This Week In Crypto: Trump/Musk Split, Gemini and Circle IPO, Altcoin Bear Market, and More

This week in crypto, a number of important developments happened: Trump and Elon Musk ended their partnership, a Spanish coffee company pivoted to focus on Bitcoin investment, Gemini filed for an IPO, and more.

Polymarket also conducted a partnership with X, and analysts noted that the altcoin market is in a record-breaking bear market. All these topics and more are available at BeInCrypto.

Trump and Elon Musk’s BreakupObviously, the biggest crypto news this week was the split between Donald Trump and Elon Musk. Although both men had been close allies since Trump’s Inauguration, these crypto titans went through a messy political divorce.

Musk accused the President of pedophilia, while Trump threatened to pull the CEO’s government contracts and subsidies.

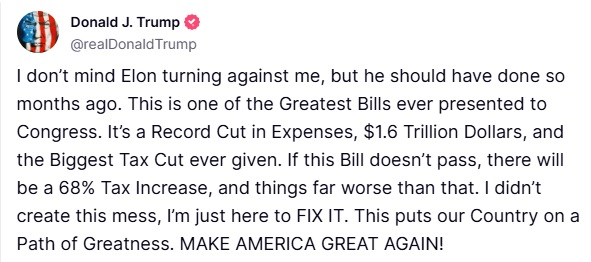

Trump Attacks Elon Musk. Source: Donald Trump

Trump Attacks Elon Musk. Source: Donald Trump

At the core of their argument was Trump’s “Big Beautiful Bill,” a budget proposal that Musk harshly criticized. In response, a flurry of “Kill (the) Bill” themed meme coins arose after the argument, but most of them crashed in value today.

Spanish Coffee Chain Pivots to BitcoinAnother important crypto event this week was Vanadi Coffee, a Spanish firm that decided to follow in MicroStrategy’s footsteps.

After losing more money than it made last year, Chairman Salvador Martí proposed abandoning the coffee business entirely to custody Bitcoin. He proposed spending $1.1 billion on BTC purchases.

Corporate Bitcoin acquisitions are a growing trend in this market, and firms around the world are joining it. This is a gamble that can have unexpected risks, especially for smaller firms, but it can pay out huge dividends.

Over the past few months, Bitcoin has been much less volatile than usual, so this might help Vanadi’s chances.

Gemini Files for IPOGemini, a prominent crypto exchange, filed for an IPO this week. Its co-founders have been teasing the development for months, but Circle’s massive IPO success may have influenced the decision.

Still, some prominent KOLs expressed unease with these IPOs, claiming that they may signal an unhealthy crypto market.

Oh boy here comes the next one already.

So we have Bitcoin Treasury companies and IPOs this cycle.

Doubt Gemini is a good investment, but neither is Circle and look what they're valued at. Bubble forming.https://t.co/MQmpwo0W1u

Gemini’s IPO is still in the earliest stages, so it’s unclear how much money the firm is trying to raise. Still, co-founder Cameron Winklevoss recently promised big developments for the firm, so Gemini’s IPO goals might be quite ambitious.

Polymarket Partners with XPolymarket, crypto’s favorite predictions market, announced a new partnership with X this week. Neither company gave clear details about what this partnership will entail, but Polymarket’s press release addressed a few distinct possibilities.

“Combining Polymarket’s accurate, unbiased, and real-time prediction market probabilities with Grok’s analysis and