The Advantages of Web3 Development for E-Commerce Businesses

In the fast-evolving world of cryptocurrency and blockchain technology, strategic partnerships are paving the way for unprecedented innovations and security enhancements. One such groundbreaking collaboration that has caught the industry’s attention is the integration of Fireblocks with the injective blockchain. This integration represents a significant milestone in the quest to secure digital assets and streamline transactions on the blockchain, offering a robust solution to the challenges of custody and scalability that have long plagued the digital asset space. The importance of this partnership cannot be overstated as it not only enhances asset security but also broadens the horizon for possible blockchain applications, indicating a promising direction for the future of finance and technology.

This article will delve into the specifics of how Fireblocks, a leader in digital asset custody, aligns with injective blockchain, a prominent layer 1 blockchain, to revolutionize the digital asset space. It will explore the pioneering aspects of the injective blockchain, the significance of Fireblocks in safeguarding digital assets, and the strategic implications of their integration. Furthermore, the impact of this collaboration on institutional adoption and the wider Web3 landscape will be analyzed, showcasing how these advancements are likely to set new benchmarks for the industry. By providing a comprehensive overview, this piece aims to clarify the complex dynamics of blockchain integration and its potential to reshape digital transactions and asset management in the Web3 era.

Understanding Fireblocks and Its Importance in Digital Asset CustodyThe Role of Fireblocks in the Digital Asset EcosystemFireblocks has established itself as a pivotal component in the digital asset ecosystem by securing billions in customer funds through its MPC Wallets. The platform facilitates direct transfers to exchanges on the Fireblocks Network and rebalances between exchange accounts, enhancing operational efficiency and security.

Security Features Attracting Institutional ClientsA key attraction for institutional clients is the Fireblocks Policy Engine, which configures transaction governance to protect funds against internal collusion, human error, and external attacks. Additionally, the integration of Fireblocks API connects back- and middle-office systems, streamlining settlement operations and automating transaction authorization workflows, thereby eliminating the need for manual and in-person approvals.

Impact of Securing Over $4 Trillion in Digital AssetsFireblocks’ role in securing over $4 trillion in digital assets underscores its significant impact on the industry. This security is achieved through a multi-layer technology that combines the latest breakthroughs in MPC cryptography with hardware isolation, providing robust protection against cyber threats and operational risks. This comprehensive security framework not only attracts major institutional clients but also sets a high standard for digital asset custody solutions globally.

Injective: Pioneering the L1 Blockchain SpaceInteroperable Layer One Blockchain for Web3 FinanceInjective stands as a formidable layer one blockchain, specifically optimized for building advanced Web3 finance applications. Its architecture leverages the powerful and modular Cosmos SDK framework, enabling seamless interoperability and high transaction throughput. With capabilities exceeding 25,000 transactions per second, Injective ensures instant transaction finality, which is crucial for the fast-paced environment of decentralized finance. This robust platform supports a diverse range of applications, from DeFi to NFT finance, by facilitating secure and efficient cross-chain data transfer and crypto asset management across major blockchains like Ethereum, Solana, and Cosmos Hub.

INJ: The Native Asset Powering Injective’s EcosystemThe INJ token, native to Injective, plays a pivotal role in the ecosystem, serving multiple functions including staking for network security, incentivizing trading activities, and participating in protocol governance. The economic model of INJ incorporates deflationary mechanisms where trading fees contribute to a buyback-and-burn strategy, enhancing the token’s value alignment with the platform’s growth. This design not only secures the network but also empowers INJ holders to actively participate in governance decisions, influencing the future direction of the blockchain.

Support from Leading Investors and Binance IncubationInjective’s potential and innovation have attracted significant support from leading investors in the blockchain space, including Pantera Capital, Jump Crypto, and notable entrepreneur Mark Cuban. Additionally, being incubated by Binance, one of the largest and most influential crypto exchanges, provides Injective with unparalleled access to resources and expertise. This backing underscores the platform’s credibility and positions it as a significant player in the DeFi sector, poised to drive the next wave of financial innovation on the blockchain.

The Strategic Integration of Fireblocks with InjectiveEnabling Seamless Access to Native Injective AssetsThe integration between Fireblocks and Injective has established a pivotal gateway for institutions to securely hold and manage native Injective assets like INJ. This strategic collaboration ensures that global institutional users can directly connect to Injective’s ecosystem, significantly enhancing the accessibility and management of digital assets within the blockchain space.

Spurring Institutional Adoption in the Blockchain SpaceFireblocks has played a crucial role in accelerating institutional adoption of Injective by providing a secure and efficient platform for engaging with decentralized finance (DeFi) applications. This integration enables institutions to leverage Fireblocks’ robust security features and regulatory expertise, ensuring a seamless transition into the blockchain and DeFi sectors. The partnership is hailed as a major milestone for Injective, facilitating rapid onboarding of institutions into a new realm of on-chain finance.

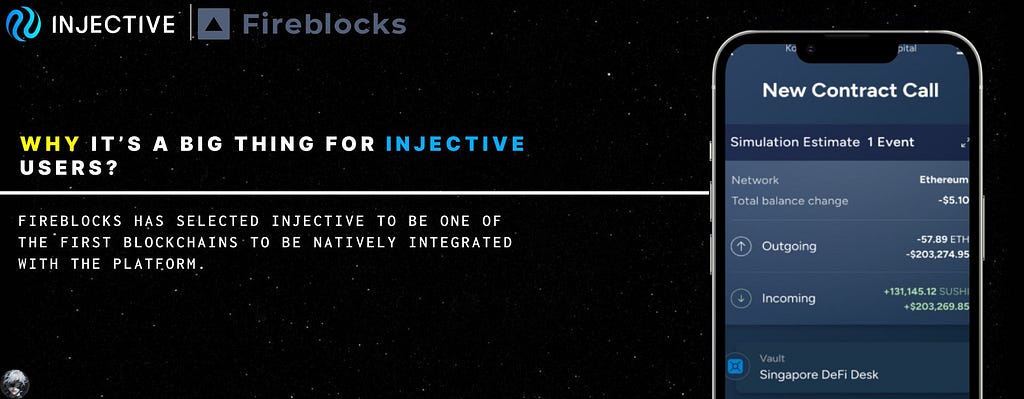

The Significance of Being One of the First L1 Blockchains Integrated with FireblocksInjective’s integration with Fireblocks marks it as one of the pioneering Layer 1 blockchains to achieve such a collaboration. This positions Injective at the forefront of the blockchain industry, enhancing its credibility and attracting further institutional interest. The integration not only boosts Injective’s global presence but also sets a new standard for security and efficiency in blockchain transactions, promising a more streamlined and accessible DeFi ecosystem.

What This Means for Institutional Adoption and the Web3 LandscapeThe integration between Fireblocks and the injective blockchain heralds a new era for institutional adoption and the Web3 landscape. This strategic collaboration is set to significantly streamline the entry of traditional finance institutions into the decentralized finance (DeFi) space, enhancing both security and accessibility. Below are the key aspects of how this integration impacts the broader financial ecosystem.

Improving access to decentralized applications for institutional usersFireblocks users now have the capability to custody INJ in their Fireblocks Vault, securely transfer INJ on the Fireblocks Network, and connect to dApps on the injective blockchain via WalletConnect. This not only simplifies the process for institutions to engage with the DeFi ecosystem but also opens up a plethora of opportunities for them to explore innovative financial applications. By staking INJ through partners like Figment and Kiln, institutions can further contribute to and benefit from the ecosystem’s growth.

Providing a secure gateway for capital deployment in the Injective ecosystemThe collaboration ensures a secure and efficient gateway for institutions to onboard onto the injective blockchain, allowing for rapid deployment of capital within its ecosystem. Institutions can now leverage Fireblocks’ robust security features and regulatory expertise to safely access injective’s advanced DeFi features. This integration serves as a critical bridge, connecting traditional finance with the burgeoning world of Web3 finance, thereby fostering a more inclusive financial landscape.

Facilitating a smoother transition for traditional institutions into Web3 financeThe integration of Fireblocks with the injective blockchain is a major milestone in enabling institutions to transition more rapidly into the realm of truly on-chain finance. By offering an unparalleled gateway for institutional access, this collaboration not only enhances the injective blockchain’s global presence but also sets a new standard for security and efficiency in blockchain transactions. The involvement of established institutions is expected to bring a wealth of experience and expertise, leading to the development of novel DeFi applications and use cases that benefit the entire ecosystem.

In summary, the strategic integration of Fireblocks with the injective blockchain is poised to significantly accelerate institutional adoption of digital assets and DeFi, marking a pivotal moment in the evolution of the Web3 landscape.

ConclusionThrough the collaboration of Fireblocks with the injective blockchain, a new threshold in the digital finance space has been established, signifying a leap towards secure and streamlined blockchain applications. This partnership underscores the importance of innovative solutions in overcoming the historical challenges of digital asset custody and scalability, thereby facilitating a more accessible and efficient ecosystem for institutional involvement. With the integration emphasizing enhanced security measures and operational efficiencies, it not only sets a new industry benchmark but also broadens the scope for blockchain applications, echoing a promising trajectory for the future of finance and technology.

Furthermore, this strategic alliance is instrumental in accelerating the institutional adoption of decentralized finance (DeFi), marking a significant step towards the intersect of traditional finance and the Web3 landscape. By providing a secure and regulatory-compliant gateway, the collaboration paves the way for traditional finance institutions to explore and integrate blockchain solutions seamlessly, thereby enriching the digital asset space with their expertise. As we consider the wider implications, the integration of Fireblocks with the injective blockchain is not just about enhancing transaction security; it’s about unlocking the full potential of blockchain technology, pushing the boundaries of what’s possible in the digital finance realm, and setting the stage for a new era of financial innovation.

The Impact of Fireblocks Integrating with Injective Blockchain was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.