58% of Ethereum (ETH) Traders Are Long, Price Rally Incoming?

The post 58% of Ethereum (ETH) Traders Are Long, Price Rally Incoming? appeared first on Coinpedia Fintech News

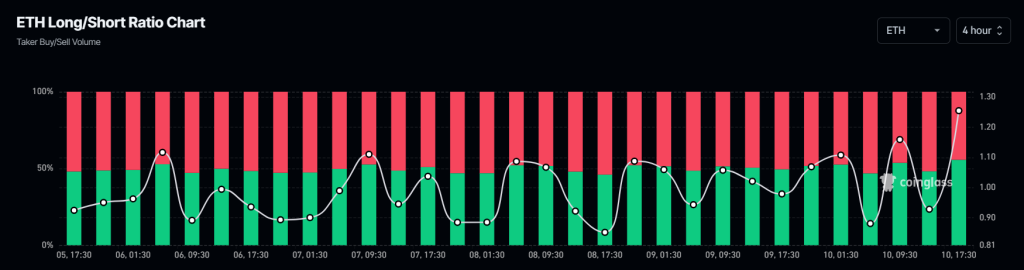

In this ongoing market reversal, the Ethereum (ETH) price is poised for a significant rally as bulls are currently dominating the assets. According to the on-chain analytic firm CoinGlass, 58.15% of top Ethereum traders are holding long positions, while 41.85% are holding short positions.

Source: CoinGlass

Traders Sentiment are Bullish for Ethereum

Source: CoinGlass

Traders Sentiment are Bullish for Ethereum

This data suggests that bulls are back and could trigger a significant upside rally. However, CoinGlass’s Long/Short ratio currently stands at +1.392, indicating bullish sentiment (a ratio above 1, signals a bullish market outlook).

Meanwhile, ETH future open interest has increased by 2.3% in the last 24 hours, reflecting bullish bets on long positions. However, it has been continuously increasing for the last four trading days.

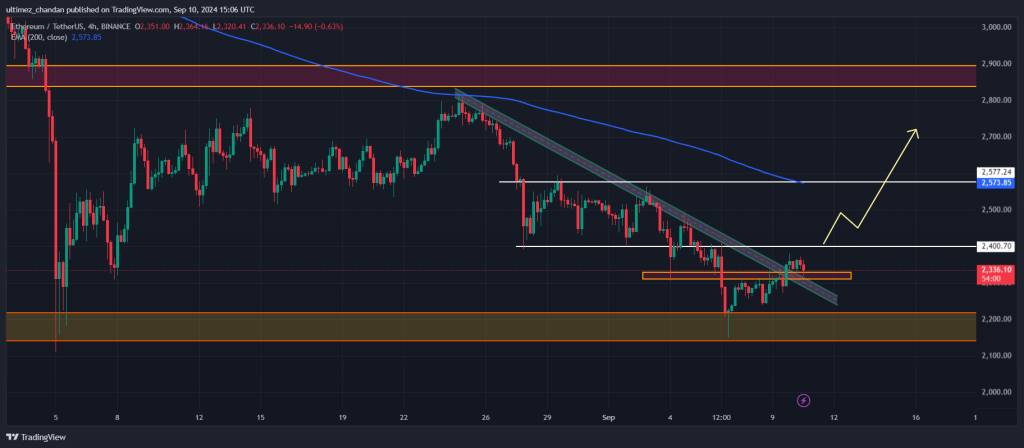

Ethereum Price PredictionAccording to expert technical analysis, ETH appears bullish despite trading below the 200 Exponential Moving Average (EMA) on both four-hour and daily time frames. Ether recently gave a broke out of a descending trendline on a four-hour time frame. Following the breakout, ETH is currently consolidating within a tight range between $2,330 and $2,375 levels.

Source: Trading View

Source: Trading View

Based on the historical price momentum, if ETH breaks out of this consolidation zone and closes a candle above the $2,390 level, there is a high possibility it could reach the $2,570 level and $2,840 level in the coming days.

However, this bullish thesis will only hold if Ether’s price closes a four-hour candle above the $2,390 level, otherwise, it may fail.

Ethereum Price MomentumAt press time, Ether is trading near the $2,335 level and has experienced a price surge of over 2.5% in the last 24 hours. Meanwhile, its trading volume has increased by 7.5% during the same period indicating higher participation from traders and investors in the ongoing price reversal.

Institutions Recent ActivityAmidst this price reversal, on September 10, 2024, during Asian trading hours, Metalpha a Hong Kong asset manager dumped a notable 10,000 ETH worth $23.45 million on Binance. Over the past four days, the institution has offloaded a total of 33,589 ETH, valued at $77.55 million, on the exchange.

This suggests that some investors, whales, and institutions remain bearish or believe further price corrections are ahead. For now, the market appears bullish as long as it stays above the $2,300 level.