Ethereum (ETH) Remains Under Pressure Despite Bybit’s Recovery

Ethereum (ETH) has fallen more than 8% in the last 24 hours and over 22% in the past 30 days, reflecting a bearish market sentiment. The price was already in decline before the Bybit hack, which further impacted market sentiment.

Although Bybit has since recovered 84% of its reserves, ETH’s price remains under pressure. With key resistance at $2,850 and no break above $2,900 since February 2, Ethereum’s outlook remains uncertain as bearish indicators continue to dominate.

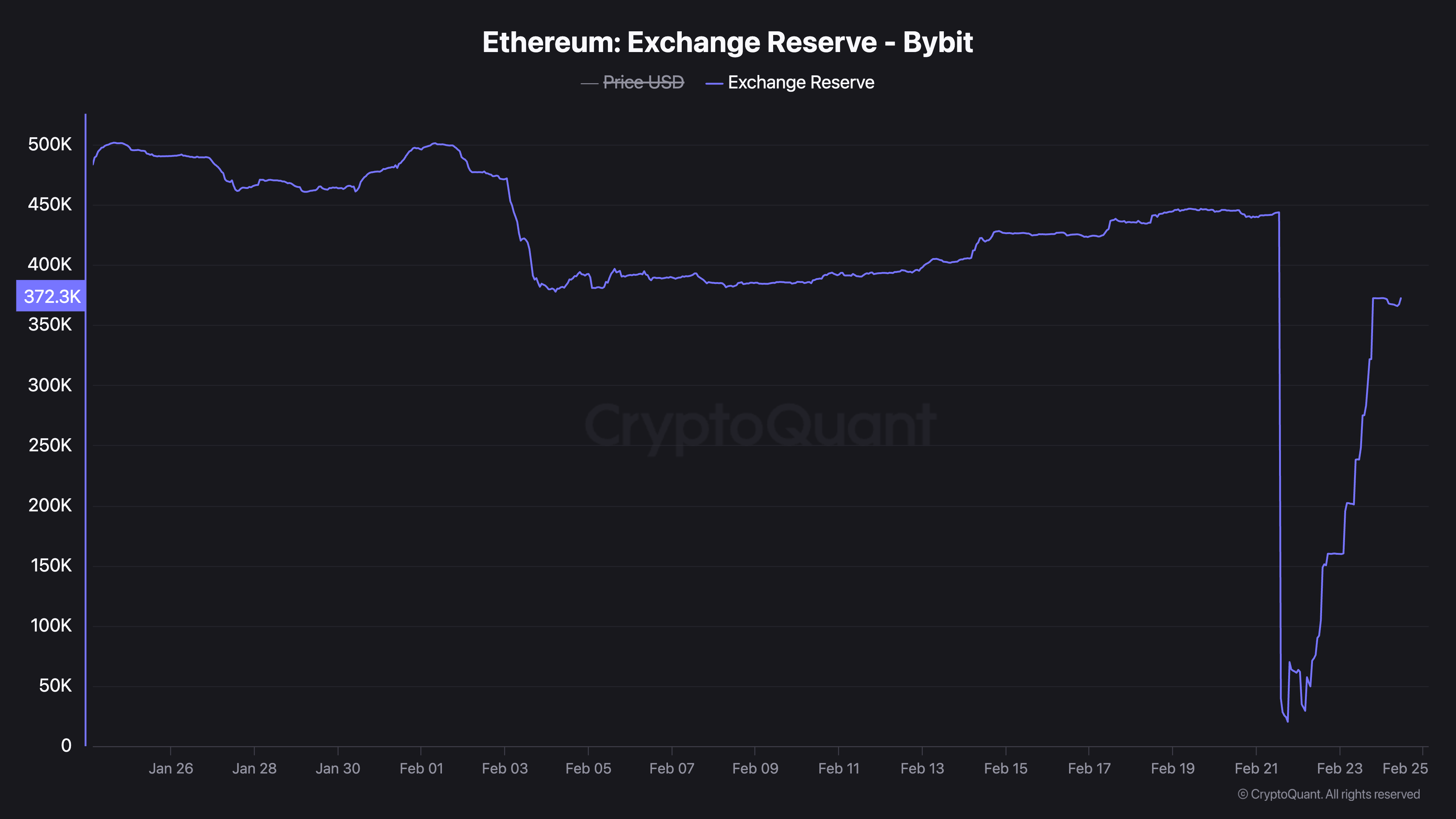

Bybit Is Recovering Its ETH Reserves After the HackEthereum’s supply on Bybit experienced a dramatic decline after the hack, plummeting from 443,000 ETH to just 20,250 ETH in a single day.

This sudden drop triggered panic selling pressure on ETH and also on BTC and other coins, as market participants feared a potential liquidity crisis.

Ethereum Reserves in Bybit. Source: CryptoQuant.

Ethereum Reserves in Bybit. Source: CryptoQuant.

The sharp decrease in reserves heightened uncertainty, leading to widespread speculation about the aftermath. Some users suggested that Bybit might be forced to buy back ETH to restore its reserves, potentially creating strong buying pressure.

Since February 22, Bybit’s ETH reserves have shown significant recovery, surging from 29,000 ETH to 372,000 ETH by February 24, which accounts for 84% of its pre-hack reserves.

The market’s initial panic selling appears to have been temporary, and the rebound in reserves could lead to renewed buying interest in ETH. However, Ethereum’s price has not recovered to levels before the hack yet.

Indicators Show No Signs of a Bullish MomentumThe Relative Strength Index (RSI) for Ethereum was recovering after the Bybit hack, reaching 63.2 yesterday, indicating strong buying momentum.

However, it has since dropped sharply and is now at 43, signaling a significant shift in market sentiment. RSI is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

Typically, an RSI above 70 suggests that an asset is overbought, indicating potential selling pressure, while an RSI below 30 indicates that an asset is oversold, potentially signaling buying opportunities.

An RSI between 30 and 70 is generally considered neutral, with movements within this range reflecting normal market fluctuations.

ETH RSI. Source: TradingView.

ETH RSI. Source: TradingView.

Ethereum’s RSI dropping from 63.2 to 43 in just one day suggests a rapid shift from bullish to bearish sentiment. This significant decline could indicate increased selling pressure or reduced buying interest, possibly due to lingering concerns about the aftermath of the Bybit hack.

A drop to 43 also brings RSI closer to the oversold territory, which, if continued, could indicate a further bearish trend. However, if buying interest resumes, the RSI could stabilize or even rebound, suggesting a potential recovery.

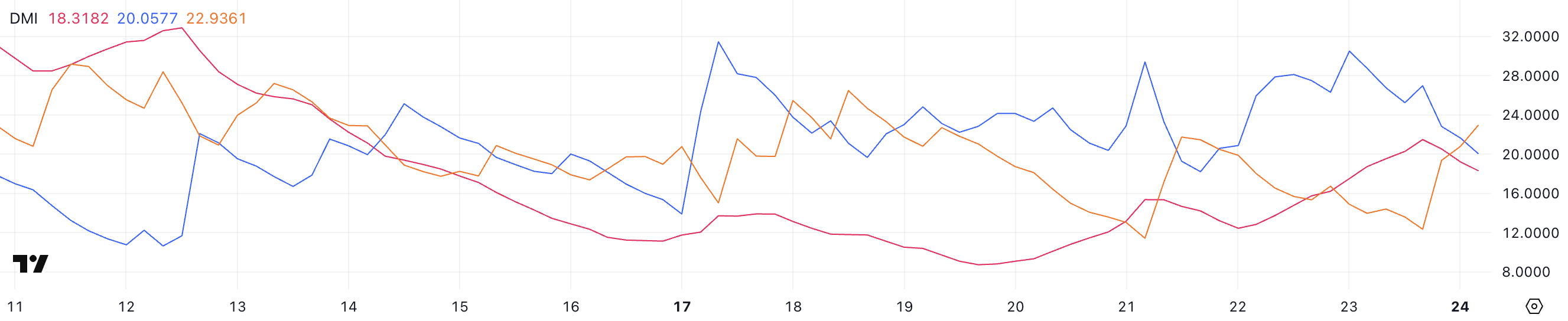

Ethereum’s DMI chart shows the ADX at 18.3, down from 21.4 yesterday, indicating weakening trend strength. An ADX below 20 suggests a lack of clear momentum, aligning with Ethereum’s ongoing downtrend.

ETH DMI. Source: TradingView.

ETH DMI. Source: TradingView.

Meanwhile, the +DI dropped from 30.4 to 20, showing decreased buying interest, while the -DI rose from 12.3 to 22.9, signaling increased selling pressure.

The crossover of -DI above +DI confirms bearish dominance, suggesting continued downward pressure on Ethereum’s price.

The weakening ADX, combined with rising -DI, points to a declining trend that may persist unless buying momentum returns. This could result in further price drops or sideways movement in the short term

Ethereum Price Has Been Below $2,900 For Three WeeksEthereum has struggled to break above the $2,850 resistance, which has been repeatedly tested in recent weeks. If the current downtrend continues, ETH could test the support at $2,551, and if that level fails, it might drop further to $2,159.

Notably, Ethereum hasn’t broken above $2,900 since February 2, highlighting strong resistance in this range.

ETH Price Analysis. Source: TradingView.

ETH Price Analysis. Source: TradingView.

However, if Bybit successfully restores its reserves to pre-hack levels, this could boost positive sentiment for ETH. In this scenario, an uptrend might retest the $2,850 resistance, and if broken, Ethereum price could rise to $3,020.

Should momentum continue, the next target would be $3,442. A break above $2,900 would be significant, as ETH has struggled with this level since early February, potentially signaling a bullish reversal.

The post Ethereum (ETH) Remains Under Pressure Despite Bybit’s Recovery appeared first on BeInCrypto.