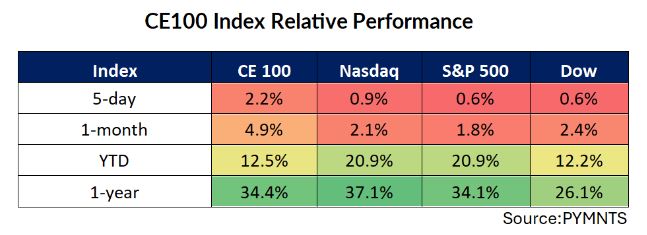

Chinese Stocks Tencent and Pinduoduo Soar, Drive CE 100 Index 2.2% Higher

The CE 100 Index got a boost this week from China.

The overall Index’s 2.2% rally came as two of our names — Pinduoduo and Tencent — soared double digit percentage points.

Investor sentiment was buoyed as the the People’s Bank of China announced rate cuts and also a reduction to capital requirements in terms of the amount of cash that banks must hold on their balance sheets. The central bank actions are aimed at stimulating the economy.

As a result, Pinduoduo shares surged 35.6%, as the “Shop” pillar of the CE 100 Index climbed 8.8% higher.

Tencent shares roared ahead by 24.5% as the Pay and be Paid segment was up 2.2%.

Rallies were not confined to names domiciled outside the U.S. Stateside, Vroom’s stock was 17.1% higher. The company said this week that it completed the wind-down of its eCommerce and used vehicle dealership operations and released a long-term strategic plan leveraging its assets like United Auto Credit Corporation (UACC), its automotive finance company and CarStory, its focused AI-powered analytics and digital services for automotive retail.

UACC and CarStory will continue to serve their third-party customers and focus on growing those businesses, according to the strategic plan.

Affirm Retraces Some GainsAffirm shares gave up 8.4%, offsetting some of the upward movement seen in Tencent and the payments-specific pillar of the CE 100 Index. The move retraces some of the gains seen through the past several weeks and in the wake of the announcement that the company’s offerings would be available for Apple Pay users. In other company related news, retailers are increasingly interested in offering buy now, pay later (BNPL) options to consumers, Affirm CEO Max Levchin said in an interview earlier this month.

More shoppers are using BNPL to finance their spending, so retailers are willing to absorb the costs of BNPL as a way to offer zero-interest loans and attract consumers ahead of the holiday shopping season, Levchin told Bloomberg Television.

Visa’s 3.3% decline also gave some headwinds to the payments segment, on the heels of an antitrust lawsuit filed by the Justice Department. The DoJ has accused Visa of stifling competition in the debit card market and suppressing alternatives. The complaint alleged that Visa employed exclusionary contracts and anticompetitive practices to maintain its market share dominance in debit, resulting in higher fees for merchants and consumers.

In a statement provided to PYMNTS, Visa General Counsel Julie Rottenberg said the lawsuit is “meritless,” adding that “anyone who has bought something online, or checked out at a store, knows there is an ever-expanding universe of companies offering new ways to pay for goods and services.”

CrowdStrike shares slipped 4.7%, though the the Work vertical of the CE 100 Index eked out a 0.5% gain.

The U.S. House Committee on Homeland Security Subcommittee on Cybersecurity held a hearing entitled, “An Outage Strikes: Assessing the Global Impact of CrowdStrike’s Faulty Software Update.” The July IT outage severely disrupted key functions of the global economy, resulting in cancellations of 3,000 commercial flights, delays of 11,800 other flights, cancellations of surgeries, disruptions to 911 emergency call centers, and a need for companies across nearly all commercial sectors to devote millions of manual labor hours to solving the problem.

“Just over two months ago, we let our customers down,” CrowdStrike’s Meyers said in his testimony, as he noted that the outage was tied to the company’s own procedures and not a cyberattack.

The banking names slipped overall, down 0.6% as a sector.

J.P. Morgan lost 0.3%. In news reported this past week, First Abu Dhabi Bank (FAB) successfully completed a pilot using programmable payments with JPM Coin through Onyx by J.P. Morgan. This programmability enables payments to be triggered at specific times or events, according to an announcement this past week.

The post Chinese Stocks Tencent and Pinduoduo Soar, Drive CE 100 Index 2.2% Higher appeared first on PYMNTS.com.