Bitcoin Buying Opportunity, Expert Reveals Best Time to Invest

The post Bitcoin Buying Opportunity, Expert Reveals Best Time to Invest appeared first on Coinpedia Fintech News

On September 7, 2024, Bitcoin and other major cryptocurrencies experienced a significant price decline and have been continuously falling. Amid this market downturn, a crypto expert recently shared a post on X (formerly Twitter) highlighting how market corrections often occur in September before prices skyrocket in October.

In a post on X expert noted, “You don’t get a good October without a bad September.”

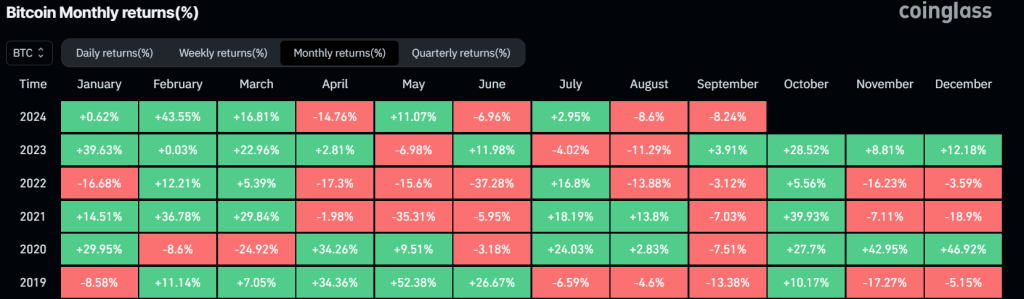

Best Time to Buy Bitcoin, ReportCoinGlass’s Bitcoin Monthly returns show that September is a bearish month where BTC experienced a massive price drop or correction before a significant price surge in October. In the last five years, September has been bearish for Bitcoin four times, while October has seen a price surge with a 100% success rate.

Source: CoinGlass

Source: CoinGlass

This data indicates that now is the perfect time to buy Bitcoin before October begins. As of now, BTC has lost 8.3% of its value this month.

Bitcoin Technical AnalysisAccording to expert technical analysis, Bitcoin is near a crucial support level of $53,000. Since July 2024, it has reached this level four times, and each time it has seen significant buying pressure.

Source: Trading View

Source: Trading View

Based on the historical price momentum, there is a high chance that BTC’s price may rebound and soar to the $67,000 level. However, if BTC fails to hold this level, it could fall to the $47,500 level or even lower.

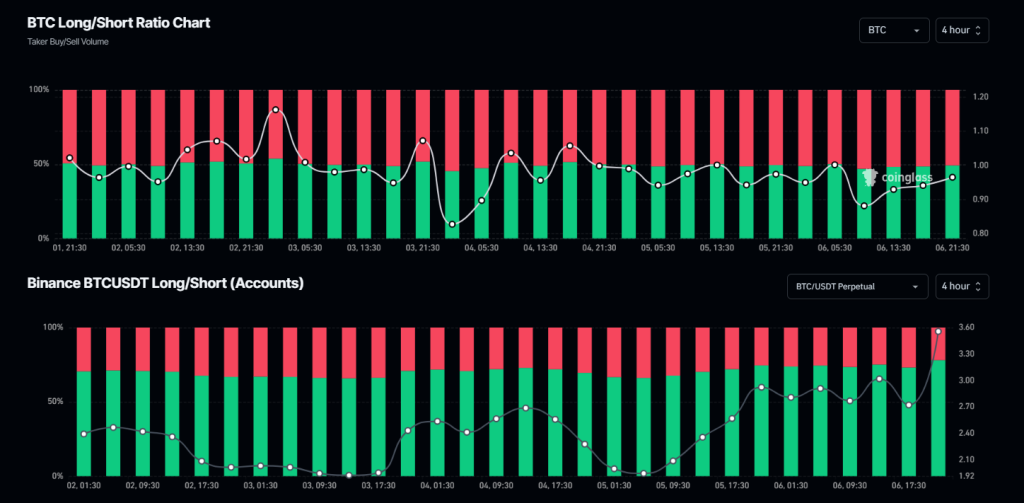

Mixed Sentiment from On-chain MetricsBesides this technical analysis, CoinGlass’s BTC Long/Short Ratio is a sentiment indicator that highlights trader views and market sentiment. Currently, this ratio stands near 0.965, indicating a bearish sentiment. Additionally, the data also shows that nearly 51% of top traders hold short positions, while 49% hold long positions.

Source: CoinGlass

Source: CoinGlass

On Binance, however, 78.05% of top traders are currently holding long positions, while only 21.95% hold short positions. This indicates that traders on Binance view the current market sentiment as a buying opportunity and are potentially building their position for next month.

Current Price MomentumAt press time, BTC is trading near the $53,500 level and has experienced a price drop of over 4.5% in the last 24 hours. Meanwhile, its trading volume has increased by 50% during the same period, indicating higher participation from traders amid the recent price crash.