Bullish First Day for Ethereum ETF Inflows – Could This Upcoming ERC-20 Listing Benefit?

The post Bullish First Day for Ethereum ETF Inflows – Could This Upcoming ERC-20 Listing Benefit? appeared first on Coinpedia Fintech News

Ethereum ETFs are gaining momentum after launching on Tuesday, and analysts think this could be massive for Ether’s long-term success.

In perfect timing, the new ERC-20 token WienerAI is closing out its presale and is set to make its exchange debut.

ETH ETFs Reshuffling But Analyst Brace For Long-Term GainsThere is a lot of trading activity around the Ethereum ETFs.

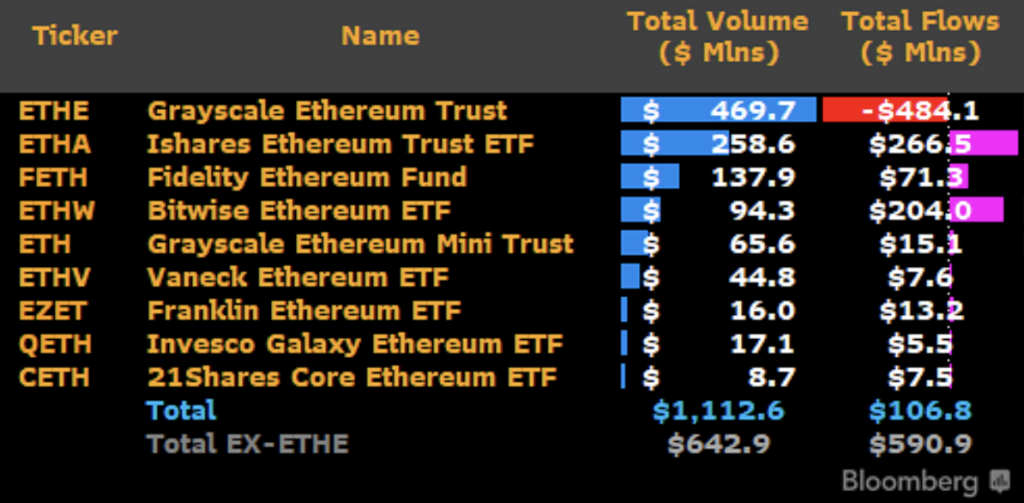

Over $107 million in net inflows came on the opening day.

Trading volume on Tuesday toppled every other ETF launch in the past year except Bitcoin’s.

I was curious how the Eth ETFs would rank in Day One volume vs all 600 or so new launches in the past 12mo but *excluding* the btc ETFs and $ETHA would be #1 (by a lot), $FETH #2, $ETHW #5 and $ETH 7th, and $ETHV in 13th spot. And $CETH, which was lowest among group, would still… pic.twitter.com/qXJFcuupi5

— Eric Balchunas (@EricBalchunas) July 23, 2024And ETF analyst Eric Balchunas also highlighted that the second day of ETF volume was neck-and-neck with its debut.

According to Balchunas, this is a positive sign and indicates a sustainable interest in the asset from Wall Street.

“ETH ETFs did about as much or even a little more volume than yesterday. That’s a good sign as a lot of times there’s a sizable dropoff after hyped-up day one,” he wrote.

However, it’s not all good news. A significant portion of the trading volume comes from Grayscale, which converted its Ethereum fund into an ETF.

This enables investors to sell more easily, which has led to substantial selling pressure.

On the opening day, Grayscale’s ETHE saw $484 million in outflows.

While the daily ETF inflows covered that, Balchunas worries that they may not be able to sustainably absorb such strong selling pressure.

However, he says it’s good to get it out the way early.

Bitcoin ETFs exemplified this. The BTC price soared after Grayscale stopped selling.

Damn. That’s a lot. Like 5% of the fund. Not sure The Eight newbies can offset w inflows at this magnitude. On flip side maybe its for best to just get it over with fast, like ripping a band aid off https://t.co/MCxGmRGAdr

— Eric Balchunas (@EricBalchunas) July 23, 2024Prominent analyst Jelle compared Ethereum’s current price action to Bitcoin’s post-ETF.

He says the ETFs will be bullish in the long term even if ETH faces a headwind in its opening weeks of presale.

$ETH since the ETF launch, and how #Bitcoin performed since the ETF launch.

Even if it keeps facing headwind in the first weeks, the ETF should be a long-term benefit to ETH price.

Be patient. pic.twitter.com/I4pNO8nyPs

Meanwhile, Moonrock Capital founder Simon Dedic speculates that “Once Grayscale is done dumping, we will have an incredible run, followed by the biggest alt season ever.”

With Wall Street liquidity flowing directly into the altcoin market, it’s an exciting time for traders.

Once the Grayscale selling stops, millions of dollars could flow into altcoins daily.

And as investors look to maximize their returns, this liquidity will trickle into smaller altcoins.

One of the projects that could benefit the most is the new AI meme coin, WienerAI.

After raising $7 million, the project is preparing to launch on exchanges.

New ERC-20 Token WienerAI Backed to 100X – Last Chance to Buy at PresaleWienerAI is unlike anything else on the market.

It’s blending the viral allure of meme coins with the groundbreaking utility of AI.

The project is building an AI-powered trading bot.

You can ask it questions, lay out trading criteria, execute trades, and track active and past transactions.

It’s the first of its kind.

Before WienerAI, Bonk created a trading bot but it doesn’t have AI capabilities.

WienerAI’s AI chatbot makes it more like ChatGPT for trading.

Then you have staking with WienerAI. The feature is already live and provides a 142% APY.

Analysts are singing praises for the new token.

Jacob Bury invested $6K into the presale and anticipates a 100x return. If accurate, that would turn his investment into a jaw-dropping $600K.

The analyst pointed to its long-term roadmap and meme coin allure as the main reasons for its potential.

Currently, investors can snag WienerAI for $0.00073.

However, the presale ends in six days, and then the token will launch on decentralized exchanges.

And with Ethereum set to rally, there’s no better time to buy $WAI.