and $1.53T. On January 27, the market even dropped below the range. Since the beginning of January 28 alone, the market has declined by over 0.71%.

US Fed Meeting and Market Reaction

US Fed Meeting and Market Reaction

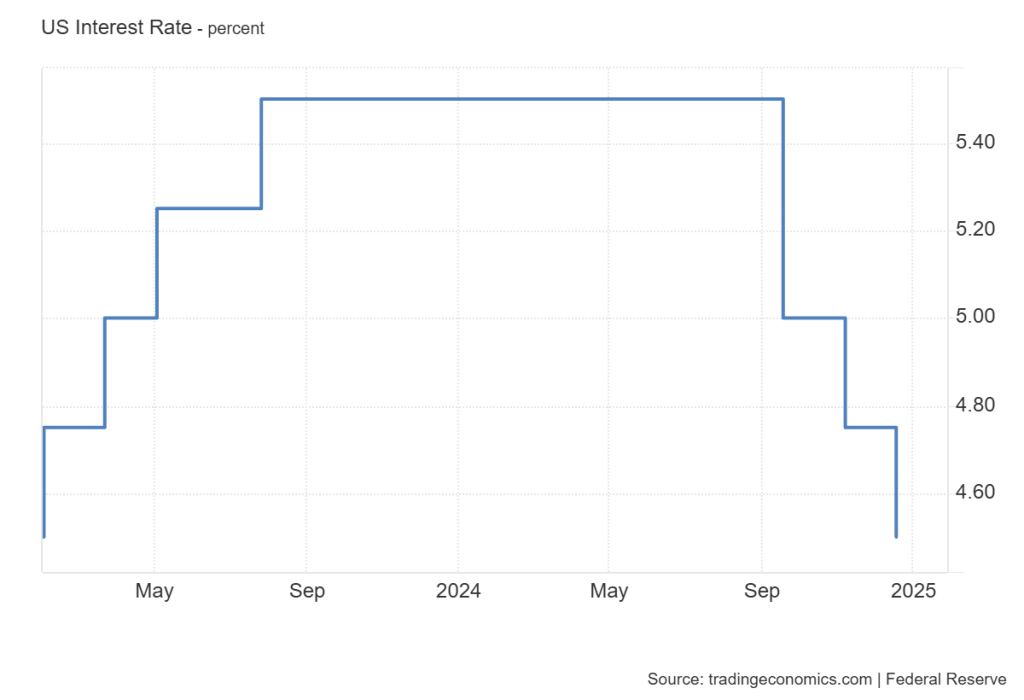

The US Federal Reserve’s interest rate decision is scheduled to be announced tomorrow. The consensus is that the US Fed will keep the interest rate unchanged at the 4.25%-4.5% range. In December, the Fed announced a rate cut of 0.25%. At that time, they hinted that they would bring a brief pause to their rate cut series.

In a recent X post, Michael van de Poppe presented the likelihood of no rate cuts as the primary reason for the latest altcoin crash.

$NVDA bounces upwards, #Bitcoin remains strength and #Altcoins continue to show weakness.

Why?

Tomorrow's FED Meeting.

Likelihood of no rate cuts and no signs of a potential rate cut to come.

That's harming the altcoin outlook.

Any minor chance –> #Altcoins to flourish.

Meanwhile, crypto expert Poppe noted that if the US Fed hints at future rate cuts, the altcoin market could bounce back.

An Alternative Trend in the US MarketThe NVIDIA Corp is trying to recover from the sharp fall it witnessed in the recent past. In the last 24 hours alone, the market has recorded a surge of 8.93%.

Likewise, in the last 30 days, Bitcoin has registered a growth of 9.9%, showcasing a strong potential for its future growth.

The crypto market remains volatile ahead of the US Fed’s interest rate decision. While Bitcoin and NVIDIA are showing strength, altcoins are struggling due to expectations of no rate cuts. If the Fed hints at future cuts, altcoins could see a rebound.

.article_register_shortcode { padding: 18px 24px; border-radius: 8px; display: flex; align-items: center; margin: 6px 0 22px; border: 1px solid #0052CC4D; background: linear-gradient(90deg, rgba(255, 255, 255, 0.1) 0%, rgba(0, 82, 204, 0.1) 100%); } .article_register_shortcode .media-body h5 { color: #000000; font-weight: 600; font-size: 20px; line-height: 22px; } .article_register_shortcode .media-body h5 span { color: #0052CC; } .article_register_shortcode .media-body p { font-weight: 400; font-size: 14px; line-height: 22px; color: #171717B2; margin-top: 4px; } .article_register_shortcode .media-body{ padding-right: 14px; } .article_register_shortcode .media-button a { float: right; } .article_register_shortcode .primary-button img{ vertical-align: middle; } @media (min-width: 581px) and (max-width: 991px) { .article_register_shortcode .media-body p { margin-bottom: 0; } } @media (max-width: 580px) { .article_register_shortcode { display: block; padding: 20px; } .article_register_shortcode img { max-width: 50px; } .article_register_shortcode .media-body h5 { font-size: 16px; } .article_register_shortcode .media-body { margin-left: 0px; } .article_register_shortcode .media-body p { font-size: 13px; line-height: 20px; margin-top: 6px; margin-bottom: 14px; } .article_register_shortcode .media-button a { float: unset; } .article_register_shortcode .secondary-button { margin-bottom: 0; } } Never Miss a Beat in the Crypto World!Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

.subscription-options li { display: none; } .research-report-subscribe{ background-color: #0052CC; padding: 12px 20px; border-radius: 8px; color: #fff; font-weight: 500; font-size: 14px; width: 96%; } .research-report-subscribe img{ vertical-align: sub; margin-right: 2px; }