Algorithmic Trading and the Role of Bots: Factors to Consider | ValueZoneAI

Introduction: What is Algorithmic Trading? Algorithmic trading (algo-trading) is like having a super-smart assistant that helps you trade in financial markets. Instead of making decisions on your own, you use computer programs (or algorithms) to do it for you, such as ValueZone AI Trading Bots. These algorithms follow a set of instructions to analyze the market and execute trades at just the right moment—often in the blink of an eye.

This approach has transformed trading, making it faster, more efficient, and often more profitable. The key to this success lies in the strategies these algorithms follow, and more often than not, these strategies are executed by bots—automated systems that work tirelessly to find the best opportunities in the market.

Common Algorithmic Strategies Used by Trading Bots:

Strategy Description Key Advantages Examples Arbitrage Exploiting price differences of the same asset across different markets or exchanges. Profit from small, quick price discrepancies. Buying Bitcoin on one exchange for $30,000 and selling it on another for $30,100. Trend-Following Buying or selling assets based on current market trends (upward or downward). Capitalizes on sustained market movements. Buying stocks as they increase in price and selling when they start to fall. Market-Making Continuously placing buy and sell orders to profit from the spread between bid and ask prices. Provides liquidity and profits from the spread. Offering to buy a stock at $100 and sell at $101, earning $1 per share. Mean Reversion Betting that asset prices will revert to their historical average. Profits from price corrections after overreactions. Buying a stock that has dropped below its usual price, expecting it to recover. Sentiment Analysis Analyzing news and social media to gauge market sentiment and make trades accordingly. Leverages market psychology for trading decisions. Buying a stock after positive news coverage expecting a price increase. Why Choose Bots for Trading?- Unmatched Speed:

Bots can analyse data and execute trades in fractions of a second. In the fast-moving world of trading, where prices can change in an instant, this speed can make all the difference. A bot can react to market changes before a human even blinks.

- Emotion-Free Trading:

Human traders often struggle with emotions like fear and greed, which can lead to poor decision-making. Bots, on the other hand, stick to their algorithms without getting emotional. They follow the plan, ensuring consistent and disciplined trading.

- 24/7 Operation:

Markets, especially in areas like cryptocurrency, never sleep. Bots don’t need rest, meaning they can monitor and trade around the clock. This nonstop operation ensures that opportunities are never missed, even when you’re asleep.

- Data-Driven Decisions:

Bots can process enormous amounts of data in real-time, something that would be impossible for a human. This allows them to make informed decisions based on the latest information, giving them an edge in predicting market movements.

Step-by-Step Guide to Optimizing Trading Bots- Start with Small Changes:

Begin by making minor adjustments to your bot’s settings. This could be changing the time frame it operates on or tweaking its risk management rules.

- Test Different Scenarios:

Optimize for different market conditions. For example, see how your bot performs during a bull market versus a bear market.

Keep Records:

Document every change you make and the results it produces. This helps you understand what works and what doesn’t.

- Use a Free Trial Plan:

Before committing to a paid plan, many platforms offer free trial plans where you can test and optimize your bot in a simulated environment. This is a risk-free way to see how your bot performs without risking real money.

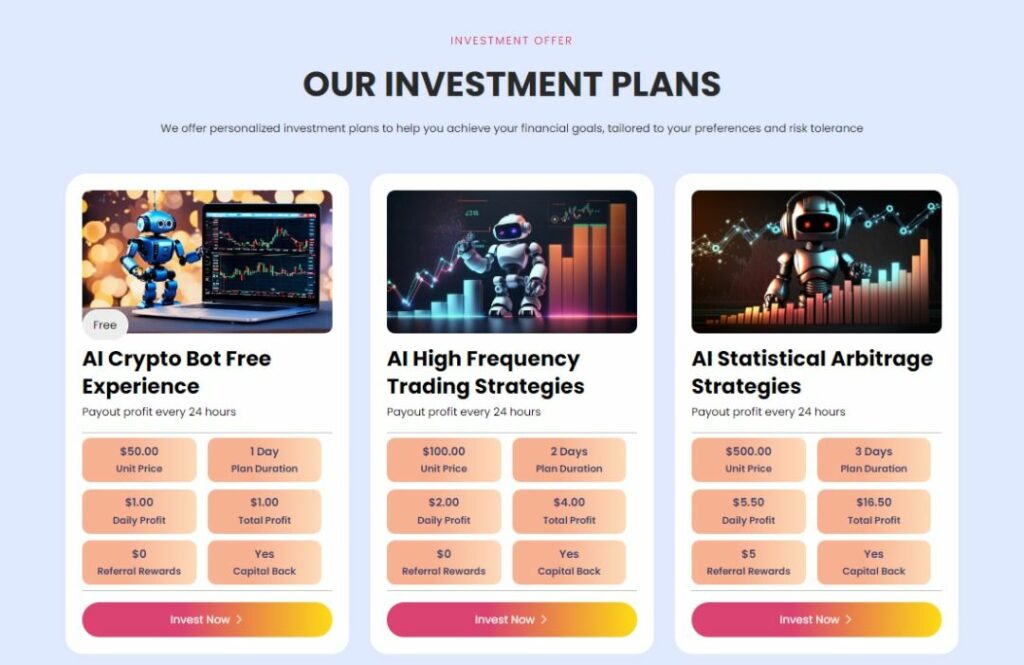

How to Get Started with ValueZone AI- Sign Up and Get a $50 Welcome Bonus:

When you SIGNUP with ValueZone AI, you can get a $50 welcome bonus. This bonus can be used to start your trading journey without using your own money.

- Try the Free Trial Plan:

Take advantage of the free trial plan to test and optimise your bot. This is a great way to get comfortable with the platform before upgrading to a paid plan.

- AI High-Frequency Trading Strategies: Invest $100 for 2 days and earn $4 daily.

- AI Statistical Arbitrage Strategies: Invest $500 for 3 days and earn $5.50 daily.

- AI Cross Market Arbitrage Strategy: Invest $1500 for 7 days and earn $18 daily.

- AI Short-Term CTA Strategy: Invest $3000 for 10 days and earn $39 daily.

- AI Short-Term Alpha Strategy: Invest $5000 for 15 days and earn $70 daily.

- AI Trend Following Strategy: Invest $8000 for 15 days and earn $120 daily.

- AI Quantitative Hedging Strategy: Invest $15,000 for 25 days and earn $240 daily.

- AI Dynamic Portfolio Strategy: Invest $23,000 for 25 days and earn $391 daily.

- AI Capital Weighted Portfolio Strategy: Invest $35,000 for 30 days, earn $630 daily.

- AI Momentum Investment Strategy: Invest $50,000 for 30 days and earn $950 daily.

- AI Growth Investment Strategy: Invest $100,000 for 45 days and earn $2000 daily.

- Referral Rewards – Earn 3.5%:

If you refer friends to ValueZone AI, you’ll earn 3.5% of their deposits. It’s a win-win—you help your friends, and you get rewarded too!

- Monitor Your Bot’s Performance:

Once your bot is live, keep an eye on its performance. Regular monitoring ensures that your bot works as expected and helps you make any necessary adjustments.

ConclusionAlgorithmic trading has revolutionized the way people trade and bots are at the heart of this transformation. They’re fast, reliable and can execute complex strategies without the emotional pitfalls that often trip up human traders. Whether it’s taking advantage of price differences with arbitrage, riding market trends, or analyzing market sentiment, trading bots offer a powerful tool for anyone looking to stay competitive in today’s financial markets. In a world where timing and precision are everything, ValueZone AI bots are the future of trading.

Disclosure: This is a sponsored press release. Please do your research before buying any cryptocurrency or investing in any projects. Read the full disclosure here.

The post Algorithmic Trading and the Role of Bots: Factors to Consider | ValueZoneAI appeared first on The Merkle News.