Data Suggests Bitcoin Is Entering a Bull Market, but Santiment Warns of Bloodbath

The post Data Suggests Bitcoin Is Entering a Bull Market, but Santiment Warns of Bloodbath appeared first on Coinpedia Fintech News

An expert analyst has expressed confidence in the cryptocurrency market, explaining the technical analysis behind the positive outlook. In a latest analysis by Allincrypto, the host/analyst discussed the impact of macroeconomic factors, pointing out that central banks worldwide (except Japan’s) are lowering interest rates, weakening currencies, and increasing global liquidity.

According to a research report, Bitcoin’s correlation with global liquidity suggests a bullish outlook. The analyst said that this trend is expected to continue as central banks ease monetary policy, further strengthening the case for crypto as a strong-performing risk asset.

Altcoins And Bitcoin To Rally Soon?

In the coming months, the analyst predicts a weakening U.S. dollar, which historically aligns with Bitcoin bull markets. As liquidity increases and the dollar declines, cryptocurrencies, particularly Bitcoin, are poised to benefit. According to him, Bitcoin is close to breaking out of its current pullback, which started in March. He also believes that altcoins are following Bitcoin’s lead and show strong signs of growth as global liquidity continues to rise.

He feels that economic stagnation combined with monetary easing is creating the perfect environment for riskier assets like crypto to thrive. As for altcoins, the analyst expects them to rise alongside Bitcoin, with some potentially outperforming as Bitcoin dominance declines. He hints that the altcoin market will experience strong growth once Bitcoin completes its breakout.

The analyst also talks about the future of finance, suggesting that cryptocurrencies and tokenized assets will play a major role. For example, BlackRock has been quietly backing a new tokenized treasury fund.

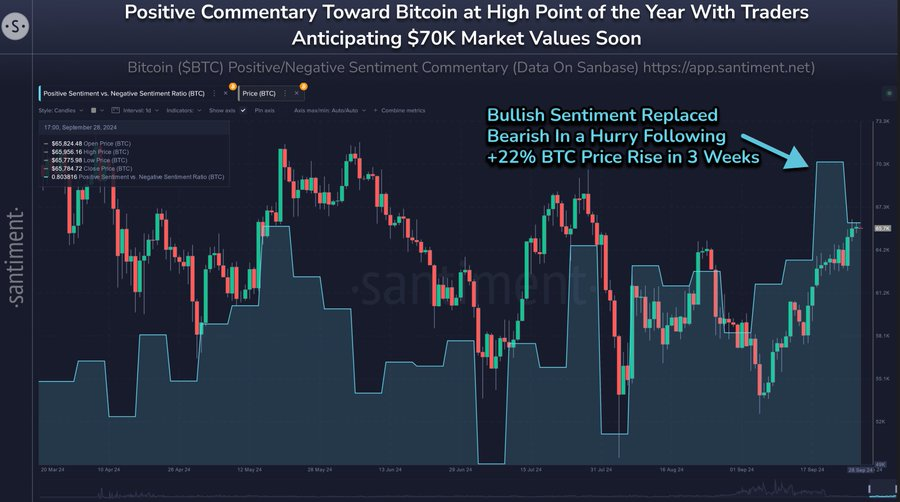

But Wait… This Could All Turn Bearish Once Again

However, Bitcoin may not reach a new all-time high anytime soon, as current crypto market sentiment is at its highest level in months, according to Santiment. It is revealed that those hoping for a new peak might need to adjust their expectations. Right now, there are 1.8 bullish posts about Bitcoin for every 1 bearish post. Historically, markets tend to move in the opposite direction of what the majority expects.