Bitcoin derivatives climb to 28% of liquid supply

The paper gold market, which includes gold derivatives such as futures, options, and ETFs, is significantly larger than the physical gold market. Estimates suggest that the paper gold market could be at least ten times bigger than the physical market, according to Goldmoney. This means that many gold contracts are settled in cash without the actual delivery of physical gold. Gold ETFs like SPDR Gold Shares (GLD), which hold roughly 1,000 tonnes of physical gold, allow investors to gain exposure to gold without physically owning it.

A similar trend is emerging with Bitcoin (BTC) ETFs, which were introduced in the U.S. earlier this year. These ETFs hold over 4% of the total Bitcoin supply, and the use of Bitcoin derivatives, including futures contracts, is increasing.

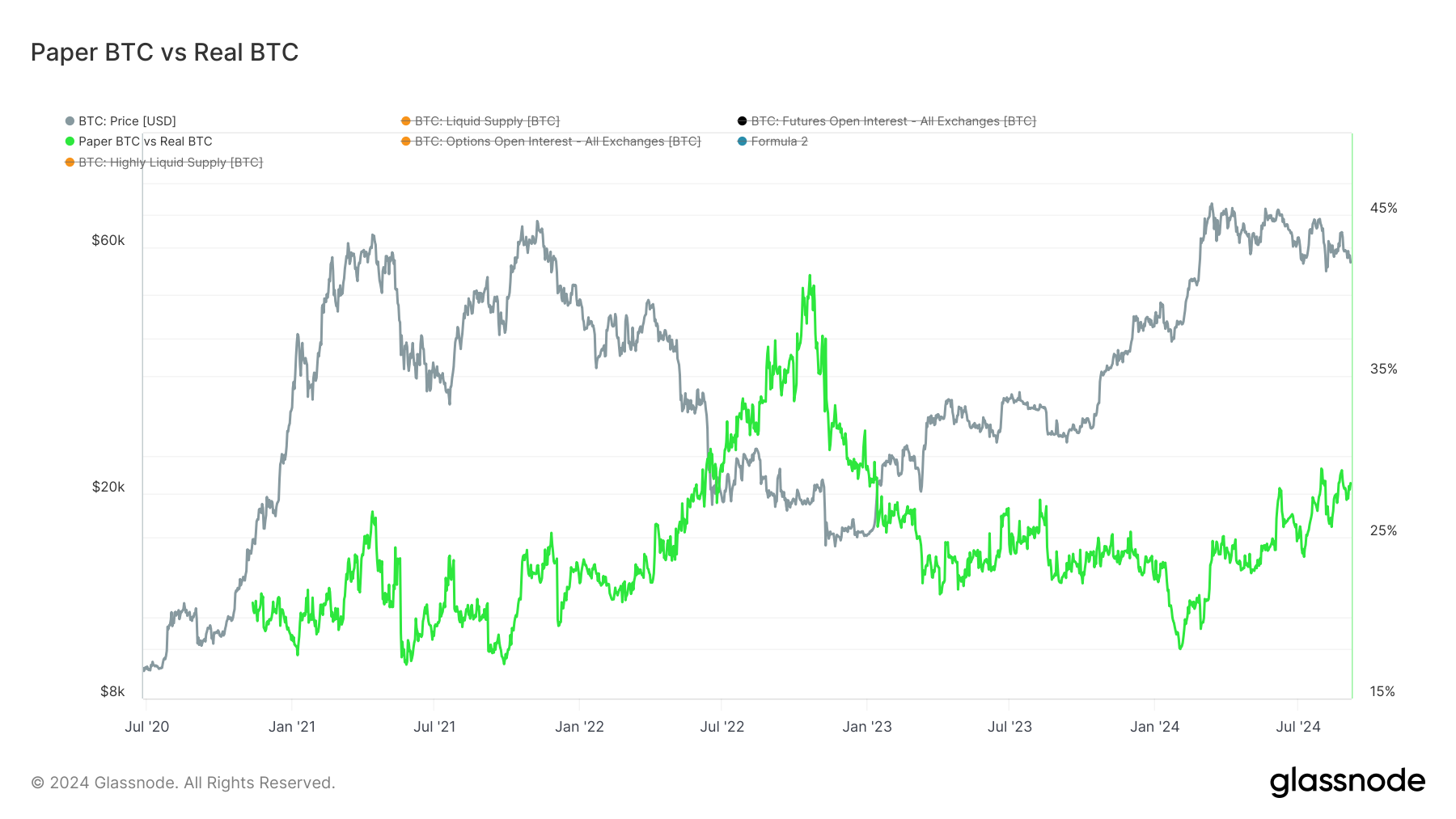

Paper BTC vs Real BTC: (Source: Glassnode)

Paper BTC vs Real BTC: (Source: Glassnode)

Currently, approximately 28% of the liquid supply of Bitcoin is traded through derivatives, up from 18% at the time of the ETF launch in January. As the market matures, we could potentially see even higher percentages of Bitcoin traded through derivative contracts, mirroring the paper gold market’s structure. This growing trend suggests that investors could favor financial instruments over holding the actual asset itself.

The post Bitcoin derivatives climb to 28% of liquid supply appeared first on CryptoSlate.