Bitcoin (BTC) Eyes Potential 11% Drop as Bearish Signals Strengthen

Bitcoin (BTC) reached a new all-time high on December 17 but still remains 5% below the $110,000 mark. Indicators such as ADX and NUPL suggest a slowdown in upward momentum, pointing to a potential shift in market sentiment.

While BTC remains in the “Belief — Denial” zone, highlighting continued confidence, its failure to surpass key resistance levels raises caution. The next few days will determine whether BTC regains upward momentum to test $110,000 or faces further corrections toward critical support levels.

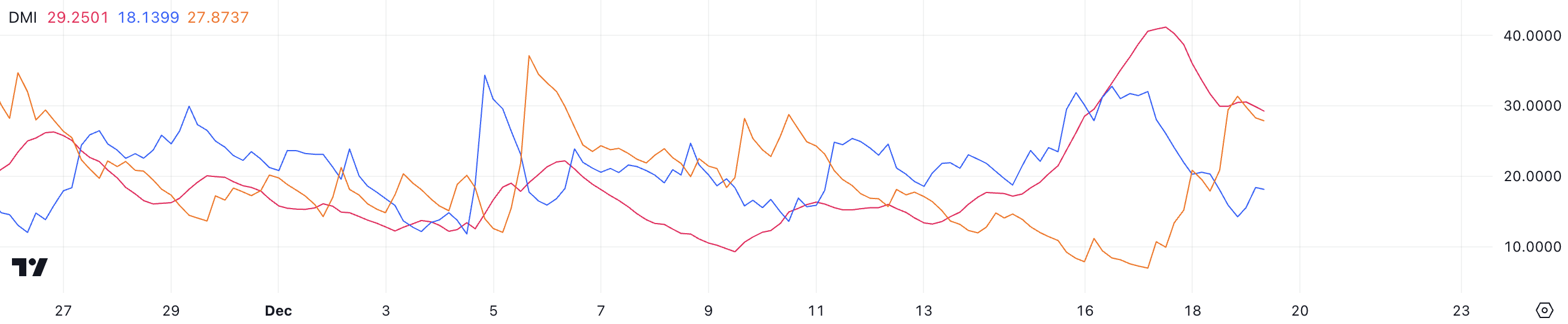

BTC Current Trend Shows a Potential Shift In SentimentBitcoin DMI chart reveals its ADX is currently at 29.2, down significantly from over 40 just two days ago when Bitcoin reached a new all-time high. This decline in ADX indicates that while the trend remains relatively strong, its intensity is fading.

With bearish momentum taking hold, the market appears to be shifting toward a period of consolidation or potential further downside.

BTC DMI. Source: TradingView

BTC DMI. Source: TradingView

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 signifying a strong trend and below 20 indicating a weak or non-trending market. Currently, BTC’s D+ at 18.1 and D- at 27.8 suggest that bearish forces are dominating, with sellers outpacing buyers in the short term.

This imbalance could push BTC price lower unless buyers regain control and D+ rises above D-, signaling renewed bullish momentum.

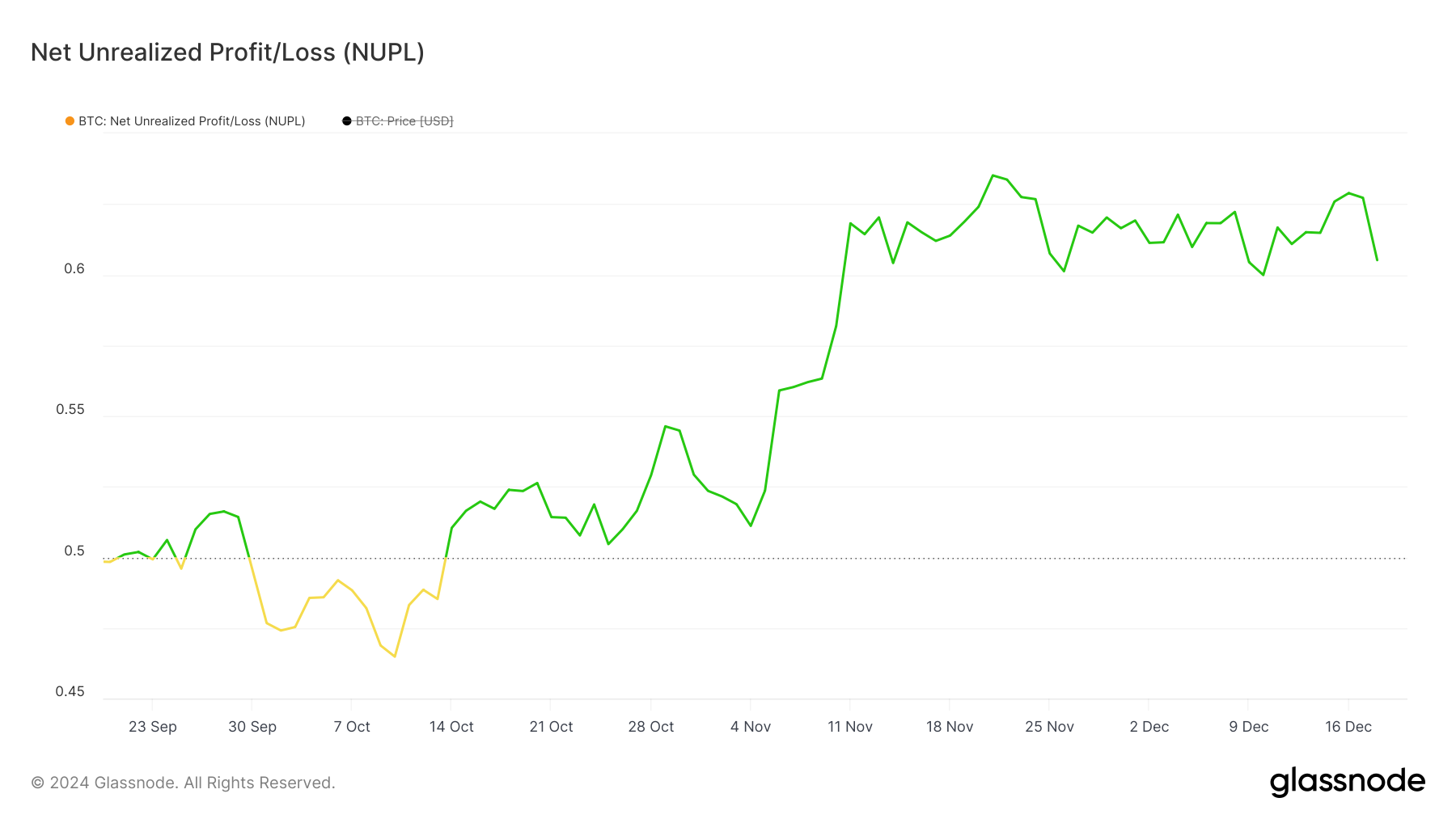

Bitcoin NUPL Is Far from the Next ThresholdsBitcoin NUPL is currently at 0.60, down from 0.628 when Bitcoin reached a new all-time high two days ago. This decline indicates a slight decrease in unrealized profits among BTC holders, reflecting some profit-taking or market cooling after the recent surge.

Despite this drop, Bitcoin price remains firmly in the “Belief — Denial” zone, signifying confidence among investors but with caution starting to emerge.

BTC NUPL. Source: Glassnode

BTC NUPL. Source: Glassnode

NUPL (Net Unrealized Profit/Loss) measures the aggregate unrealized gains or losses of BTC holders, categorizing market sentiment into stages.

Values above 0.5 fall into the “Belief – Denial” zone, while levels below 0.5 mark the “Optimism — Anxiety” stage, and above 0.7 signal the “Euphoria — Greed” stage, often associated with market tops. BTC current position at 0.60 suggests that while sentiment remains bullish, it is far from extreme greed and still comfortably above anxiety levels.

BTC Price Prediction: Is $110,000 Still Possible In 2024?If Bitcoin price can break above the resistance at $103,638, it may gain enough momentum to test new all-time highs around $108,000.

A successful move beyond this level could pave the way for BTC price to reach $110,000 for the first time, signaling continued bullish momentum and strong market confidence.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, EMA lines and ADX indicate that the current trend may be weakening, raising the possibility of a bearish shift. If the short-term EMAs cross below the long-term EMAs, a stronger downtrend could develop.

In this scenario, BTC price could test the $94,000 support level, and if that fails to hold, prices may decline further to $90,000, representing a potential 11.7% correction from current levels.

The post Bitcoin (BTC) Eyes Potential 11% Drop as Bearish Signals Strengthen appeared first on BeInCrypto.