The Ethereum spot ETF was approved by the SEC.

Chinese Version (中文版本):https://followin.io/zh-Hant/feed/10656682

Chinese Version (中文版本):https://followin.io/zh-Hant/feed/10656682Ethereum received approval from the U.S. Securities and Exchange Commission (SEC) last week and passed the 19b-4 application document for a spot ETF. This step is an important step forward for the Ethereum spot ETF to go to market, which means that it has received approval from the US government, leaving only the final S1 document to pass this procedural hurdle. The S1 filing is expected to be approved in early June, leaving only a matter of time before listing on the U.S. stock market. For those of us who are active in the cryptocurrency or stock market, the listing of the Ethereum spot ETF is undoubtedly a highlight worthy of our attention.

Ethereum spot ETF approved by SEC: major turning point and market impactThe U.S. Securities and Exchange Commission (SEC) has approved as many as eight Ethereum spot ETFs, including products from BlackRock, Fidelity and Grayscale. This news is a major positive development for the cryptocurrency market and investors. Prior to this, the market generally expected that these applications may not be approved, and investors were prepared to face adverse outcomes.

The SEC has placed strict scrutiny on cryptocurrency projects in the past, particularly on the issue of whether Ethereum should be considered a security or a commodity, and has been unable to provide clear guidance. However, the approval of the Ethereum spot ETF this time symbolizes the SEC’s clear position on Ethereum’s positioning, confirming its nature as a commodity, not a security.

The approval of this event not only provides greater legitimacy and market acceptance for Ethereum, but also provides a possible positive demonstration effect for other cryptocurrencies, especially a number of cryptocurrency projects that are fighting for detailed regulatory rules.

Why is the Ethereum spot ETF suddenly passed?

Why is the Ethereum spot ETF suddenly passed?For retail investors, the recent approval of an Ethereum spot ETF by the U.S. Securities and Exchange Commission (SEC) is undoubtedly exciting news. I think the reason behind this approval may be related to the current US political environment, especially the upcoming 2024 US election.

At present, the main competition in the US election seems to be the showdown between current President Biden and former President Trump. Cryptocurrency has become a hot topic that cannot be ignored during this election, with its popularity and attention increasing significantly since the election four years ago. Candidates have also begun discussing cryptocurrency issues.

The Biden administration has adopted a stricter stance on cryptocurrencies over the past four years, and has always adopted an unfriendly attitude towards cryptocurrencies. From Trump stating that “Bitcoin is a scam” in 2021 to softening his attitude in recent years and actively participating in the NFT market, it can be seen that he has shown a friendly attitude towards cryptocurrency issues. Trump even announced that his campaign team will accept cryptocurrency donations. Not only does he support cryptocurrency in his words, he even uses cryptocurrency applications in his own behavior. This behavior may attract a large number of cryptocurrency supporters.

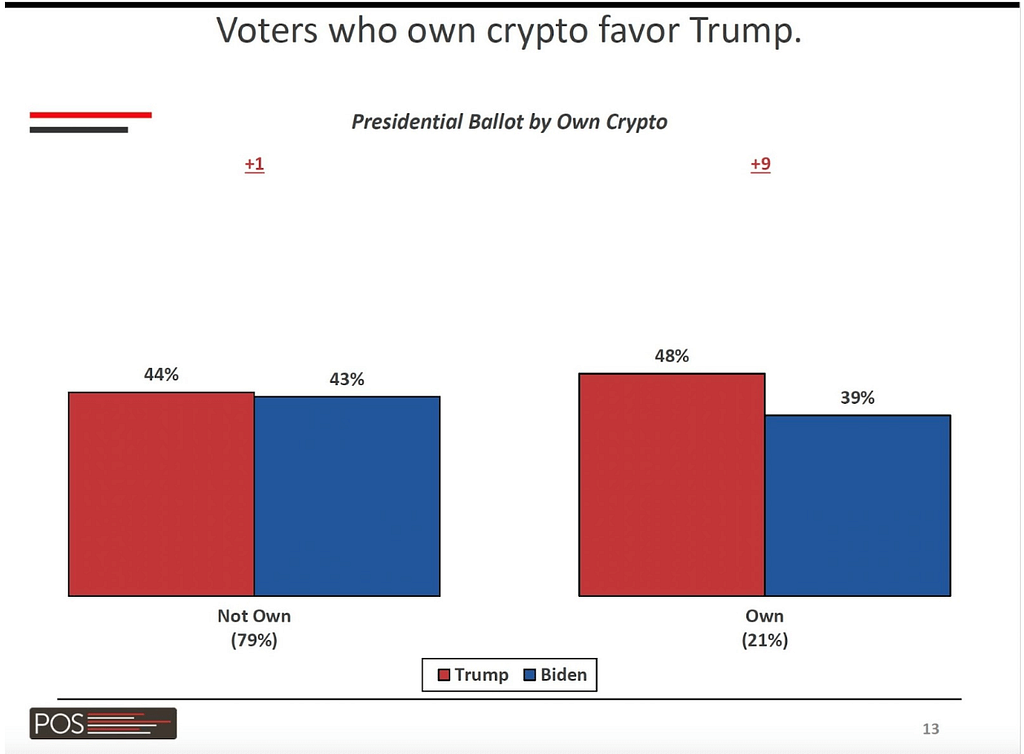

Against this political background, I think the approval of the Ethereum spot ETF may be a positive signal sent by the Biden team to the cryptocurrency community, aiming to increase its support among cryptocurrency voters. Observing recent polls and market reactions, Trump’s support rate in various polls is slightly higher than Biden’s, which may prompt the Biden team to make some strategic adjustments in cryptocurrency policy.

Prospects for the listing of Ethereum spot ETFs

Prospects for the listing of Ethereum spot ETFsAs the Ethereum spot ETF approaches the listing stage, let me make a small prediction for the performance of the ETF after listing. Compared to listed Bitcoin spot ETFs, I believe the Ethereum spot ETF may underperform slightly, primarily due to a few core factors.

First of all, compared to Bitcoin, Ethereum’s underlying technology and operating mechanism are more complex. Ethereum uses a proof-of-stake (PoS) mechanism, which is significantly different from Bitcoin’s proof-of-work (PoW) mechanism, which may affect the investment decisions of institutional investors. Because Bitcoin may be more attractive to institutional investors looking for stability and less technical risk.

Secondly, although Ethereum has a solid position in the encryption market and is currently the second largest cryptocurrency by market capitalization, Ethereum’s market history and recognition of its traditional value are still far less than that of Bitcoin. This difference may also cause institutional investors to be less enthusiastic about Ethereum spot ETFs than Bitcoin spot ETFs.

Despite this, I believe the listing of an Ethereum spot ETF will have a positive impact on Ethereum price in the short term. However, I have questions about whether this growth can be sustained in the long term. Maybe I need to wait until it is actually launched before making detailed observations and analysis.

The potential impact of Ethereum spot ETF adoption on the crypto market and projects

The potential impact of Ethereum spot ETF adoption on the crypto market and projectsI think the adoption of the Ethereum spot ETF is extremely important for the entire cryptocurrency ecosystem, especially for those exchanges that are under SEC charges such as Coinbase, Kraken and Uniswap. These platforms have long faced unwarranted SEC scrutiny and accusations of selling securities to the public. The adoption of the ETF could serve as a key reference in the legal challenges faced by these exchanges, perhaps putting them in a favorable position in future legal rulings.

In addition, the approval of the Ethereum spot ETF may also indirectly boost the market performance of other Altcoin. Although I don’t think that after the Ethereum spot ETF is passed, other Altcoin will launch their own ETF applications. However, as Ethereum is the second largest cryptocurrency by market capitalization and the leader among Alt Altcoin, this milestone victory will undoubtedly drive other small coins to gain greater exposure.

Especially for Ethereum Layer 2 expansion solutions such as Arbitrum, Base, and Optimistic, the success of Ethereum spot ETFs will likely drive the value of these projects because they directly support the expansion and efficiency improvement of the Ethereum network. Likewise, staking service providers such as Lido, RocketPool, and other re-staking services such as EigenLayer and EtherFi may also benefit from ETF approval, further cementing their important position in the Ethereum ecosystem.

For other large Altcoin such as Solana, XRP, Cardano and Chainlink, the approval of the Ethereum spot ETF also provides a positive market signal, allowing these projects to get out of the haze of accusations, although the currency price has not stabilized in a short period of time. It will be reflected immediately, but in the long run these projects will also be favorably affected by its passage.

The passage of the Ethereum spot ETF not only brings benefits to Ethereum itself, but also provides new guidance for the maturity and regulatory environment of the entire encryption market. For retail investors, I think this is an excellent time to observe market movements and re-evaluate investment strategies.

The Ethereum spot ETF was approved by the SEC. was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.