USDC Dominated $10 Trillion Stablecoin Surge in January, Yet Circle’s Stock Keeps Sliding

January 2026 marked a watershed moment for stablecoins, with total on-chain transaction volume surpassing $10 trillion in a single month. USDC dominated that surge, processing more than $8.4 trillion in payments, far outpacing rivals and exceeding the combined monthly payment volumes of Visa and Mastercard.

Yet despite this explosive growth, Circle, the issuer of USDC, continues to face a sharp disconnect between on-chain reality and market valuation.

USDC Hits $8.4 Trillion in January Transactions as Circle Stock Slides 80%According to Artemis data, January’s stablecoin activity represented one of the strongest signals yet that digital dollars are moving beyond niche crypto use cases and into mainstream financial infrastructure.

Circle’s marketer, Peter Schroeder, noted that stablecoin transaction volume crossed $10 trillion in January alone, with USDC accounting for the vast majority of flows ($8.4 trillion).

Stablecoin transaction volume in January surpassed $10 trillion.

USDC alone processed more than $8.4 trillion. pic.twitter.com/qmHqp9NDWp

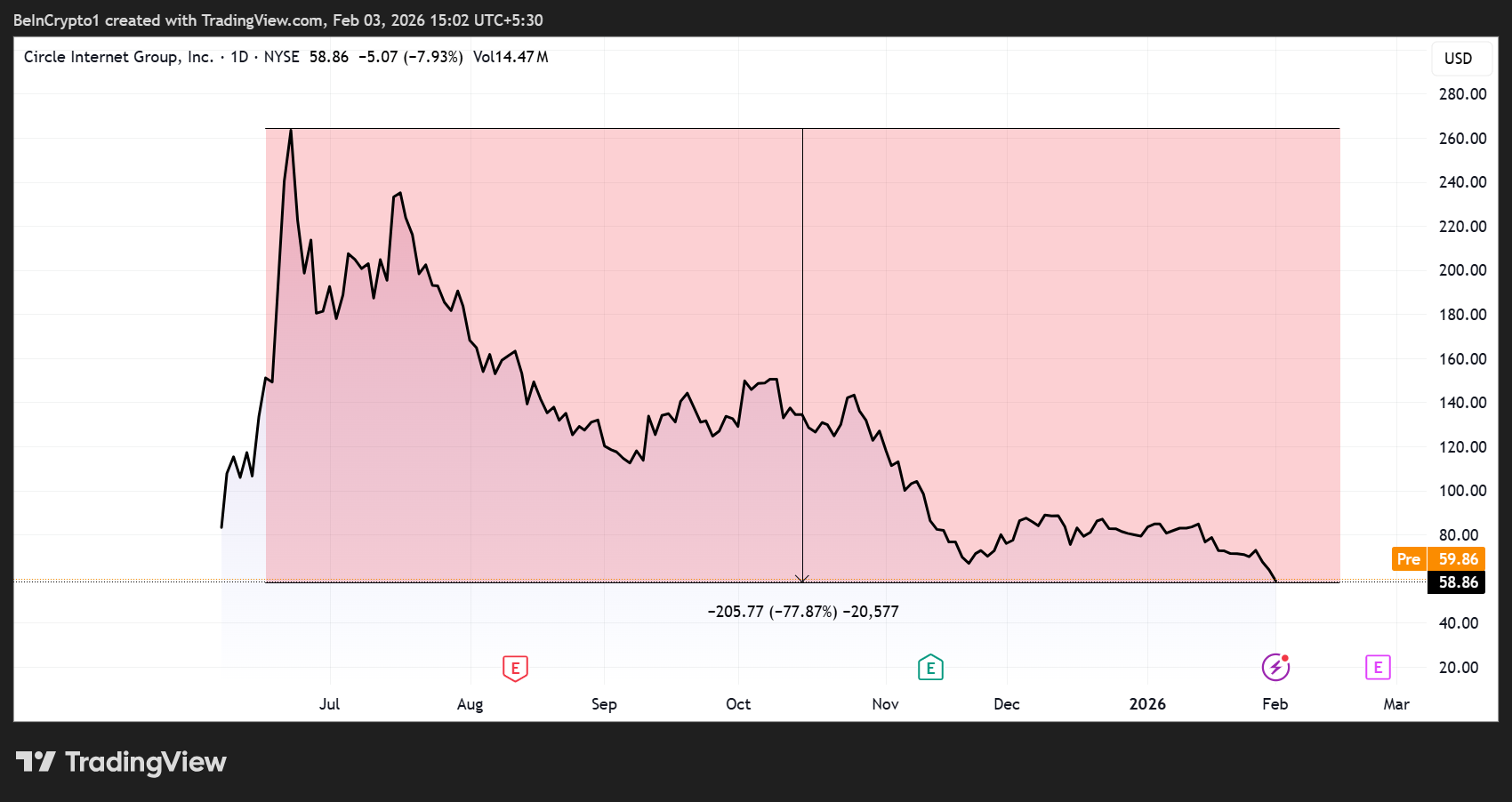

By comparison, Visa and Mastercard together typically process around $2 trillion in monthly payments. Investors, however, appear unconvinced. Circle’s stock is down roughly 80% from its peak just seven months ago, a divergence that has sparked intense debate among analysts and market participants.

Circle (CRCL) Stock Performance. Source: TradingView

Circle (CRCL) Stock Performance. Source: TradingView

Equity fund executive Dan Tapiero pointed out that while stablecoins saw $33 trillion in total volume in 2025 and $10 trillion in January alone, Circle’s equity continues to price in failure rather than scale.

“USDC was $8T of that… in one month,” Tapiero said, arguing that the total addressable market (TAM) for stablecoins could exceed $1,000 trillion over time.

Others echo the view that the market is misclassifying Circle’s role, arguing that investors still treat it as a fintech company rather than as core financial infrastructure.

Market is still pricing Circle like a fintech, not like core financial infrastructure … that changes everything

— vivek rajan (@vivekrajan1380) February 3, 2026If this framing is true, then it understates the strategic importance of regulated digital dollars in payments, treasury operations, foreign exchange, and capital markets.

Regulatory Clarity Fuels USDC’s Rise as Markets Miss the SignalCircle itself has leaned into this narrative, stating that stablecoins are now operating globally at scale following the convergence of regulatory clarity, institutional adoption, and on-chain technology.

Beyond stablecoins, a new financial system is taking shape.

What began as an innovation in digital dollars has evolved into core financial infrastructure. In just a few years, regulatory clarity, institutional adoption, and onchain technology have converged.

This report… pic.twitter.com/SH4PxdKTsk

The disconnect between usage and valuation mirrors a broader crypto pattern, with analysts noting that January’s $10 trillion stablecoin volume annualizes to roughly $120 trillion—nearly 40 times the entire crypto market capitalization of around $3 trillion.

Product destroying it.

Stock getting destroyed.

Same pattern as crypto overall:

Utility growing ✅

Price collapsing ❌

$10T stablecoin volume in January.

Annualized = $120T.

That's 40X crypto's total market cap ($3T).

Stablecoins is the real crypto product.

If regulation…