Cardano’s Supply in Profit Shrinks by 3.55 Billion ADA Amid 13% Price Drop

Cardano’s price has dropped 13% over the past week, reducing the number of ADA coins held in profit. On-chain data reveals that Cardano’s total supply in profit has decreased by 3.55 billion ADA within seven days.

As bearish momentum strengthens, ADA is likely to continue its decline, increasing the risk of further reductions in the number of coins held in profit.

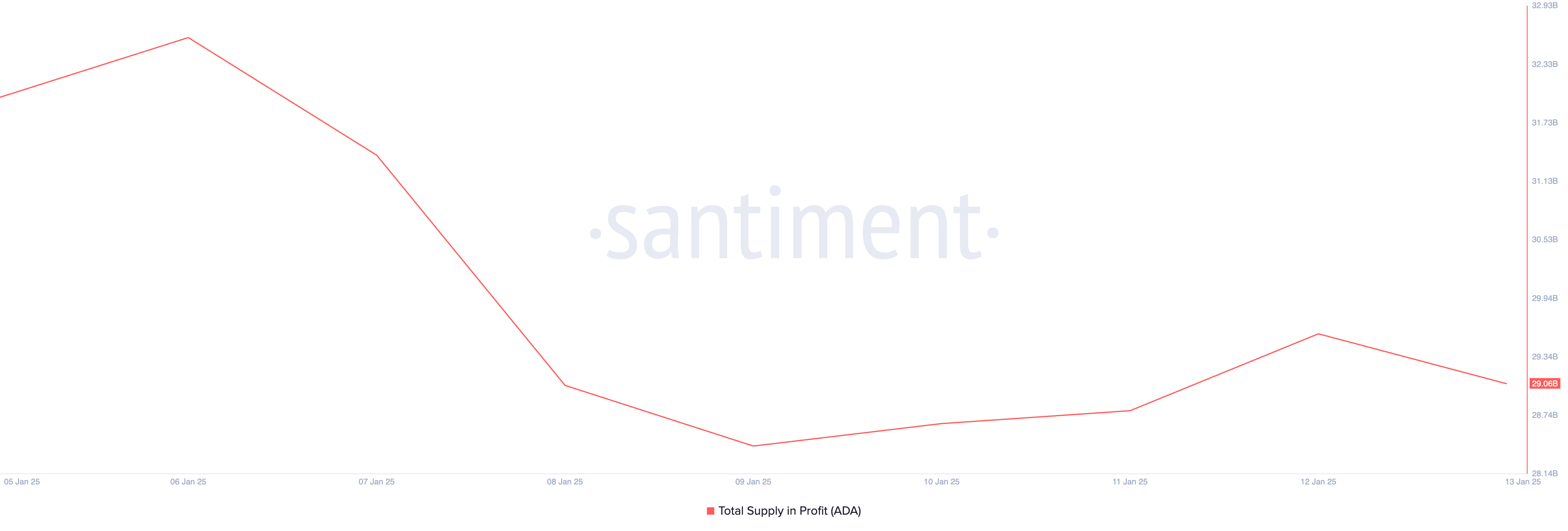

Cardano‘s Supply in Profit DwindlesAccording to Santiment, Cardano’s total supply in profit has shrunk by 3.55 billion ADA in the past week. As of this writing, 29.06 billion coins out of a total supply of 42.56 billion are held at a profit. This indicates that a significant portion of investors are now holding ADA at a loss, reflecting increased selling pressure and weakening market sentiment.

This increased selling pressure is due to the persistent fall in ADA’s value during the review period. As of this writing, the altcoin trades at $0.93, having shed 13% of its value over the past seven days.

Cardano’s Total Supply in Profit. Source: Santiment

Cardano’s Total Supply in Profit. Source: Santiment

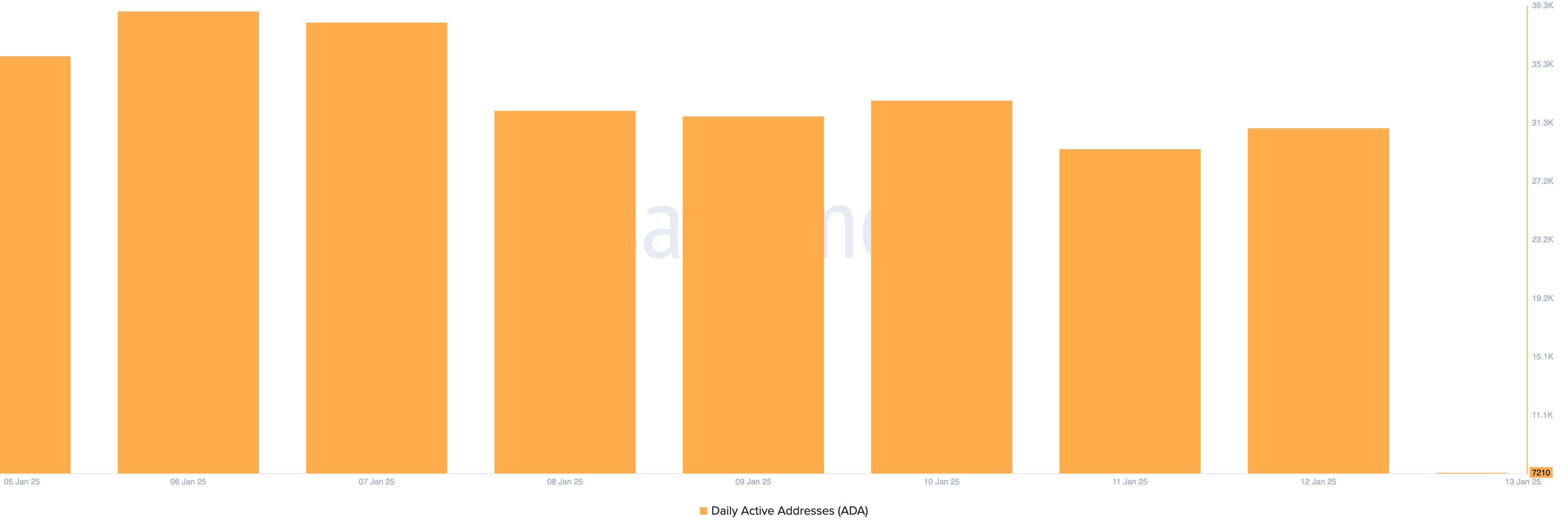

Apart from the broader market drawdown during that period, ADA’s price decline is partly driven by the drop in activity on the Cardano network. Santiment’s data reveals an 81% drop in the daily number of unique addresses completing at least one transaction with ADA over the past seven days.

This drop in Cardano’s daily address count suggests a decline in its user engagement and network utilization, which has weakened demand for ADA and further pressured its price.

Cardano Daily Active Addresses. Source: Santiment

ADA Price Prediction: Will It Fall to $0.85 or Rally to $1.12?

Cardano Daily Active Addresses. Source: Santiment

ADA Price Prediction: Will It Fall to $0.85 or Rally to $1.12?

ADA’s Relative Strength Index (RSI) on the daily chart confirms the weakening demand for the altcoin. This momentum indicator rests below the center line at 46.83 at press time.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. On the other hand, values below 30 suggest that the asset is oversold and may witness a rebound.

At 46.83 and in a downward trend, ADA’s RSI suggests that selling pressure dominates, increasing the likelihood of further price declines unless buying activity picks up.

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingView

If buying activity weakens further, the coin’s price may fall to $0.85. On the other hand, if market sentiment shifts and ADA accumulation spikes, its price may rally toward $1.12.

The post Cardano’s Supply in Profit Shrinks by 3.55 Billion ADA Amid 13% Price Drop appeared first on BeInCrypto.