Best Crypto Auto Trading Platforms 2024

The post Best Crypto Auto Trading Platforms 2024 appeared first on Coinpedia Fintech News

Pionex is the best crypto auto-trading platform, but there are many strong contenders that we have ranked in this article. These crypto trading platforms have been game-changers for investors and traders alike, and our experts suggest that you look into them to see if they might help you turn a profit.

Efficient, updated in real-time, easy to use… these platforms have dramatically transformed the landscape of digital asset trading. With such platforms, users can effortlessly engage in automated crypto investing, leveraging the best crypto trading bots and auto trading tools to maximize profits and optimize strategies in the volatile crypto market.

Top 10 Crypto Auto-Trading Platforms of 2024This guide will explore the top contenders for the title of the best crypto auto-trading platform, ensuring you’re well-equipped to thrive in the fast-paced world of crypto.

1. Pionex – Best Crypto Auto-trading Platform

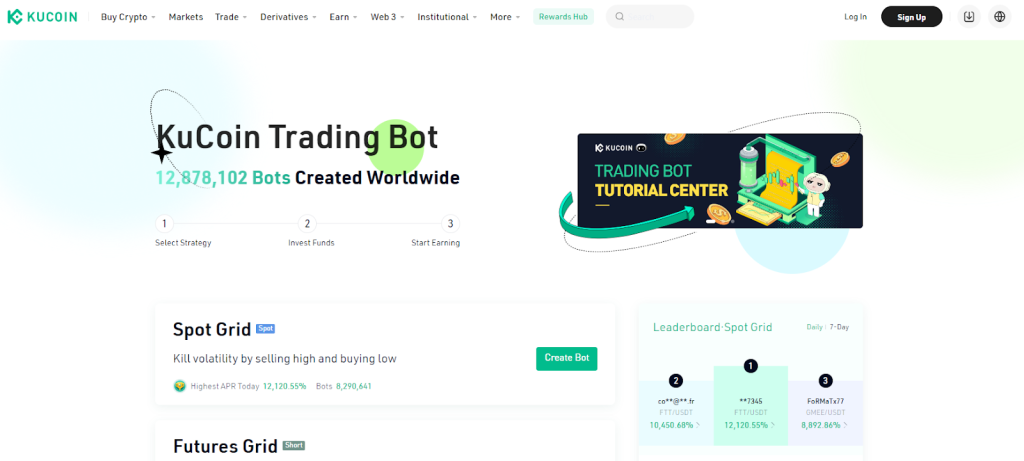

2. Kucoin – Powerful Crypto Auto-Trading Platform

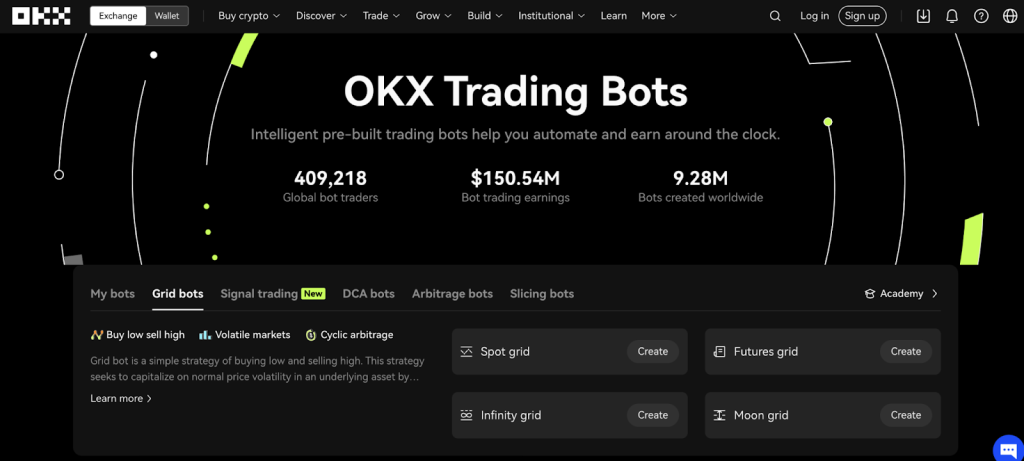

3. OKX – Best Crypto Auto-Trading User Experience

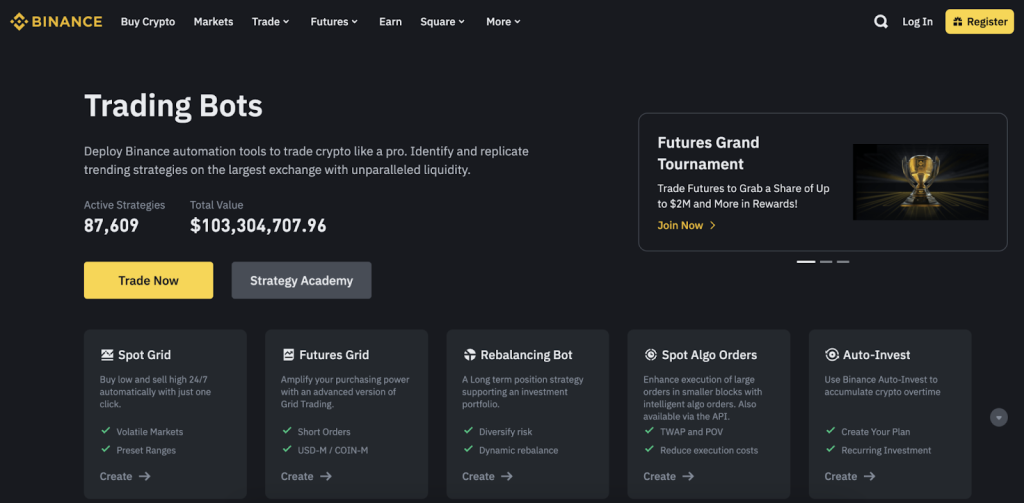

4. Binance – Best Bitcoin Trading Platform

5. Kryll – Crypto Auto-Trading Platform For Strategic Trading

6. Octobot – Best Crypto Auto-Trading Platform For Customization

7. Coinrule – Crypto Auto-Trading Platform For Passive Earning

8. SMARD – Crypto/Fiat Hybrid Trading Platform

9. Bitsgap – Crypto Auto-Trading Platform Algorithm For Small Gains

10. Tradesanta – Easy Crypto-trading Bot Creation

1. Pionex – Best Crypto Auto-trading Platform

Pionex is among the best-automated crypto trading platforms in 2024, standing out for integrating auto-trading tools directly into its platform. It allows users to leverage the benefits of automated crypto trading with minimal manual intervention, making it a go-to for seasoned traders and newcomers intrigued by auto crypto trading.

Features and FunctionalitiesThe platform offers key features, such as in-built crypto trading bots for market conditions and trading strategies. This includes the Grid Trading Bot, which works well in volatile markets by executing transactions within pre-determined price ranges, and the Dollar-Cost Averaging (DCA) Bot, which is ideal for long-term investments by spreading out purchase points.

Pionex’s automated crypto trading technology ensures that users can engage in 24/7 trading, capitalizing on opportunities even when not actively monitoring the market.

Pros:- User-friendly interface: This makes it accessible for beginners while retaining advanced features for seasoned traders.

- Low trading fees: Competitive fees compared to other platforms in the cryptocurrency trading sphere.

- Automated crypto trading: Don’t have time to read the markets daily? The platform offers an automated trading service that allows you to profit without the hassle.

- Variety of bots: Provides diverse trading bots to suit individual trading strategies and market conditions.

- Integrated with Binance: Pionex integrates seamlessly with Binance, providing access to many cryptocurrencies and trading pairs.

- Complex for new users: Despite its efforts for accessibility, the sheer number of features can be overwhelming for newcomers.

- Dependence on market conditions: Like all automated trading systems, its effectiveness can sometimes depend heavily on market conditions.

Users generally praise Pionex’s innovative integration of auto crypto trading tools directly into the trading platform, highlighting its ease of use and efficiency. However, some feedback indicates a learning curve for those new to auto crypto trading, suggesting that maximizing the platform’s potential benefits may require an initial period of learning and adjustment. Despite this, the overall sentiment from users points to satisfaction, particularly with the platform’s ability to automate trading strategies effectively, ensuring users don’t miss out on profitable market movements.

2. Kucoin – Powerful Crypto Auto-Trading Platform

Kucoin is another frontrunner in our selection of crypto auto-trading platforms in 2024, renowned for its advanced trading software and extensive range of digital assets. With a focus on offering an intuitive yet powerful platform, the platform’s commitment to integrating cutting-edge automated trading tools sets it apart, enabling users to maximize their trading strategies precisely and easily.

Features and FunctionalitiesKucoin shines with its array of features designed to enhance the auto-trading experience. Central to its offering is the advanced Trading Bot, which supports multiple strategies such as Spot Grid, Futures Grid, and DCA, catering to diverse trading needs and market conditions. Furthermore, Kucoin’s Trading Bot is hailed for its user-friendly design, making automated trading accessible to novices while offering depth for experienced traders. Additionally, the platform boasts impressive liquidity and a vast selection of cryptocurrencies, ensuring traders can execute trades efficiently and seize market opportunities across a broad spectrum of assets.

Pros:- Extensive cryptocurrency selection: Kucoin offers one of the largest assortments of cryptocurrencies, providing traders with vast opportunities.

- Advanced Trading Bot: The platform has various strategies, making it adaptable to different trading styles and objectives.

- High liquidity: Ensures quick and efficient trade execution, minimizing slippage and enhancing profitability.

- Strong security measures: Kucoin highly emphasizes security, employing multiple layers of protection to safeguard users’ assets.

- Crypto autotrader functionality.

- Interface can be overwhelming: The depth of features and functionalities might be daunting for beginners.

- Customer support: Some users have reported delays in customer service response times during peak periods.

Kucoin users often highlight the platform’s wide range of available cryptocurrencies and the high level of liquidity. For those who are savvy with crypto, these features enhance trading opportunities and user satisfaction.

On the downside, some reviewers point out the complexity of the platform’s interface, noting it can be intimidating for those new to trading. Overall, though, the feedback leans positively, with many users recommending Kucoin for its advanced features, reliability, and strategic advantages its automated trading tools provide.

3. OKX – Best Crypto Auto-Trading User Experience

With a keen focus on innovation and user experience, OKX aims to bridge the gap between complex trading technologies and traders seeking to optimize their strategies in the volatile cryptocurrency markets of 2024. It accomplishes this through great UI/UX design.

Features and FunctionalitiesOKX sets itself apart with an impressive user interface that’s both easy-to-use and contains an array of trading features and functionalities designed to meet the demands of today’s dynamic cryptocurrency market.

Automation is a big part of what makes this a top crypto auto-trading platform. Users can automate their trading strategies precisely. Features like the Spot and Futures Grid, Martingale, and Smart Rebalance cater to a broad range of trading preferences and risk appetites. Additionally, OKX offers an extensive choice of digital assets, ensuring that trades are executed promptly at the desired prices.

The platform also strongly emphasizes security, incorporating state-of-the-art technologies to protect users’ assets and information.

Pros:- Fantastic crypto auto-trading experience with great UI/UX and automation

- Comprehensive trading tools: OKX provides users with an advanced yet user-friendly suite of trading tools, enabling novice and experienced traders to automate their strategies effectively.

- Wide range of digital assets: Offers a vast selection of cryptocurrencies, providing users with numerous trading opportunities.

- Exceptional liquidity: High liquidity means users can execute large-volume trades swiftly with minimal slippage.

- Robust security measures: Employs rigorous security protocols to ensure the safety of users’ assets and personal information.

- Complexity for beginners: The extensive features and sophisticated trading tools may be intimidating for those new to cryptocurrency trading.

- Support response times: Some users have reported slower customer support response times, which can be a drawback in fast-moving market conditions.

The user experience on OKX is generally positive, especially for traders using its advanced tools. The platform’s interface, though comprehensive, is praised for its organized design.

Customer support is widely praised. OKX is often recommended on message boards as a top crypto auto-trading platform that’s extremely adaptive to user needs.

4. Binance – Best Bitcoin Trading Platform

Binance stands as a titan in cryptocurrency exchanges, catering to a global audience with diverse trading needs.

Originally founded in 2017, Binance quickly ascended to prominence, powered by its commitment to providing robust trading solutions, an expansive range of cryptocurrencies, and cutting-edge security measures. It offers the strongest support for Bitcoin trading.

Features and FunctionalitiesBinance offers staking and savings accounts with competitive interest rates – particularly for Bitcoin. Binance strongly emphasizes security, employing a comprehensive suite of security measures, including two-factor authentication, withdrawal whitelist, and its Secure Asset Fund for Users (SAFU), ensuring peace of mind for its users. In addition to all this, the crypto auto-trading platform has one of the largest range of trading opportunities in the world.

Pros:- Competitive interest rates for Bitcoin

- Massive selection of trading instruments: Binance boasts one of the most extensive lists of cryptocurrencies and trading pairs in the market, providing unparalleled trading opportunities.

- Advanced tools and features: From its comprehensive trading platform to automated bots, staking, and beyond, Binance offers many tools for optimizing trading strategies.

- Top-notch security: A multi-tier and multi-cluster system architecture and SAFU ensures users’ funds and data remain secure.

- Global reach with localized support: Binance operates globally, offering support in multiple languages and catering to the needs of a diverse client base.

- Complexity for newcomers: The sheer range of features and options can be overwhelming for those new to trading or the platform.

- Traders who focus on crypto that are not Bitcoin can sometimes feel somewhat excluded although the platform offers robust features for all currencies.

- Regulatory scrutiny: Binance has faced regulatory challenges in various countries, which may impact the accessibility of certain features in those regions.

Users express a high level of trust in Binance on the security front, underscored by the platform’s proactive measures to protect user assets. It has developed a great reputation amongst Bitcoin users. Overall, the consensus among users is positive, highlighting Binance’s role as a leading force in the crypto exchange space, driven by its dedication to innovation, security, and user satisfaction.

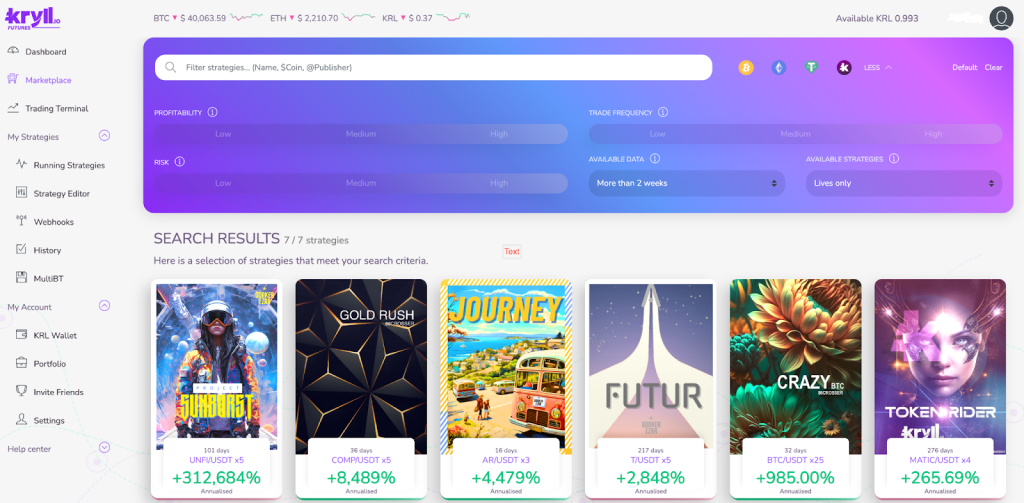

5. Kryll – Crypto Auto-Trading Platform For Strategic Trading

Kryll is an innovative platform that offers traders an advanced yet user-friendly environment to design, test, and execute their crypto trading strategies.

Established to demystify the often complex world of cryptocurrency trading, Kryll focuses on making automated trading accessible to both novices and seasoned traders. Its standout feature is the ‘Strategy Editor,’ a drag-and-drop interface that allows users to visually assemble and deploy trading strategies without writing a single line of code.

Features and FunctionalitiesKryll’s platform is rich in features designed to empower traders. As mentioned earlier, Editor, the Strategy is complemented by a Marketplace where users can rent out their successful strategies or utilize others’. For those interested in passive earning, Kryll offers a ‘Hodl & Earn’ function, providing an opportunity to earn rewards on unused tokens. Backtesting capabilities enable traders to test their strategies with historical data before live deployment, reducing risk. In addition, Kryll has integrated with several major exchanges, allowing users to manage their portfolios across platforms seamlessly.

Pros:- Intuitive Strategy Editor: Enables users to create powerful trading strategies using a simple drag-and-drop interface, accessible to traders of all skill levels.

- Marketplace for Trading Strategies: Offers a platform for users to share and profit from their trading strategies, fostering a community of traders.

- Strong Backtesting Tools: Allows traders to thoroughly test strategies with historical data before applying them in real market conditions.

- Cross-Exchange Integration: Users can manage and automate their trading across multiple exchanges, enhancing flexibility.

- Dependence on Strategy Success: The platform’s effectiveness largely depends on the success of the trading strategies it executes, which can vary widely.

- Learning Curve: Despite the user-friendly tools, new users may need help understanding strategy creation and market principles.

Users often commend Kryll for its innovative approach to simplifying automated trading, particularly praising the Strategy Editor for its ease of use and effectiveness. The platform’s Marketplace also receives positive feedback for enabling a collaborative environment where traders can share and discover successful strategies. While some users mention a learning curve, most find the educational resources and supportive community helpful in accelerating their proficiency.

6. Octobot – Best Crypto Auto-Trading Platform For Customization

Octobot is a cutting-edge cryptocurrency trading bot that caters to a wide range of traders, from novices to seasoned professionals.

Developed with a focus on flexibility and customisation, Octobot aims to streamline the trading process by offering automated solutions that adapt to individual trading styles and market conditions. It highlights user empowerment through extensive customisation options, real-time analytics, and comprehensive support for major cryptocurrency exchanges.

Features and FunctionalitiesAdvanced features include customisable indicators, stop-loss and take-profit parameters, trade signals, and more. The platform also offers automated portfolio management tools, enabling users to track their performance and make informed decisions. Octobot’s support for multiple exchanges allows users to diversify their trading and exploit market opportunities.

Pros:- Highly Customizable: Offers an unparalleled level of strategy customisation, catering to diverse trading methodologies.

- User-Friendly Interface: Despite its advanced functionalities, Octobot maintains a user-friendly dashboard that simplifies navigation and operation.

- Comprehensive Analytics: Provides detailed reports and analytics, allowing users to monitor and adjust their strategies based on performance closely.

- Complexity for Beginners: The depth of customisation and array of features might overwhelm users new to automated trading.

Users typically report a positive experience with Octobot, citing its customisation capabilities and the effective automation of trading processes as significant advantages. The user-friendly interface is also highlighted, making it easier for users to manage their trades and analyze performance.

7. Coinrule – Crypto Auto-Trading Platform For Passive Earning

With its motto “Trade while you sleep,” Coinrule allows users to automate their trading strategies, simplifying the trading process and enabling users to take advantage of market opportunities around the clock. Its straightforward interface is coupled with advanced features that aim to democratize trading, making it accessible and effective for everyone.

Features and FunctionalitiesCoinrule offers over 150 trading template strategies among its standout features, enabling users to set up trades or customize them to their preferences quickly. The platform also supports rule simulation, allowing traders to test their strategies against historical market data and adjust them before going live. Coinrule is integrated with more than 10 major cryptocurrency exchanges, providing users with a wide range of trading options and the ability to manage various portfolios from a single dashboard.

Pros:- Simplifies Automated Trading: The easy-to-use interface and IFTTT rules make automation accessible for traders at every skill level.

- Wide Range of Templates: Over 150 strategy templates are available, making it easy for users to start trading immediately or inspire their customized strategies.

- Effective Strategy Testing: Users can simulate rules against historical data, reducing risk and enhancing strategy effectiveness.

- Multi-Exchange Integration: Broad compatibility with major exchanges increases trading flexibility and opportunities.

- Limited Advanced Features for Professionals: While perfect for beginners and intermediate traders, advanced traders might find the tool’s capabilities could be improved.

- Dependent on Market Conditions: As with all trading platforms, users’ success on Coinrule depends highly on volatile market conditions, which can impact the effectiveness of predefined rules.

User feedback commonly highlights the platform’s ease of use, allowing them to automate trades effortlessly and “sleep while their bot trades”. Many appreciate the comprehensive range of templates and the ability to test strategies without risking capital. However, some experienced traders desire more complex features to develop intricate strategies. Overall, Coinrule is praised for its approachability, reliability, and support to traders seeking to optimize their market participation without constant monitoring.

8. SMARD – Crypto/Fiat Hybrid Trading Platform

Positioned as a bridge between traditional financial trading methodologies and the fast-paced world of cryptocurrency, SMARD aims to deliver an option for conservative investors who seek to mitigate risk through diversification. This platform stands out for its commitment to security, efficiency, and adaptability, ensuring that users, from beginners to seasoned traders, can find value and performance unparalleled in the current market.

Features and FunctionalitiesSMARD supports multiple exchanges and cryptocurrencies, making it ideal for diversifying portfolios and taking advantage of market fluctuations. The platform offers advanced trading tools such as algorithmic strategies, technical analysis indicators, and customisable charts for in-depth market insights.

Pros:- Multi-exchange Support: Users can diversify their portfolios and utilize market movements by trading on multiple exchanges from a single platform.

- State-of-the-art Trading Speed: With an average execution time of under two milliseconds, SMARD’s high-volume trading capabilities are among the fastest in the industry.

- Advanced Crypto Trading Software for Informed Trading: SMARD’s technical analysis indicators, algorithmic strategies, and customisable charts provide traders invaluable insights into market trends and potential opportunities.

- Efficient Order Management: Users can easily manage multiple orders simultaneously with SMARD’s intuitive interface, reducing time and effort.

- Limited Asset Support: While SMARD supports a wide range of cryptocurrencies, some traders might find the selection limited compared to other platforms.

Users commonly praise SMARD for its realistic approach to crypto trading. The platform’s analysis tools and customization are data-driven. This should allow users to make better decisions without the need for in-depth expertise. Better customer support – especially trained professionals who are on-call – would help to make the product more accessible to beginners.

9. Bitsgap – Crypto Auto-Trading Platform Algorithm For Small Gains

Bitsgap is well known for its algorithm-based applications which inspect share market data and generate signals based on the parameters set by users.

In simple terms, the tool’s functionality sports small opportunities and allows users to take advantage of them and aggregate gains – leading to sizable profits. This applies especially to arbitrage trading.

Bitsgap aims to empower both novice and professional traders to make informed decisions, manage their portfolios efficiently, and maximize their trading potential. The platform is known for its fast, real-time market analysis, and the ability to execute strategies across multiple exchanges simultaneously.

Features and FunctionalitiesBitsgap delivers a broad spectrum of features designed to enhance the trading experience. One of the platform’s standout offerings is its automated trading bots, which enable users to implement and maintain trading strategies 24/7, ensuring they never miss a market opportunity. Additionally, the platform provides an integrated trading terminal, allowing traders to execute orders on multiple exchanges from a single interface. Bitsgap also offers portfolio management, performance analytics, and a comprehensive set of market indicators and trading signals. This combination of tools assists users in navigating the complexities of the cryptocurrency market with precision and ease.

Pros:- Automated Trading Bots: Bitsgap’s automated bots simplify the trading process, enabling novice and seasoned traders to stay active in the market 24/7 without constant monitoring.

- Integrated Trading Terminal: The platform offers a unified trading experience across multiple exchanges, enhancing efficiency and decision-making speed with its integrated terminal.

- Comprehensive Portfolio Management: Users can effectively manage and analyze their crypto holdings within the platform, making it simpler to track performance and make informed adjustments.

- Rich Set of Trading Tools: With an extensive array of market indicators and trading signals, Bitsgap equips users with the necessary tools to make data-driven decisions.

- Subscription Costs: Access to the most powerful features of Bitsgap comes with a price tag, which might deter users looking for a free trading solution.

Bitsgap streamlines and automates the trading process across various exchanges through algorithm-powered investment. Traders looking to make arbitrage-style trades – that is, extracting profit from the difference in prices for the same asset – will find that Bitsgap is ideal for this purpose due to the automation that spots discrepancies between asset prices. If you can overcome the initial challenge of learning how to calibrate the tool, you will find great value.

10. Tradesanta – Easy Crypto-trading Bot Creation

TradeSanta is a cloud-based software that allows you to automate your own bot. The platform facilitates setting up crypto trading bots to execute strategies automatically, allowing users to capitalize on market trends without needing to monitor their portfolios constantly. TradeSanta supports many major exchanges, enabling users to spread their trading activities across various platforms and maximize their potential gains.

Features and FunctionalitiesTradeSanta offers tools and features that facilitate an efficient trading experience. The platform’s primary offering is its trading bots, which enable users to set up automated strategies based on their preferences and risk tolerance levels. Additionally, TradeSanta provides technical indicators, customisable templates for creating bots, real-time market data analysis, and the ability to backtest trading strategies to fine-tune performance. Users can also take advantage of features such as stop-loss and take-profit orders, portfolio management, and a user-friendly dashboard for monitoring bot activity.

Pros:- Automated Trading: TradeSanta’s trading bots provide an ideal solution for traders looking to automate their trading activities while maintaining control over their strategies.

- Multi-Exchange Support: With access to major exchanges, users can diversify their trading activities and minimize risk by spreading their investments.

- Easy-to-use Interface: The platform’s user-friendly design simplifies setting up and managing bots, making it accessible for traders of all levels.

- Technical Indicators and Backtesting: TradeSanta equips users with various technical indicators and the ability to backtest strategies, providing data-driven insights to improve performance.

- Subscription Costs: The platform offers various subscription plans, which may be expensive for new or inexperienced traders.

Users often praise TradeSanta’s simplicity and user-friendly interface, making it an ideal solution for traders looking to automate their strategies. The platform’s diverse range of supported exchanges also receives positive feedback as it allows users to spread out their trading activities. However, some users have mentioned experiencing limited functionality with the bots, which is being addressed by the platform’s team.

Guide To Online Crypto BettingIf you are confused about trading assets online, read these sections. trading assets online, especially in the context of cryptocurrencies, involves several key elements and steps. Here’s a breakdown of the basics of how to trade assets online:

Understanding the Basics:- Assets: Assets can be anything of value that can be bought or sold. In the context of online trading, assets can include stocks, cryptocurrencies, commodities, and more.

- Marketplaces: Online trading takes place on various platforms or marketplaces. For cryptocurrencies, popular exchanges include Coinbase, Binance, and Kraken.

- Choose a Platform: Select a reputable trading platform that suits your needs. Ensure it supports the assets you want to trade.

- Account Creation: Sign up for an account on the chosen platform. This usually involves providing personal information, verifying your identity, and securing your account with two-factor authentication.

- Deposit Funds: Transfer funds into your trading account. Most platforms accept deposits in fiat currencies (like USD, EUR) or cryptocurrencies.

- Payment Methods: Different platforms offer various payment methods, including bank transfers, credit/debit cards, and cryptocurrency deposits.

- Market Orders: Execute a trade at the current market price. This is a quick way to enter or exit a position.

- Limit Orders: Specify the price at which you want to buy or sell an asset. The order will be executed when the market reaches that price.

- Technical Analysis: Study price charts, indicators, and patterns to make informed trading decisions based on historical price movements.

- Fundamental Analysis: Consider the underlying factors affecting an asset’s value, such as company news, economic indicators, or project developments in the case of cryptocurrencies.

- Diversification: Spread your investments across different assets to reduce risk.

- Stop-Loss and Take-Profit Orders: Set automatic orders to limit potential losses or secure profits at predetermined levels.

- Stay Informed: Keep up with market trends, news, and developments that may impact your chosen assets.

- Educational Resources: Utilize educational materials provided by the trading platform or external sources to enhance your understanding of trading strategies and market dynamics.

- Patience and Control: Emotions can impact trading decisions. Stay disciplined, avoid impulsive actions, and stick to your trading plan.

- Automation Tools: Some platforms offer auto-trading features that use algorithms to execute trades on your behalf.

- Research: Before using an auto-trading platform, research its reputation, features, and performance. Understand the associated risks.

Remember, trading involves risks, and it’s crucial to start with a clear strategy, educate yourself continuously, and only invest what you can afford to lose.

The Evolution of Crypto Auto-Trading PlatformsThe best automated cryptocurrency trading platforms have rapidly advanced over recent years due to the increased sophistication of automation in bots and crypto trading technology. This has led to a paradigm shift in how individuals approach cryptocurrency trading.

Definition of Automated Crypto Trading BotsAutomated crypto trading bots are computer programs designed to buy and sell cryptocurrencies at optimal times without human intervention. These bots play a pivotal role in crypto auto-trading platforms by analyzing market data and executing trades based on predefined criteria. Their efficiency in data analysis and precision in executing trades make them indispensable tools for maximizing returns on investments.

Advances in Automated Crypto Trading TechnologyThe technology underpinning automated crypto trading has seen remarkable advances. Early iterations of crypto auto-trading platforms relied on simple algorithms that executed trades based on basic indicators. However, recent developments have introduced more sophisticated technologies into automated crypto trading, including machine learning and artificial intelligence. These advancements have significantly enhanced the capabilities of crypto auto-trading platforms, enabling them to predict market movements with greater accuracy and execute trades at the most opportune moments.

Guide To Cryptocurrencies 1. Understanding Cryptocurrencies:- What is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. It operates on decentralized networks based on blockchain technology.

- Blockchain Technology:

Blockchain is a distributed ledger that records all transactions across a network of computers. It ensures transparency, security, and immutability of data.

2. Popular Cryptocurrencies:- Bitcoin (BTC):

The first and most well-known cryptocurrency. It’s often considered digital gold and is used as a store of value.

- Ethereum (ETH):

Known for its smart contract functionality, enabling the creation of decentralized applications (DApps) on its blockchain.

- Ripple (XRP), Litecoin (LTC), and others:

There are thousands of cryptocurrencies, each with its own purpose and features.

3. Getting Started:- Wallets:

Choose a cryptocurrency wallet to store your digital assets. Wallets can be hardware, software, online, or mobile-based.

- Exchanges:

Use cryptocurrency exchanges to buy, sell, and trade digital currencies. Popular exchanges include Coinbase, Binance, and Kraken.

4. Security:- Private Keys:

Your private key is like a password; keep it secure and never share it. Losing access to your private key means losing access to your funds.

- Two-Factor Authentication (2FA):

Enable 2FA on your accounts for an extra layer of security.

5. Buying and Selling:- Buying Cryptocurrency:

Deposit fiat currency into your exchange account and use it to purchase cryptocurrencies.

- Selling Cryptocurrency:

You can sell your cryptocurrencies for fiat currency or other digital assets.

6. Risks and Volatility:- Market Risks:

- Cryptocurrency prices can be highly volatile. Be prepared for market fluctuations.

- Research:

- Do thorough research before investing in any cryptocurrency. Understand the project, technology, and team behind it.

- Legal Considerations:

Cryptocurrency regulations vary globally. Stay informed about the legal aspects in your jurisdiction.

- Tax Implications:

Understand the tax implications of cryptocurrency transactions in your country.

8. Staying Informed:- News and Updates:

Follow reputable cryptocurrency news sources to stay informed about market trends, developments, and regulatory changes.

- Community Engagement:

Join cryptocurrency communities on forums and social media platforms to learn from others and stay updated.

9. Long-Term Perspective:- Hodl (Hold On for Dear Life):

Some investors adopt a long-term strategy, holding onto their cryptocurrencies despite short-term market fluctuations.

10. Educate Yourself Continuously:- Books, Courses, and Forums:

Stay educated about blockchain technology, cryptocurrencies, and the evolving landscape.

Remember, investing in cryptocurrencies carries risks, and it’s crucial to only invest what you can afford to lose. Always do your research and seek advice if needed.

Expert ChoicePionex is our experts top choice as best automated crypto trading platform, followed by Kucoin. Both offer valuable tools and functionalities that empower traders of all experience levels to engage more effectively and efficiently with volatile cryptocurrency markets. Our crypto trading experts have assessed that these two platforms offer the most value to players.

By automating trading strategies, these platforms enable users to take advantage of market opportunities around the clock without constant supervision. Despite the learning curve and subscription costs, the benefits of leveraging such platforms—including time savings, strategy optimization, and the ability to manage multiple exchanges—make them an indispensable resource in the crypto trading community.

As the cryptocurrency landscape continues to evolve, automation and sophisticated trading tools will undoubtedly become increasingly vital for traders aiming to maximize their investment potential.

Click the link for an alternative list of the best automated auto trading platforms.

Frequently Asked Questions (FAQs) Can I Use Crypto Auto-Trading Platforms without Any Trading Experience?Yes, one of the key advantages of crypto auto-trading platforms is their accessibility to traders of all experience levels, including beginners. These platforms are designed with user-friendly interfaces and provide automated trading bots that execute trades on your behalf based on predefined strategies. However, having a basic understanding of the cryptocurrency markets is recommended to make informed decisions about your trading strategy.

Are Crypto Auto-Trading Platforms Safe to Use?Crypto auto-trading platforms prioritize the security of users’ funds and data, employing various security measures such as encryption and two-factor authentication (2FA). It’s important to choose reputable and transparent platforms about their security practices. Nonetheless, users should also take personal security measures, such as using strong, unique passwords and being cautious of phishing attempts.

How Do Crypto Auto-Trading p+Platforms Make Money?Crypto auto-trading platforms typically generate revenue through subscription models, charging users a monthly or annual fee to access their automated trading bots and other premium features. Additionally, some platforms may offer a free tier with basic functionalities and charge for extra services such as advanced analytics, technical indicators, or increased bot operation limits. Always review the platform’s pricing structure before signing up to understand what you’re getting for your investment.