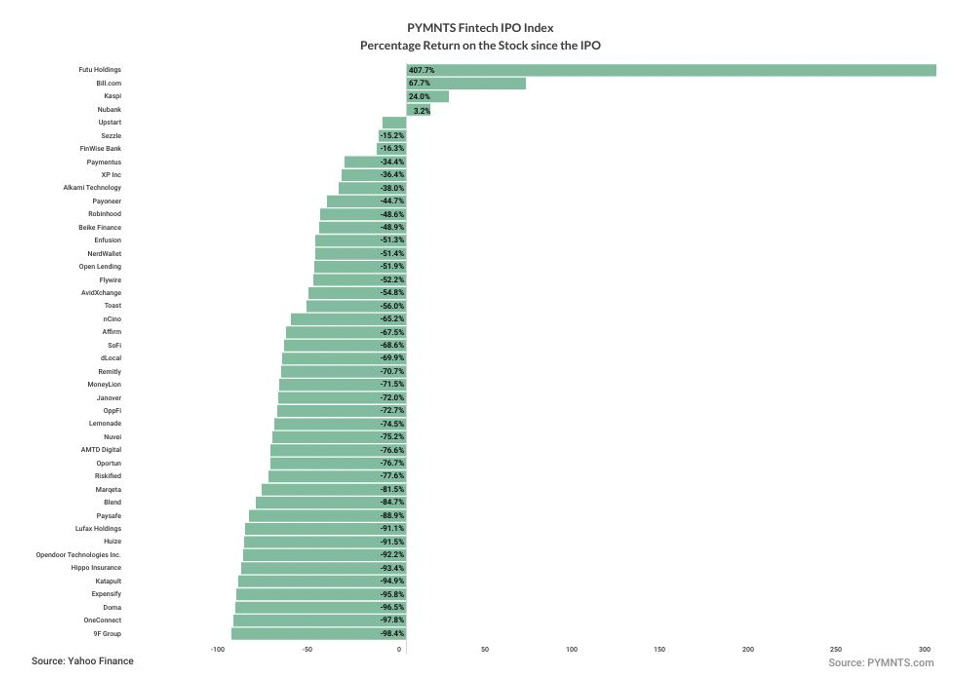

FinTech IPO Index Edges Up 1.7% as Katapult Earnings Lead Platforms Higher

Call it the week of the platform.

Earnings reports from firms that focus on bringing supply and demand together — in lending, for example, or for modernizing payments between merchants and consumers — were dominant in the headlines.

With stocks remaining volatile in the wake of those earnings reports, the FinTech IPO Index was 1.7% higher this week.

Katapult’s stock rallied 18.5% through the week. Katapult Pay gross originations grew more than 150% year over year in the latest quarter to $55.6 million and 55.9% of gross originations for the first quarter of 2024 came from repeat customers. Total revenue was $65.1 million, an increase of 18.1%

Blend Labs shares gained a bit more than 15%. Company earnings materials stated that total company revenue in Q1 2024 was $34.9 million, composed of Blend Platform segment revenue of $23.8 million and Title segment revenue of $11.1 million. Within the Blend Platform segment, mortgage suite revenue decreased by 15% year over year to $15.1 million. Consumer banking suite revenue totaled $6.7 million in Q1, an increase of 29% from last year. Professional services revenue increased 21% year over year to $2.1 million.

Paysafe’s stock rocketed 15.2% higher. The company’s earnings showed that revenue from the Merchant Solutions segment rose by 11%, tied to strength in eCommerce and demand from small- to medium-sized business (SMB) clients. Digital wallet-related revenue surged 5% year on year, underpinned by strength in the gambling sector. Consolidated revenue of $418 million was up 7% on a constant currency basis. Total payment volume of $36.1 billion was up 7%, and transactions per active user were 14% higher.

Open Lending shares gathered 7.8% this week as the company partnered with Core Specialty Insurance Holdings, enabling Core Specialty to begin providing credit default insurance policies for Open Lending’s Lenders Protection platform.

Robinhood shares inched 3.4% higher through the past five sessions. The company reported Q1 profits that exceeded expectations, driven by strong cryptocurrency trading volumes and increased net interest revenue. Retail traders, encouraged by hopes of a soft landing of the economy, have reentered the market, leading to a 59% increase in transaction-based revenue for the company. The company’s net interest revenue rose by 22% to $254 million.

Oportun shares were up 2.7%. The company had already reported preliminary results for Q1, and in the official report May 9 noted that aggregate originations were $338 million, compared to $408 million last year. Portfolio yield was 32.5%, an increase of 113 basis points compared to the prior-year quarter. The annualized net charge-off rate of 12% compared favorably to the 12.1% seen a year ago and 12.3% in the fourth quarter.

dLocal Leads to the DownsidedLocal shares sank 27% as the firm’s earnings indicated that total payment volume was $5.3 billion in Q1, up 49% year over year compared to $3.6 billion in the first quarter of 2023 and up 4% compared to the fourth quarter of 2023. Revenues were 34% higher year on year to $184.4 million and down 2% sequentially. Gross profit margins were pressured a bit, with the renegotiation of terms with a top merchant and higher payout volumes. Operating income was 32% lower year over year.

Nu Holdings said in its report that it added 5.5 million customers in Q1 to reach 99.3 million customers globally by the end of March. Nubank is now the fourth-largest financial institution in Latin America by number of customers, the company said. Monthly average revenue per active customer grew 30% year over year. In Brazil, the company’s consumer credit portfolio’s 15-90 NPL ratio was 5%, in line with expectations and historical seasonality. The firm’s shares lost 0.6%.

Expensify added unlimited virtual cards to its spend management platform. With the new Expensify Visa Commercial Card, businesses can manage all their expenses across employees and merchants, including both one-time and recurring expenses. The new feature allows customers to set fixed or monthly spending limits for each card. It can deliver fixed-spend cards for one-time purchases and monthly spend cards for recurring expenses. The company’s share lost 3.4%.

The post FinTech IPO Index Edges Up 1.7% as Katapult Earnings Lead Platforms Higher appeared first on PYMNTS.com.