Binance, Bybit Eye Growing Solana Liquid Staking Market

Binance, the world’s largest crypto exchange by trading volume, is planning to launch a liquid staking token (LST) on the Solana blockchain, alongside other exchanges.

This move comes as Solana’s liquid staking ecosystem continues to grow, attracting interest from major industry players.

Exchanges Foray into SOL Liquid StakingOn Thursday, Binance, Bybit, and Bitget hinted at plans to launch new liquid staking tokens (LSTs) on the Solana blockchain through cryptic messages. Bybit’s liquid staking token will carry the ticker BBSOL, while Bitget’s will be BGSOL. Binance will use BNSOL as the symbol for its LST.

These tokens will enable holders to earn yield on their Solana (SOL) holdings while participating in decentralized finance (DeFi) activities such as lending and borrowing. Additionally, they will help secure the blockchain through staking. Sanctum, a liquid staking layer on Solana, has suggested that these LSTs will be built on its protocol.

“BBSOL will serve as a bridge between Bybit’s centralized exchange (CEX) and Web3 platforms, providing users with consistent and reliable rewards. By staking Solana (SOL) on Bybit Web3, users receive BBSOL tokens, unlocking a wealth of earning opportunities across Bybit’s CEX and Web3 products,” Bybit shared with BeInCrypto

Read more: What Is Liquid Staking in Crypto?

Amid this news, Sanctum’s CLOUD token has surged by 47%, trading at $0.2629 at the time of writing. Jae Sik Choi, senior associate at Greythorn Asset Management, described the development as bullish for Sanctum, predicting that up to $3 billion worth of Solana could be added to the staking layer’s total value locked (TVL).

“BNSOL — Binance’s LST, potentially adds $3 billion worth of SOL in Sanctum staking layer TVL. That will bring potentially a 55.48% increase in TVL, once native staked are converted to LSTs,” he wrote.

Sik Choi suggests that Binance, Bitget, and Bybit may have initiated a centralized exchange (CEX) LST season, which could boost Sanctum’s value. In addition to Sanctum, other staking layers on Solana, such as Jito, Marinade, Jupiter, and Blaze, are contributing to the growth of Solana’s liquid staking market.

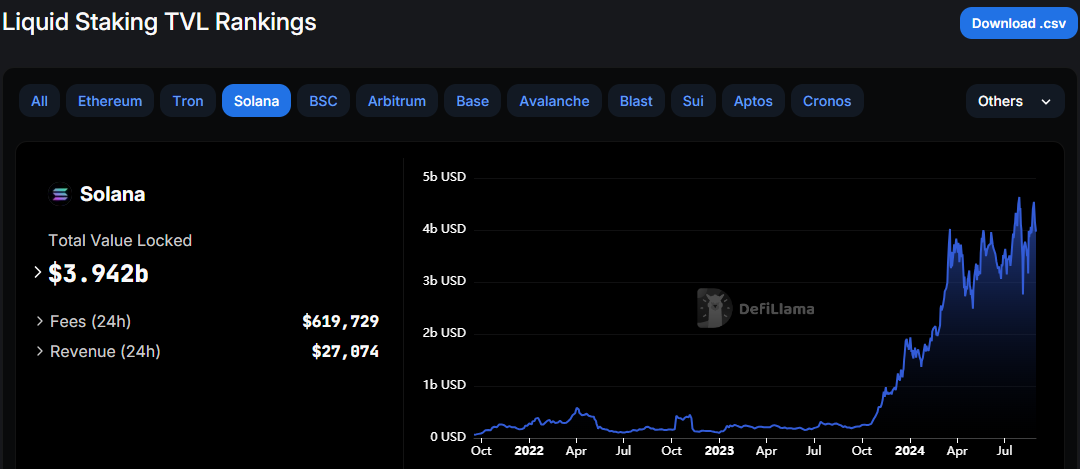

Solana Liquid Staking Market Doubles in 2024According to DefiLlama data, Solana’s liquid staking total value locked (TVL) has more than doubled in 2024, increasing from $1.9 billion to $3.94 billion. Since its inception in 2021, the sector has seen an impressive growth, attracting a large number of participants.

However, the $3.9 billion TVL accounts for just 9.6% of the $42.5 billion locked across all liquid staking protocols. Ethereum still dominates the sector, holding 83% of the total market share.

Solana Liquid Staking TVL. Source: DefiLlama

Solana Liquid Staking TVL. Source: DefiLlama

Liquid staking protocols are gaining popularity because they combine security contributions to network consensus with financial flexibility, making them an attractive option for savvy investors aiming to maximize profits.

For exchanges, introducing LSTs adds a new revenue stream, as these tokens expand their product offerings. Stakers earn rewards, while exchanges collect fees. For instance, Binance, which offers BETH — the third-largest LST by market capitalization — charges a 10% fee on Ethereum (ETH) staking rewards.

Read more: Top 8 High-Yield Liquid Staking Platforms To Watch in 2024

According to Binance’s support page, this 10% fee covers operational costs, including hardware and network maintenance for validator nodes. Additionally, LSTs like BNSOL, BBSOL, and BGSOL will allow exchanges retain Solana balances on their platforms.

The post Binance, Bybit Eye Growing Solana Liquid Staking Market appeared first on BeInCrypto.