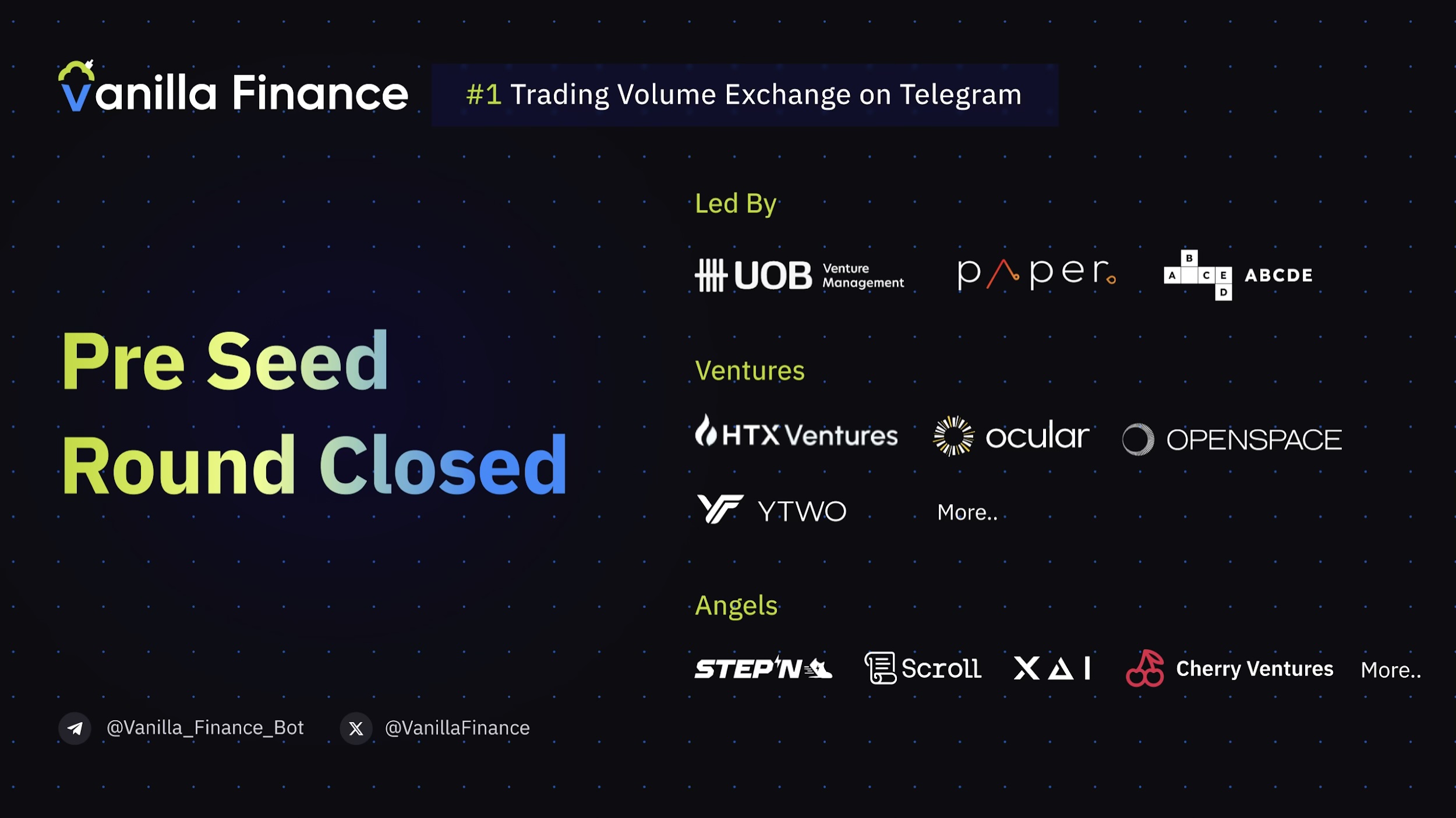

Vanilla Finance Closes Pre-Seed Investment Round Led by UOB Ventures, Paper Ventures and ABCDE Labs

November 26, 2024 – Singapore

Vanilla Finance – the number-one exchange by trading volume on Telegram – today announced the successful closure of their pre-seed investment round led by Paper Ventures, UOB Ventures and ABCDE Labs – among other top-tier ventures and investors, including HTX Ventures, Ocular, Openspace, Y2 Ventures and Signum Capital, as well as angel investors from STEPN, Scroll, XAI, Cherry Ventures and more.This significant funding round coincides with Vanilla Finance’s notable achievements in the digital asset sector, where it has quickly risen to become the number-one exchange by trading volume on Telegram, amassing over $8 billion in USDT trading volume within the first 60 days of launching.

A landmark achievementVanilla Finance has further solidified its position by winning the Binance MVB (most valuable builder) season eight – an accolade that not only celebrates its innovative trading solutions but also recognizes its market leadership and success.

Vision for the futureVanilla Finance, having closed its round, is now poised to redefine the user experience in crypto trading.

- Redefining user Experience – The platform will focus on becoming more intuitive, secure and user-friendly, employing new features to simplify and enhance the trading process for beginners and experts alike.

- Expanding market offerings – Vanilla Finance plans to launch its spot market in the coming weeks, particularly focusing on meme trading pairs, which have seen a surge in popularity. Additionally, they intend to introduce a meme creator platform, staking products and futures trading to diversify their offerings and cater to a broader user base.

With a strategic focus on Southeast Asia and APAC, Vanilla Finance is gearing up to tap into the region’s rapidly growing digital economy.

The platform aims to capture the next 100 million users by offering localized services, including support in local languages and integration with regional payment systems.

Strategic investments and market leadershipThe investment from UOB Ventures – a venture arm of one of Asia’s leading banks – and Paper Ventures – known for its focus on tech-driven financial solutions – signals strong institutional backing.

A spokesperson from UOB Ventures said,

“We are thrilled to support Vanilla Finance. Their innovative approach to trading on Telegram – combined with their vision for the future – aligns perfectly with our investment philosophy in fostering leaders in finance.”

Danish Chaudhry, GP of Paper Ventures, added,

“Vanilla Finance’s strategy to expand into the Southeast Asia and APAC regions aligns perfectly with the tremendous growth potential in digital finance.

“We see these markets as the future of investment opportunities.”

Looking aheadAs Vanilla Finance moves forward with its ambitious plans, the company remains committed to maintaining the security and integrity of its platform while pushing the boundaries of what a crypto exchange can offer.

The integration of community-driven features, like meme spot trading and exchange products, could set a new standard in how digital assets are traded and engaged with.

Vanilla Finance is not just building a trading platform – it’s crafting an ecosystem where innovation drives user engagement and growth.

With this new investment, the future looks promising not just for Vanilla Finance but for the countless users it aims to serve in Southeast Asia and beyond.

Contact Vanilla FinanceX | Telegram | Vanilla Finance Bot

This content is sponsored and should be regarded as promotional material. Opinions and statements expressed herein are those of the author and do not reflect the opinions of The Daily Hodl. The Daily Hodl is not a subsidiary of or owned by any ICOs, blockchain startups or companies that advertise on our platform. Investors should do their due diligence before making any high-risk investments in any ICOs, blockchain startups or cryptocurrencies. Please be advised that your investments are at your own risk, and any losses you may incur are your responsibility.Follow Us on Twitter Facebook Telegram

Check out the Latest Industry Announcements

The post Vanilla Finance Closes Pre-Seed Investment Round Led by UOB Ventures, Paper Ventures and ABCDE Labs appeared first on The Daily Hodl.