Blockchain Report of February 2024: Dominance, Development, and Adoption Insights

The post Blockchain Report of February 2024: Dominance, Development, and Adoption Insights appeared first on Coinpedia Fintech News

The blockchain sector is booming and no longer just a futuristic tech concept – it is today’s technology. For tech enthusiasts to thrive in this fast-paced, competitive world, a clear understanding about each and every development of the industry is crucial.

This monthly report simplifies blockchain analysis, offering a clear overview of the sector’s latest developments. Using high-quality data ensures utmost clarity in this exploration. Let’s dive into the report to stay updated on the rapidly transforming blockchain landscape, and to remain informed about all the major trends, which the data collected for the month recognises.

1. Blockchain Performance: A General AnalysisA primary analysis of the performance of a blockchain for a particular month can be done using Total Value Locked.

Total Value Locked in a blockchain’s decentralised finance ecosystem reflects the aggregate value of assets locked in smart contracts. A rising TVL indicates adoption, economic activity, and user trust, suggesting a positive month of robust DeFi participation, enhancing the overall performance of the blockchain.

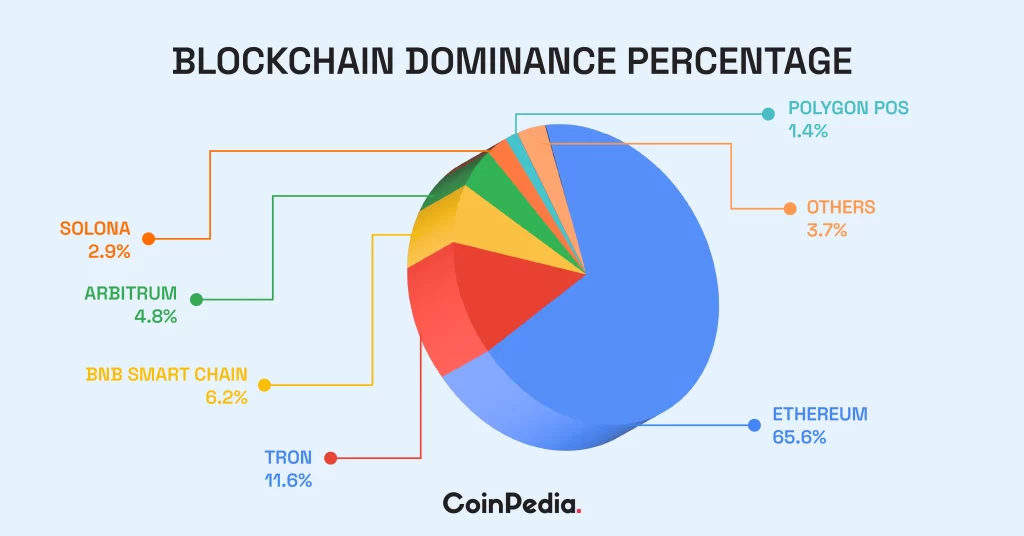

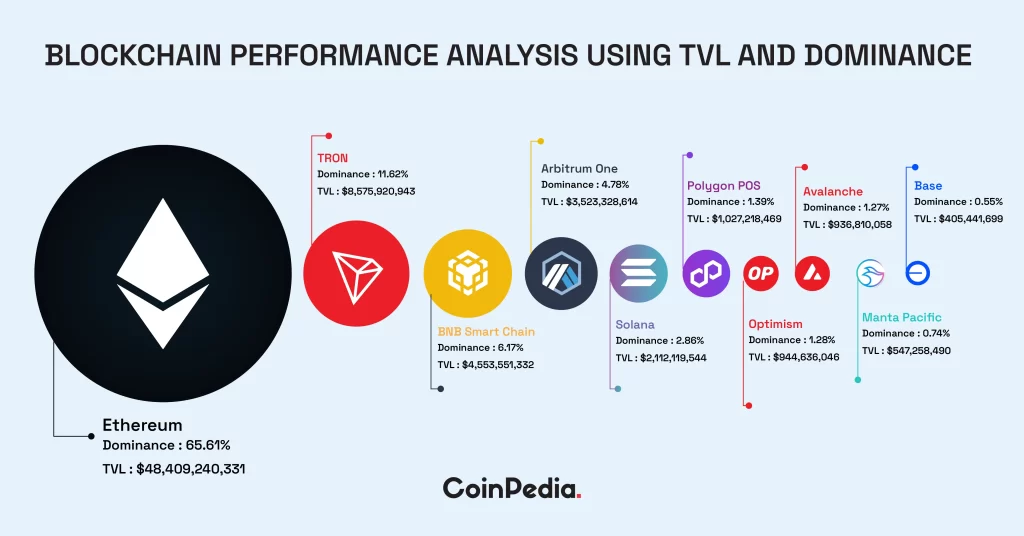

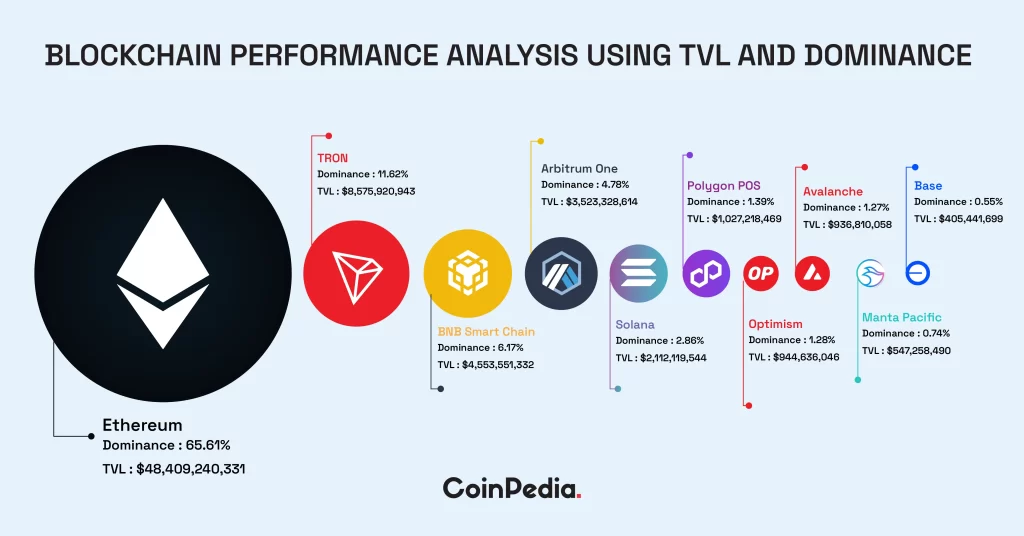

1.1. Blockchain Performance Analysis Using TVL and Dominance

Ethereum dominates with 65.61%, and Tron and BSC closely follow with 11.62%, 6.17%.

1.1.1. Analysing Top Blockchains Using 30-Day TVL MovementLet’s re-analyse the top blockchains, which dominates the blockchain sector in terms of the YTD TVL data, with the 30-Day TVL movement data, to know how much movement the top chains have witnessed in the last 30 days.

No.Blockchain 30-Day TVL Movement (in %)1Ethereum 43.8%2TRONNil3BNB Smart Chain23.4%4Arbitrum One22.0%5Solana 53.1%6Polygon POS18.4%7Optimism 7.9%8Avalanche 15.2%9Manta Pacific 24.4%10Base5.0%Solana dominates with 53.1%. Ethereum follows closely with 43.8%.

1.2. Blockchain Monthly Performance Analysis Using 30-Day TVL MovementLet’s see how things will appear when we do the performance analysis solely based on the 30-day TVL movement data.

Blockchain 30-Day Movement (in %) Sei Network116.6%StarkNet85.4%Aptos60.5%Hedera Hashgraph59.6%Mantle 56.8%Solana 53.1%Ethereum43.8%Boba Network 38.2%Scroll 34.4%Ronin 34.3%Sei Network dominates with 116.6% 30-day movement. Meanwhile, StarkNet’s 30-day movement is 85.4% and Aptos’s 30-day movement is 60.5%. Hedera Hashgraph, Mantle, Solana, Ethereum, Boba Network, Scroll and Ronin also experience impressive 30-day movement.

2. Blockchain Comparative Analysis: How Top Blockchains Performed This MonthBy focusing on four aspects, you can gain insights into the economic strength, development activity, market stability, and adoption potential of each blockchain.

2.1. Blockchain Analysis: Total Value Locked and Economic Activity

Let’s assess the economic activity within each blockchain’s ecosystem. A higher TVL, transaction volume, and revenue may indicate a more vibrant and utilized blockchain.

BlockchainsRevenue Fees Volume TVLEthereum 10740K USD12060k USD1772M USD$48,409,240,331TRON1560K USD1560K USD53.77M USD$8,575,920,943BNB Smart Chain51.41K USD514.1K USD698.55M USD$4,553,551,332Arbitrum One85.91K USD400.26K USD413.81M USD$3,523,328,614Solana 1.66K USD3.32K USD656.14M USD$2,112,119,544Polygon POS34.29K USD79.94K USD149.89M USD$1,027,218,469Optimism -12.97K USD214.1K USD91.5M USD$944,636,046Avalanche 41.68K USD41.68K USD77.07M USD$936,810,058Manta Pacific $547,258,490Base19.08K USD179.11K USD40.27M USD$405,441,699The data showcase total value locked in the top ten blockchains. Ethereum dominates with $48.4 billion, followed by TRON and BNB Smart Chain. Solana and Polygon POS also exhibit substantial values. This indicates Ethereum’s entrenched position, while emerging networks like Solana show potential for growth in decentralised finance.

The data illustrates volumes in the top ten blockchains, with Ethereum leading at 1772M USD, followed by BNB Smart Chain and Solana. Ethereum’s high volume indicates its continued dominance in transactions. Solana’s notable volume suggests growing adoption, while BNB Smart Chain’s position underscores Binance’s significant presence in the blockchain space.

The data reveals fees in the top blockchains, with Ethereum leading at 12060k USD, followed by TRON and BNB Smart Chain.

The data depicts revenue in the top ten blockains, with Ethereum leading at 10740K USD, followed by TRON and Arbitrum One. Ethereum’s high revenue indicates its thriving ecosystem. Negative revenue on Optimism suggests early challenges.

Anway, in the blockchain economic analysis, revenue, fees, volume and TVL indices provide vital insights. Revenue showcases the financial health of networks, with Ethereum leading, indicating a thriving ecosystem despite Optimism’s early challenges. Fees reflect transaction costs, where Ethereum dominates, suggesting network congestion. Volume highlights transaction activity, with Etheruem’s dominance and Solana’s growing adoption evident. TVL signifies the value invested in DeFi, showcasing Ethereum’s entrenched position and Solana’s potential.

2.2. Blockchain Analysis: Development and InnovationLet’s evaluate the development activity and innovation within each blockchain. A blockchain with a strong development community, active core developers, and more commits may suggest ongoing improvement and evolution.

BlockchainsCommits Core Developers Ethereum 9870330TRON264BNB Smart Chain14820Arbitrum One176041Solana 50028Polygon POS20917Optimism 230046Avalanche 168037Manta Pacific Base15515The data presents the number of core developers in the top blockchains, with Ethereum leading at 330, followed by Optimism and Arbitrum One. Ethereum’s large developer base indicates robust ecosystem support and ongoing development efforts. Optimism and Arbitrum One also show significant developer activity, crucial for maintaining and improving blockchain protocols. Networks with fewer developers like TRON may face challenges in keeping up with innovation and security standards.

The data displays commit counts in the top blockchain, with Etheruem leading at 9870, followed by Optimism and Arbitrum One. High commit counts signify active development and maintenance of blockchain protocols. Etheruem’s substantial commits indicate ongoing enhancements and updates, crucial for its robustness. Networks like TRON with fewer commits may encounter difficulties in keeping up with technological advancements and ensuring security.

Notably, core developers and commit indices are crucial for assessing development and innovation. Core developers represent the talent pool driving blockchain advancements, with Ethereum leading at 330, indicating strong ecosystem support. High commit counts, led by Ethereum at 9870, signify active protocol development and maintenance. Networks like Optimism and Arbitrum One show significant developer activity, vital for protocol improvement. However, networks with fewer developers like TRON may lag in innovation and security, emphasising the importance of developer support for sustainable blockchain evolution.

2.3. Blockchain Analysis: Market Performance and StabilityLet’s analyse the market performance and stability of each blockchain’s native cryptocurrency. The prevalence and usage of stablecoins within the ecosystem can measure stability and potential as a medium of exchange.

BlockchainsStablecoins Market CapPrice Ethereum 71.288B USD2.98K USDTRON51.506B USD0.1 USDBNB Smart Chain4.732B USD351.8 USDArbitrum One2.226B USD2 USDSolana 2.206B USD108.6 USDPolygon POS1.451B USD1 USDOptimism O.632B USD3.8 USDAvalanche 1.206B USD37.7 USDManta Pacific Base0.3B USDNilAs per the above data, Ethereum leads with a substantial market cap of 71.288B USD, indicating its dominant position. TRON follows closely, reflecting its strong market presence. BNB Smart Chain also shows significant market cap, underscoring Binance’s influence. Stablecoin market caps are indicators of investor confidence and network stability, with higher values suggesting greater adoption and resilience. However, lower market caps like Base’s 0.3B USD may imply lower stability or adoption rates, emphasising the need for sustained growth and market confidence.

2.4. Blockchain Analysis: Adoption and User InterestLet’s examine the level of adoption and user interest by looking at inflows, coin price and market capitalisation. A blockchain with increasing user interest and growing market capitalisation may indicate a higher level of adoption.

BlockchainsToken Market CapNet Inflows Token Price Ethereum 358.397B USD29.78M USD2.98K USDTRON12.263B USDNil0.1 USDBNB Smart ChainNilNil351.8 USDArbitrum One2.564B USD-110M USD2 USDSolana 47.893B USD-0.7M USD108.6 USDPolygon POS8.831B USD-0.61M USD1 USDOptimism 3.618B USD-5.25M USD3.8 USDAvalanche 13.865B USD0.978M USD37.7 USDManta Pacific Basenil3.3M USDNilThe data depicts net inflow in the top blockchains. Ethereum leads with a positive inflow of 29.78M USD, indicating investor interest. Base and Avalanche also show positive inflows, albeit smaller. However, Arbiturm One exhibits a substantial negative inflow of -110M USD, suggesting significant funds moving out. Optimism, Solana, and Polygon POS show moderate negative inflows.

The date presents token market caps. Ethereum dominates with a market cap of 358.397B USD, reflecting its established position. Solana follows with 47.893B USD, showcasing its growing popularity. Avalanche, TRON, and Polygon POS also exhibit significant market caps. Meanwhile, Optimism and Arbitrum One show comparatively smaller market caps.

Let’s explore the adoption and user interest factor of the top blockchains using the above indices.

Token market cap and net inflow data are crucial for analysing blockchain adoption and user interest. Market cap reflects overall investor sentiment and network value, while net inflow indicates recent capital movements, highlighting investor activity and sentiment shifts.

Ethereum’s high market cap and positive net inflow suggest strong adoption and sustained user interest. Solana’s growing market cap supports its increasing popularity. However, substantial negative inflows in Arbitrum One and moderate negative inflows in Optimism, Solana and Polygon POS may signal investor caution or shifting preferences, impacting adoption rates.

The report covers all the vital developments the blockchain sector has witnessed in this month. The report is the product of the fine blend of professional analysis and quality data.