The DeFi Revolution: A Business Perspective for 2024

Let’s talk about disruption. It’s a word and notion that at the moment echoes through most industries as blockchain technology redefines customer-business interactions. What we are seeing is a metamorphosis set in motion just over a decade ago by the emergence of Bitcoin. With each passing day, we edge closer to fully realizing the potential of digital transformation within the Fintech realm. This transformation is led by DeFi, or decentralized finance applications, which are reshaping how we exchange value. From shopping to banking transactions, or simply safeguarding wealth, DeFi is becoming the go-to amidst this technological shift.

With a global crypto market cap approaching $2 trillion, DeFi’s role as a disruptor is undeniable. As we look towards 2024, the fusion of DeFi with cutting-edge technologies like AI and blockchain is set to redefine the financial sector, offering unprecedented opportunities for businesses and individuals alike.

So What is DeFi?It’s a suite of services and apps built on a decentralized network, aiming to do what Uber did to taxis, what Airbnb did to hotels — for the banking sector. The goal is simple yet ambitious: replace the old guard of financial protocols with open-source, transparent alternatives, providing access to services like decentralized lending and investment platforms, which could empower people to earn passive income from their cryptocurrency assets while saving on transactional fees.

If you’re wondering how DeFi operates, it’s like a peer-to-peer network that cuts out the middlemen from financial services. This ecosystem encompasses everything from loans to trading, all within a decentralized framework. It runs on smart contracts — self-executing contracts with the terms of the agreement directly written into lines of code. These smart contracts ensure that when you transfer your crypto assets into DeFi, you retain control. You’re free to reverse the transaction whenever you wish, retrieving your original assets. While smart contracts minimize human error, they’re not infallible; coding bugs and the risk of fraud remain present.

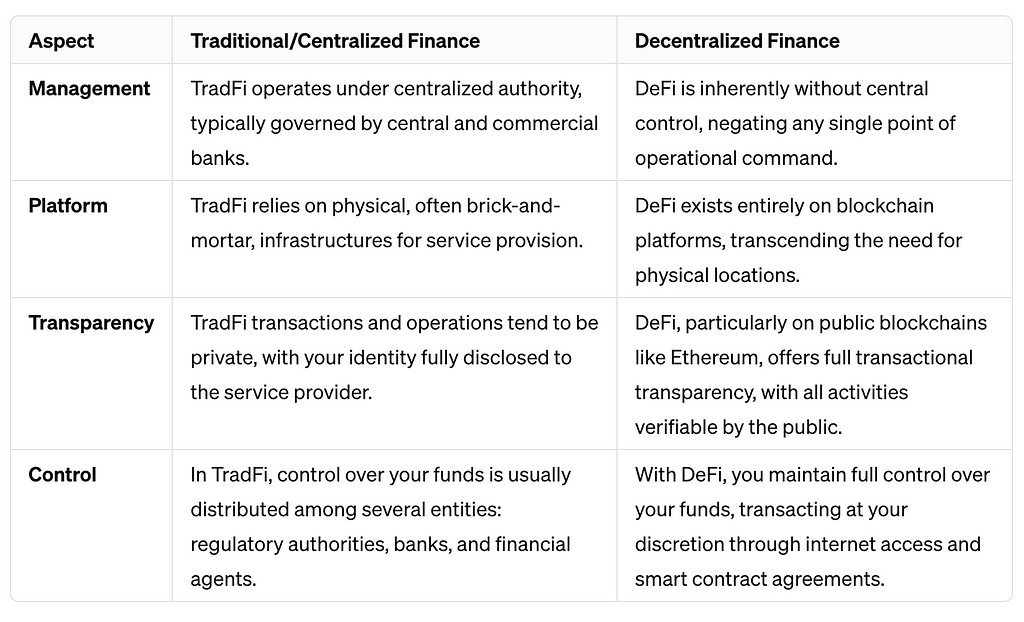

Centralized/Traditional Vs Decentralized FinanceWhen we peel back the layers of the financial systems, we find two distinct philosophies at their core. On one side, there’s the traditional finance system, an established and centralized structure governed by a network of banks and financial institutions with the Central Bank at the helm. This is the system most of us grew up with; it’s tangible, with brick-and-mortar branches dotting the landscape. It’s also personal, where transactions often happen face-to-face, and your identity is an open book.

DeFi comes out as a challenger born out of the blockchain revolution. It’s a system that thrives on the lack of centralization; there’s no singular authority here. It’s built on technology that doesn’t need a physical space, operating entirely online. The transparency it offers is unprecedented — every transaction is out there for the world to see, thanks to public blockchains like Ethereum. And when it comes to control, the aim of DeFi is to give the control back to you. Your funds are yours alone to manage, with the assistance of smart contracts and the omnipresent internet.

Here’s a side-by-side comparison of the two:

CeFi vs DeFiWhat DeFi Means for Businesses — Benefits and Opportunities

CeFi vs DeFiWhat DeFi Means for Businesses — Benefits and OpportunitiesDeFi’s ecosystem provides a suite of tools for businesses to enhance liquidity, manage assets more effectively, and streamline operations. Smart contracts, at the heart of DeFi, automate and secure transactions, while the open ecosystems of DeFi encourage a culture of innovation and collaboration. This democratization of finance allows businesses to engage with global markets more readily, lowering traditional barriers to entry.

- Lower Transaction Costs: In the traditional financial world, layers of intermediaries extract fees at every step, from cross-border transfers to payment processing. DeFi, by contrast, offers a streamlined approach where entrepreneurs engage directly with decentralized networks. This direct engagement means a dramatic reduction in costs, a benefit that any DeFi enterprise understands and leverages. Cost reduction isn’t just a feature — it’s a strategic imperative within the DeFi space.

- Asset Financing and Management: When it comes to asset management, DeFi isn’t just a new option — it’s a revolution. DeFi protocols allow for the pooling of funds and the automated allocation of these to a variety of assets, with the goal of generating returns. This democratization of investment means that opportunities once reserved for the wealthy or institutional investors are now accessible to a broader audience, changing the face of asset management.

- Faster Transactions: DeFi is synonymous with speed, security, and decentralization. The distributed ledger technology underlying DeFi ensures that no central authority can exert control over transactions, allowing for swift and uninterrupted financial exchanges. This is especially advantageous for businesses with high-frequency transaction needs, as it not only accelerates transactions but also reduces fees typically pocketed by third-party payment processors.

- Cost-Effectiveness: Through blockchain technology, DeFi enables businesses to eliminate many third-party interactions, thus scaling up operations more rapidly and cost-effectively. Whether it’s a startup or a multinational corporation, DeFi brings efficiency and functionality, facilitating international transactions and simplifying the complex web of lending and borrowing. The cryptographic security and smart contract infrastructure of DeFi ensure that transactions are not only cheaper but also transparent and direct, cutting out middlemen and their associated costs.

- Borrowing and Lending Opportunities: Borrowing and lending lie at the heart of DeFi’s utility. DeFi lending platforms dismantle the traditional barriers imposed by banking institutions, allowing for a fluid exchange of digital assets. Entrepreneurs now have more accessible avenues to capital, and investors have new channels for generating passive income, all within the realm of DeFi.

- Increased Flexibility: DeFi’s open-source technology empowers companies to tailor their payment systems to specific needs, whether adapting to regional markets or catering to unique customer groups. This flexibility is a significant asset, especially in the face of a pandemic that has forced companies to operate with constrained resources. Automation becomes not just a luxury but a necessity, simplifying complex and repetitive tasks and ensuring continuity and excellence in customer transactions. DeFi’s adaptability is a game-changer, allowing businesses to implement smart contract solutions that automate data and transaction validation with greater accuracy and less human intervention.

- Increased Transparency: In a marketplace where trust is currency, DeFi’s superior transparency can be the differentiator for businesses. Unlike traditional banking systems, where opaque processes can cast doubt, DeFi operates on a decentralized ledger that is open for all to verify. This level of transparency allows businesses to establish and maintain high-trust relationships with customers, enhancing the overall integrity of financial transactions.

- Improved Tokenization: With business growth comes an increase in data, which can become cumbersome to manage. Tokenization is a process that addresses this challenge by encrypting and distributing data across a decentralized network, significantly enhancing security. In an environment rife with cyber threats, tokenization provides an added layer of protection, making it nearly impossible for unauthorized entities to manipulate or compromise sensitive business information.

Through these features and benefits, DeFi presents not just an alternative to traditional finance but a comprehensive overhaul of financial interaction paradigms. It promises a landscape where businesses can thrive with greater autonomy, where transactions are not just transactions but transparent and trust-building interactions. DeFi is the pathway to a more empowered and equitable financial future for businesses of all sizes.

Understanding the Risks and Challenges of DeFiAs businesses venture into the world of decentralized finance (DeFi), it’s crucial to recognize that this innovative frontier is not without its risks and challenges. The promise of financial autonomy and efficiency comes hand-in-hand with new forms of exposure:

Smart Contract Vulnerabilities: At the core of DeFi are smart contracts — self-executing contracts with the terms of the agreement directly written into code. However, these are not foolproof. A single bug in the smart contract’s code could be catastrophic, potentially allowing attackers to exploit the protocol or manipulate it for unfair gains.

Transparency vs. Privacy: The transparency of smart contracts is a double-edged sword. While it promotes trust and verifiability, it also means that every transaction is visible to anyone with internet access. This level of openness can raise privacy concerns and may expose business transactions to potential surveillance and competition analysis.

Reliance on Oracles for Off-Chain Data: Blockchain and smart contracts inherently lack access to off-chain data, which is necessary for many financial services. Oracles serve as bridges, providing external data to smart contracts. However, reliance on oracles introduces a dependency on third parties and the risk of data manipulation or inaccuracies affecting contract execution.

Despite these risks, DeFi’s allure lies in its potential to bring about a fundamental shift in efficiency and transparency, attracting new users and contributing significantly to the growth of platforms like SourceLess. DeFi is positioned as a potential replacement for traditional financial services. Yet, it’s important to note that it may take several years for DeFi to transition from a niche market to a mainstream financial solution. As the DeFi ecosystem matures, businesses must navigate these challenges carefully, balancing the innovative benefits against the inherent risks.

SourceLess: At the Intersection of DeFi and Tech RevolutionSo as blockchain and decentralized finance (DeFi) are reshaping how we think about digital assets and their ownership, we’re seeing the rise of some platforms that come to deliver on the promise and potential of blockchain technology that can be leveraged for the DeFi business opportunities. Such platform is SourceLess — a tech company that is offering innovative (and custom made) solutions to redefine digital ownership and asset management. Central to this transformation is the deployment of A.R.E.S. AI, SourceLess’s proprietary artificial intelligence system designed to elevate the DeFi experience to new heights.

Creative and Innovative AI Solutions: A.R.E.S. AI is at the heart of the SourceLess ecosystem, delivering instant answers, creative inspiration, and a new level of learning. Its foundation in Natural Language Processing (NLP), combined with sophisticated automation capabilities, empowers users with a seamless and intuitive interaction model that goes beyond traditional interfaces.

Transforming the DeFi Landscape: The introduction of A.R.E.S. AI by SourceLess is a significant milestone in the evolution of DeFi. By harmonizing AI-driven innovation with blockchain’s inherent security and transparency, SourceLess is actively shaping its future. Users of the SourceLess platform can look forward to a range of functionalities — from enhanced data analysis and predictive analytics to sophisticated security measures — that redefine what’s possible in the realm of digital finance.

The Future of Finance Across Industries with DeFiAs DeFi’s implications span across various industries, from automotive to consumer products manufacturing, we’re starting to see the picture of a future where customers and businesses operate within a decentralized financial infrastructure. Organizations that are keen on staying ahead of the curve are recognizing the necessity of integrating blockchain solutions into their operations.

Actually, we are already seeing traditional centralized finance (CeFi) players reducing entry barriers to DeFi and launching DeFi-like initiatives. This strategy serves a dual purpose: it allows the advantages of DeFi to become more widely understood and appreciated, while still maintaining the liquidity, stability, and security that users of CeFi are familiar with. This hybrid approach will likely be the bridge that acquaints traditional finance users with the benefits of DeFi.

Once these hybrid models are vetted by the market and the DeFi model demonstrates its viability, we can expect to see a surge in demand. The intrinsic allure of DeFi lies in its promise of financial autonomy and decentralization — concepts that resonate deeply with the original ethos of blockchain technology. It’s about offering the ”freedom of money” and opening up financial opportunities to an unprecedented number of people.

Indeed, DeFi could well be the final piece in the puzzle of cryptocurrency’s evolution, marking the full maturation of this digital asset class. With its potential to democratize finance, DeFi points toward a future where financial inclusivity is the norm, and economic empowerment is accessible to all. So, we have solid reasons to believe this isn’t a fleeting trend — it’s actually the next chapter in the story of finance, rewriting the rules and reshaping the world’s economic structures.

The DeFi Revolution: A Business Perspective for 2024 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.