Bearish Signal for POPCAT: Price Could Fall by 15%, Here’s Why

The post Bearish Signal for POPCAT: Price Could Fall by 15%, Here’s Why appeared first on Coinpedia Fintech News

The popular Solana-based meme coin Popcat (POPCAT) is poised for a price decline following a bearish pattern and notable selling pressure that appears on its daily chart. This bearish pattern appears when major cryptocurrencies are experiencing notable price surges and upside momentum.

POPCAT Recent PerformancePOPCAT has gained significant attention from traders and investors in the past few days with an impressive price surge of over 100%. However, the sentiment has potentially shifted toward a downtrend.

At press time, the meme coin is trading near $0.95 and has experienced a price decline of over 10% in the past 24 hours. During the same period, POPCAT’s trading volume declined by 19%, indicating lower participation from traders, potentially due to fear of a price crash.

POPCAT Technical Analysis and Upcoming LevelsAccording to expert technical analysis, POPCAT appears bearish as it has broken the low of the past two days with a large red candle at the $1 resistance level. The formation of such a candle near resistance indicates a bearish signal and potential selling pressure.

Source: Trading View

Source: Trading View

Based on historical price momentum, if the meme coin closes its daily candle below the $0.95 level there is a strong possibility that POPCAT could drop by 15% to reach the $0.80 level in the coming days.

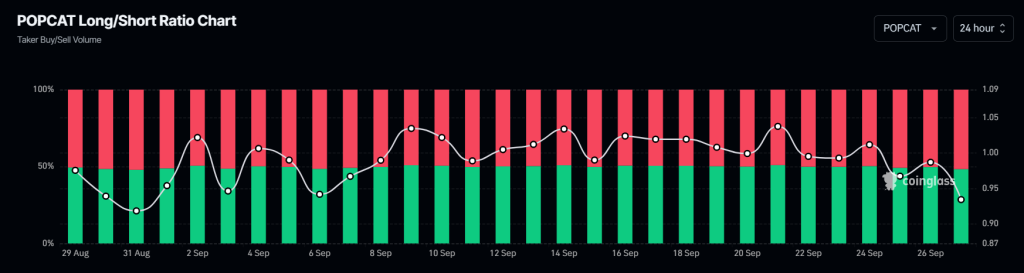

Bearish On-Chain MetricsHowever, this negative outlook is further supported by on-chain metrics such as long/short ratio and future open interest. According to the on-chain analytics firm Coinglass, POPCAT’s Long/Short ratio currently stands at 0.933 level which indicates a bearish sentiment among traders.

Source: Coinglass

Source: Coinglass

Additionally, its future open interest has declined by 7.5% in the last 24 hours and has been steadily falling. This drop in the open interest indicates the liquidation of higher long positions due to the massive price decline in the past 24 hours. Currently, 51.72% of top traders hold short positions, while 48.28% hold short positions.