Bitcoin ETFs Inflows Surge As IBIT Joins $10 Billion Club

The post Bitcoin ETFs Inflows Surge As IBIT Joins $10 Billion Club appeared first on Coinpedia Fintech News

The Bitcoin ETF market has witnessed significant activity recently, marked by a substantial influx into the IBIT ETF, while Grayscale’s GBTC experiences withdrawals amidst the Genesis bankruptcy saga.

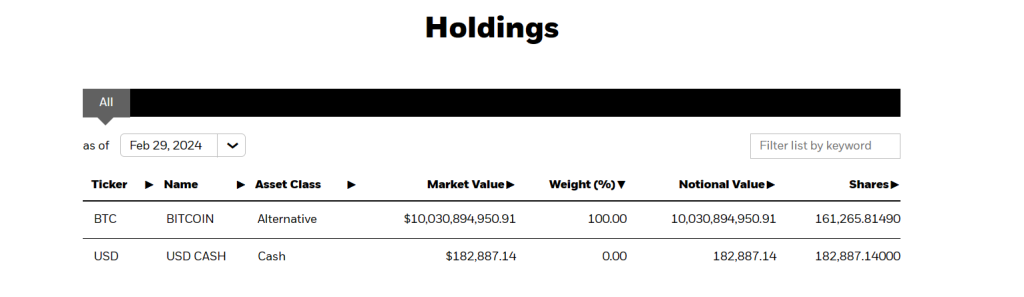

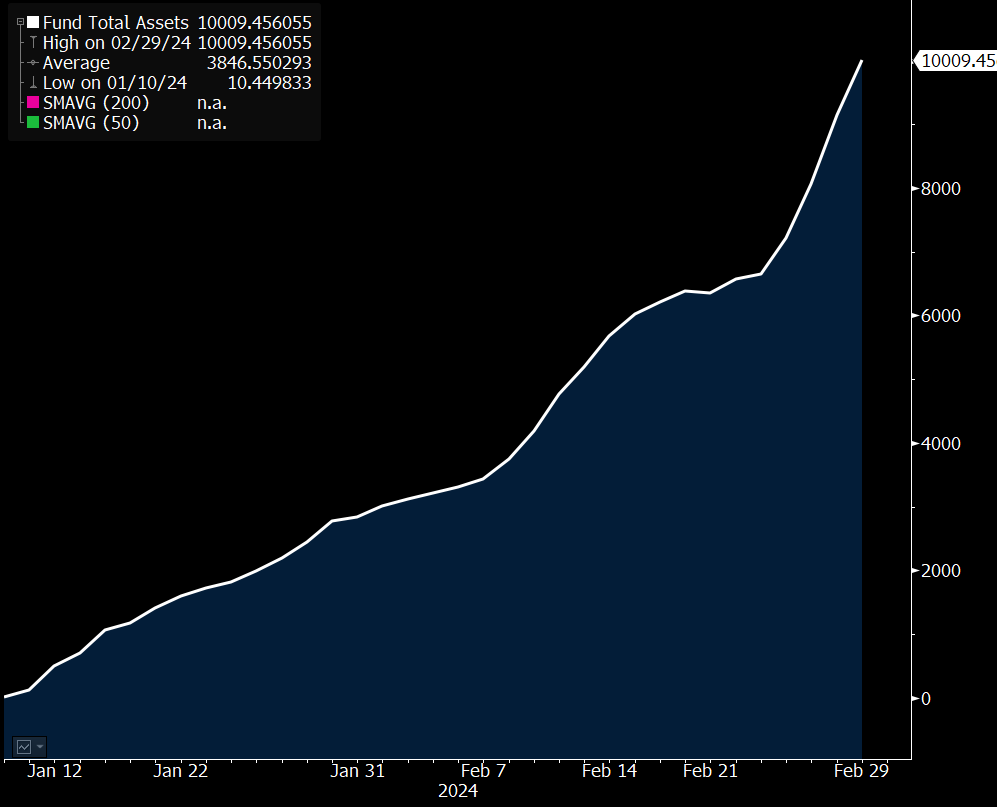

Blackrock’s Bitcoin ETF (IBIT) fund has seen impressive inflows, placing it into the prestigious “$10 Billion Club,” a remarkable achievement for any ETF. With only 152 ETFs out of a total of over 3,400 reaching this milestone, IBIT’s rapid ascent is a record and a signal of growing investor confidence in the structure and management of crypto-based financial instruments.

This surge has been partially offset by a notable decline in the Grayscale Bitcoin Trust (GBTC) holdings. The recent approval for Genesis Global Holdco to liquidate approximately $1.3 billion worth of GBTC shares adds to the pressure.

The dynamic shift in investment flows within the Bitcoin ETF market underscores a broader trend. IBIT’s journey to a $10 billion AUM has been predominantly driven by actual capital inflows. This accounts for 78% of its AUM. This is significant as it reflects direct investor action rather than market appreciation. Further, it often plays a larger role in the growth of AUM figures.

Looking forward, the second $10 billion milestone for any ETF typically comes with less difficulty. This is because of the market appreciation playing a more substantial role. Nevertheless, for crypto ETFs like IBIT, market volatility and regulatory developments continue to pose challenges and opportunities alike.