Buzz in Crypto Community Over Possible Lifting of China’s Bitcoin Ban Rumors

Crypto market participants are buzzing about the potential lifting of China’s Bitcoin ban. With significant advancements in Hong Kong and other developments, speculation is rife that China might soften its stance on digital assets.

Should China ease its restrictions, the global crypto market could experience substantial changes, making this a pivotal moment for digital assets worldwide.

What Ignites the Speculation of China’s Crypto Lifting Ban?Rumors are circulating within the crypto community that the Chinese government may reconsider its Bitcoin and cryptocurrency ban by Q4 of 2024. These speculations gained traction on social media, particularly on X (formerly Twitter), where notable figures like Mike Novogratz, CEO of Galaxy Digital, voiced their curiosity.

“If this is true, and it’s the second time I’ve heard it in weeks, it’s a huge deal. Anyone have insight?” Novogratz questioned.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

One of the significant developments fueling these rumors is Justin Sun’s recent legal victory. In June, the founder of the TRON Network won a defamation case in the People’s Court of China.

The court ruled in his favor against the Chongqing Business Media Group, which had accused him of various illegal activities. Some have interpreted Sun’s legal success as a sign of potential shifts in China’s regulatory approach to cryptocurrencies.

Adding to the speculation is the move from crypto exchange Bybit which announced plans to allow Chinese expatriates to open accounts and trade in June. This move aims to cater to the growing demand for secure and user-friendly crypto trading solutions among the Chinese diaspora.

Reports suggest that Bybit may have streamlined the signup and verification processes for users in China. Some perceive this action as hinting at a possible softening of the country’s crypto stance.

The approval of spot Bitcoin and Ethereum exchange-traded funds (ETFs) in Hong Kong this April has further fueled the speculations. These ETFs are available in multiple currencies, including the US dollar, Hong Kong dollar, and renminbi. However, mainland Chinese investors are still prohibited from investing in these ETFs.

Underground Markets and High Volumes: The Hidden Crypto Scene in ChinaHong Kong’s efforts to become a crypto hub and its unique relationship with China hint at a possible relaxation of the country’s crypto restrictions. Notably, industry leaders have commended Hong Kong for its clear regulations, suggesting a brighter future for digital assets in the region.

China began restricting cryptocurrency trading in 2017, banning banks and payment systems from dealing with digital assets. In May 2021, the People’s Bank of China (PBOC) declared all transactions involving Bitcoin and other cryptocurrencies illegal.

This comprehensive ban included mining, storing, and using crypto. The reasons cited for this were capital controls, financial stability, and the promotion of the digital yuan.

Despite these measures, mainland Chinese citizens have found ways to access cryptocurrencies. Reports indicate that some investors use an underground network of brokers to obtain cryptocurrencies. Meanwhile, others trade directly in public places, exchanging crypto wallet addresses and completing transactions with cash or bank transfers.

Read more: Why do Hong Kong Spot Crypto ETFs Matter?

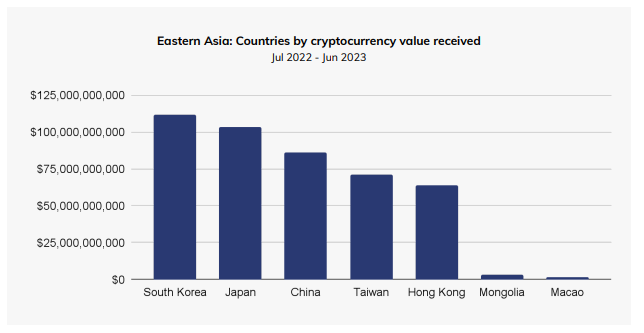

Value of Received Cryptocurrencies Among Eastern Asia Countries. Source: Chainalysis

Value of Received Cryptocurrencies Among Eastern Asia Countries. Source: Chainalysis

A report from Chainalysis revealed that between July 2022 and June 2023, the value of cryptocurrencies received in China reached $86.4 million. The report also highlighted that transaction volumes on centralized and decentralized exchanges in China accounted for 73.5% and 20.5%, respectively, of global averages. These figures strengthen the narrative that lifting the crypto ban in China could significantly affect the broader market.

The post Buzz in Crypto Community Over Possible Lifting of China’s Bitcoin Ban Rumors appeared first on BeInCrypto.