Cardano (ADA) Risks 18% Fall as Demand Wanes

Cardano (ADA) appears set to continue its decline as the number of active addresses trading the altcoin keeps falling.

Additionally, large transactions involving ADA have decreased, indicating a reduction in whale activity.

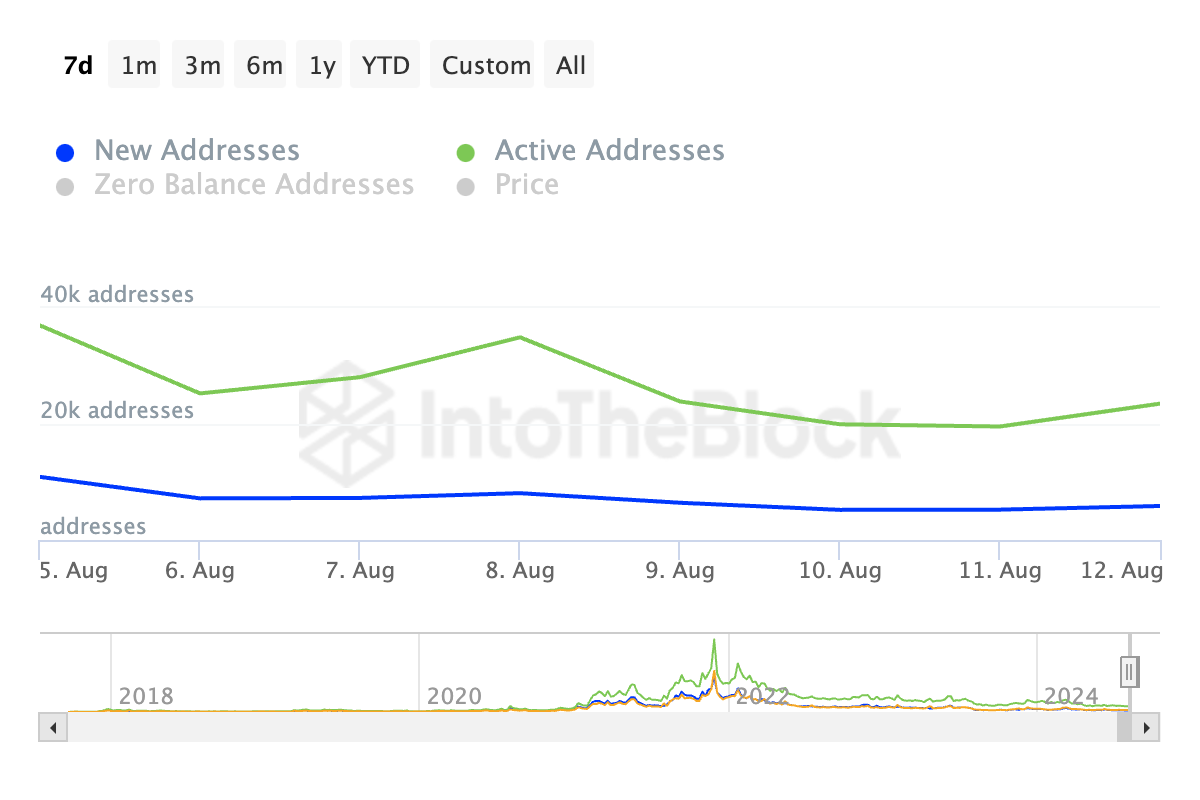

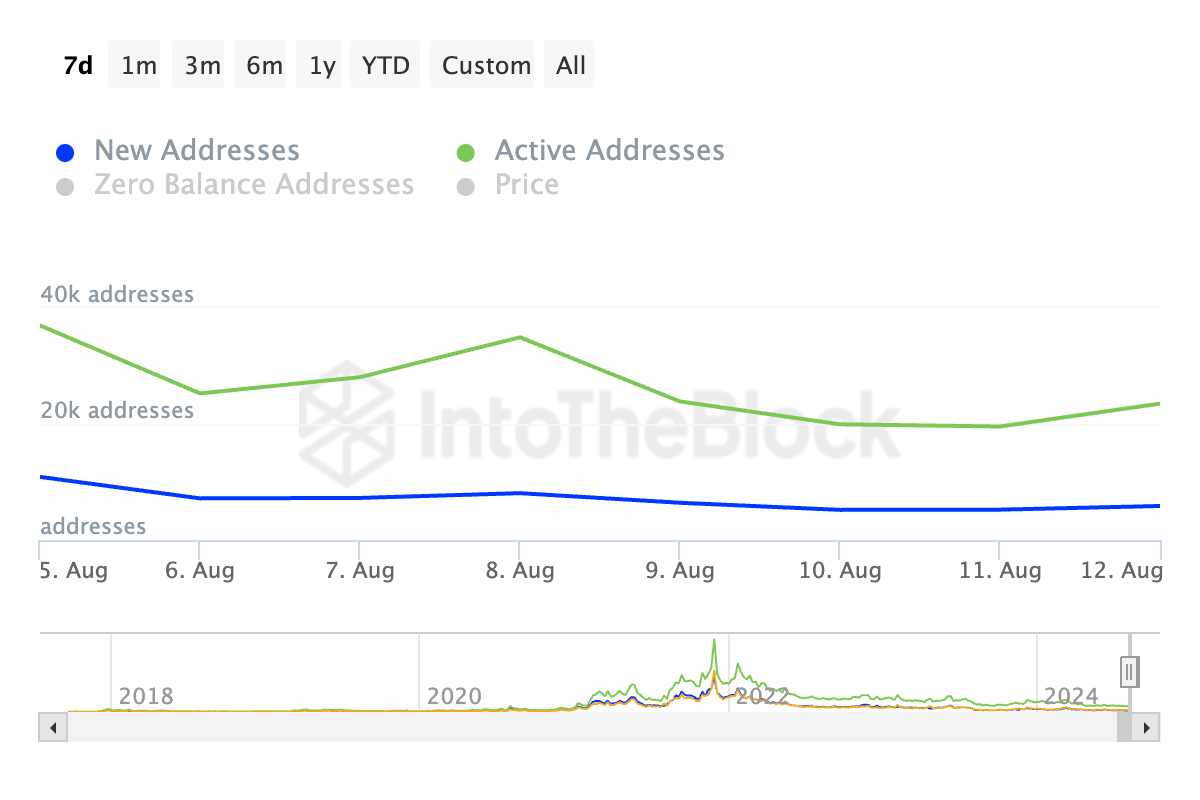

Cardano Holders Refuse to Accumulate More CoinsAccording to data from IntoTheBlock, the daily count of active addresses that have completed at least one transaction involving ADA has dropped by 36% over the last week. Likewise, the number of new addresses created to trade the altcoin during that period has also fallen by 46%.

Cardano Daily Active Addresses. Source: IntoTheBlock

Cardano Daily Active Addresses. Source: IntoTheBlock

When an asset sees a drop in daily active and new addresses, it indicates declining user activity and interest. This reduction suggests fewer people are engaging with the cryptocurrency, signaling decreased demand and weakening market sentiment.

The decline in ADA demand is further confirmed by its price-daily active address (DAA) divergence, which is currently negative. The metric has consistently shown negative values since August 7.

Read more: How To Stake Cardano (ADA)

Cardano Price Daily Active Address Divergence. Source: Santiment

Cardano Price Daily Active Address Divergence. Source: Santiment

An asset’s price DAA divergence measures its price movements against changes in the number of daily active addresses. It shows whether price trends are backed by network activity.

As of this writing, ADA’s price DAA divergence stands at -30.89%. A decline in both an asset’s price and its price DAA divergence indicates a weakening market. This suggests reduced interest in the asset and low user activity on its network.

ADA Price Prediction: Whales Seek to Reduce ExposureADA whales have ramped up their coin distribution over the past month, as evidenced by a 244% decline in large holders’ netflow during that time.

Cardano Large Holders’ Netflow. Source: IntoTheBlock

Cardano Large Holders’ Netflow. Source: IntoTheBlock

This metric measures the difference between the coins that whale investors buy and the amount they sell over a specific period. When it declines, it suggests a spike in whales’ selling activity. It is a bearish signal that often prompts retail investors to distribute their holdings.

If demand for ADA continues to weaken, its next price target could be $0.27. The altcoin last hit this low on August 5 during a broader market downturn and previously traded at this level in October 2023.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Cardano Daily Analysis. Source: TradingView

Cardano Daily Analysis. Source: TradingView

Reaching $0.27 would represent an 18% drop from its current price of $0.33. However, if ADA demand witnesses a resurgence, its price may climb to $0.40.

The post Cardano (ADA) Risks 18% Fall as Demand Wanes appeared first on BeInCrypto.